How Safe Is that Flight? Auditors Question Airport Security

A government spat between Congress and the Transportation Safety Administration yesterday raised a question: Is the TSA trying to stonewall a congressional committee looking into reports suggesting the agency may be failing in its $7 billion-a-year mission to safeguard airports and air travel from terrorist threats?

At the start of Wednesday’s TSA: Are Airports Safe? hearing, House Oversight Committee Chairman Jason Chaffetz (R-UT ) immediately pointed out a glaring absence from the witness panel—the TSA.

Related: Poor Maintenance Could Make that Airport Scanner a Dud

Chaffetz said the committee had invited TSA acting administrator Melvin Carraway, but the agency offered a lower-level official in his place.

“The Department of Homeland Security objected to [Carraway’s] presence on the panel because they felt it was demeaning to have the acting director sit on the same panel as a private sector witness,” he said, referring to Raffi Fron, president of New Age Security Solutions, a company that provides security systems such as video surveillance.

The hearing was prompted by two separate but equally scathing watchdog reports that question the TSA’s ability to effectively screen passengers.

“Our audits have repeatedly found that human error— often a simple failure to follow protocol—poses significant vulnerabilities,” DHS’s IG John Roth said—adding that despite offering hundreds of recommendations the TSA has failed to assure that its mission is succeeding.

Related: Report Says TSA Wasted $1 Billion on Screening Program

DHS stood by its decision not to send its acting administrator. An agency official told The Fiscal Times that the department only participates in congressional hearing panels with other government agencies—not with private-sector witnesses in order to avoid conflicts of interest.

A spokesperson for the committee said that “witness invitations are not transferable” and that the “DHS does not dictate how we run our hearings.”

This isn’t the only roadblock the Oversight Committee has run into with the TSA. During the hearing, Chairman Chaffetz showed off a heavily redacted document he had requested from the agency—saying even members of Congress had “exceptional” difficulties getting information from them.

The committee spokesperson said House Oversight is currently looking into other ways the TSA has frustrated congressional inquiries—and what kinds of action can be taken.

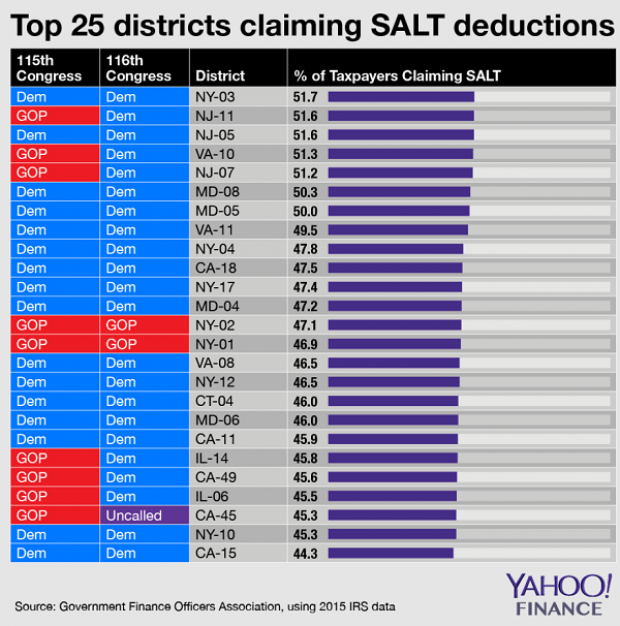

Chart of the Day: SALT in the GOP’s Wounds

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

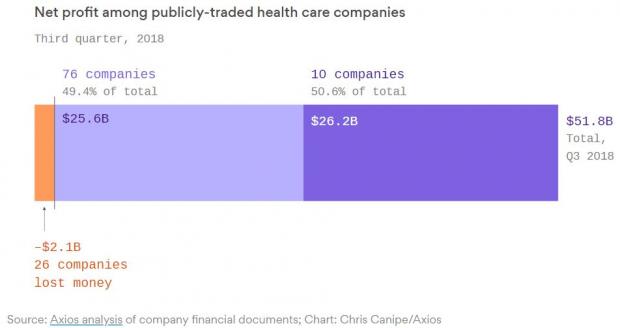

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

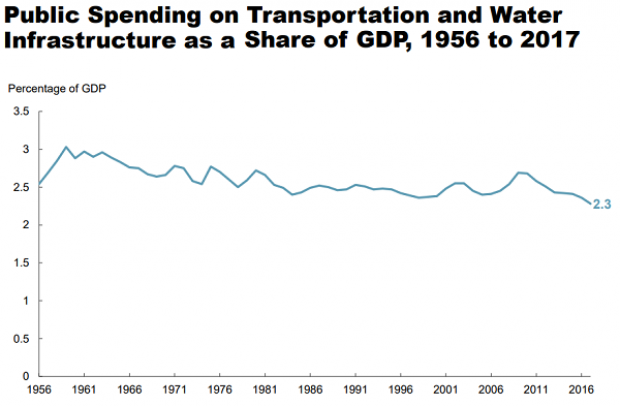

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.