Pentagon Doesn’t Know What Happened to $1.3 Billion in Afghanistan

The Pentagon isn’t able to tell federal auditors what happened to more than $1.3 billion in funds intended for construction projects in Afghanistan.

The money was dispersed through a program established to speed up the rebuilding process in Afghanistan by giving money directly to military officers to build roads, bridges, dams and other projects to avoid the lengthy bureaucratic procurement process.

But in the rush to spend and build, much of the money paid out by the Commander’s Emergency Response Program (CERP) between 2004 and 2014 has gone unaccounted for, according to auditors who spent the last year trying to find it.

Related: 7 Threats to U.S. Rebuilding Efforts in Afghanistan

A new report released Friday by the Special Inspector General for Afghanistan Reconstruction says the Defense Department could only provide its office with documentation for $890 million, or roughly 40 percent, of the total $2.2 billion in funds.

The auditors blamed the Pentagon’s financial and project management process for not sufficiently tracking spending, saying DoD’s system doesn’t contain enough data or comprehensive information relating to the actual costs of the projects.

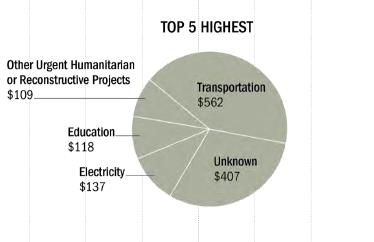

The auditors took the information the Pentagon did provide and divided it up into categories like education, health care, water and sanitation. Aside from transportation, the item that had the most expenses was labeled “unknown.”

U.S. Central Command responded to the inspector general’s findings, or lack thereof, by saying that some of the unaccounted for CERP funds had been shifted to other military needs. “Although the report is technically accurate, it did not discuss the counterinsurgency strategies in relationship to CERP,” the Central Command said.

In total, the U.S. has doled out about $3.7 billion through CERP funds, with $2.2 billion coming from the Defense Department.

This is just the latest report from SIGAR highlighting the Pentagon’s problems keeping track of the enormous amount of money flowing into Afghanistan. Earlier reporting suggested the U.S. has lost some $100 billion in the reconstruction efforts.

Number of the Day: 51%

More than half of registered voters polled by Morning Consult and Politico said they support work requirements for Medicaid recipients. Thirty-seven percent oppose such eligibility rules.

Martin Feldstein Is Optimistic About Tax Cuts, and Long-Term Deficits

In a new piece published at Project Syndicate, the conservative economist, who led President Reagan’s Council of Economic Advisers from 1982 to 1984, writes that pro-growth tax individual and corporate reform will get done — and that any resulting spike in the budget deficit will be temporary:

“Although the net tax changes may widen the budget deficit in the short term, the incentive effects of lower tax rates and the increased accumulation of capital will mean faster economic growth and higher real incomes, both of which will cause rising taxable incomes and lower long-term deficits.”

Doing tax reform through reconciliation — allowing it to be passed by a simple majority in the Senate, as long as it doesn’t add to the deficit after 10 years — is another key. “By designing the tax and spending rules accordingly and phasing in future revenue increases, the Republicans can achieve the needed long-term surpluses,” Feldstein argues.

Of course, the big questions remain whether tax and spending changes are really designed as Feldstein describes — and whether “future revenue increases” ever come to fruition. Otherwise, those “long-term surpluses” Feldstein says we need won’t ever materialize.

JP Morgan: Don’t Expect Tax Reform This Year

Gary Cohn, President Trump’s top economic adviser, seems pretty confident that Congress can produce a tax bill in a hurry. He told the Financial Times (paywall) last week that the Ways and Means Committee should be write a bill “in the next three of four weeks.” But most experts doubt that such a complicated undertaking can be accomplished so quickly. In a note to clients this week, J.P. Morgan analysts said they don’t expect to see a tax bill passed until mid-2018, following months of political wrangling:

“There will likely be months of committee hearings, lobbying by affected groups, and behind-the-scenes horse trading before final tax legislation emerges. Our baseline forecast continues to pencil in a modest, temporary, deficit-financed tax cut to be passed in 2Q2018 through the reconciliation process, avoiding the need to attract 60 votes in the Senate.”

Trump Still Has No Tax Reform Plan to Pitch

Bloomberg’s Sahil Kapur writes that, even as President Trump prepares to push tax reform thus week, basic questions about the plan have no answers: “Will the changes be permanent or temporary? How will individual tax brackets be set? What rate will corporations and small businesses pay?”

“They’re nowhere. They’re just nowhere,” Henrietta Treyz, a tax analyst with Veda Partners and former Senate tax staffer, tells Kapur. “I see them putting these ideas out as though they’re making progress, but they are the same regurgitated ideas we’ve been talking about for 20 years that have never gotten past the white-paper stage.”

The Fiscal Times Newsletter - August 28, 2017

|