Why the Class of 2015 May Actually Get Good Jobs

Not only are there more jobs available for 2015 college grads, there are more good jobs available to them, according to a new analysis by economists with the Federal Reserve Bank of New York.

The New York fed found that the underemployment rate for recent graduates—which had risen steadily with the exception of a fleeting dip in 2011—has finally started to fall. It has dropped about 2 percentage points since last June to 44.6.

That trend, coupled with a continued decline in unemployment for recent college grads, offers reason for hope for the class of 2015. Job postings for college graduates have increased by about 10 percent since last summer.

Related: The 10 Best Cities for New Grads to Launch their Careers

“While the demand for college graduates appears to be picking up, significant labor market slack remains,” write authors Jaison R. Abel and Richard Dietz. “So continued strong growth in the demand for college graduates may well be necessary to make a more serious dent in the underemployment rate.”

A separate study released last month by the National Association of Colleges and Employers found that employers expect to hire nearly 10 percent more new college graduates this year than last year.

The ease with which students can find jobs will depend not only on their major (those with degrees in engineering, business and computer science are the most in demand), but also on their location. A recent report by WalletHub ranking the nation’s largest cities from best to worst places to start a career found showed that cities in Texas and California have the most opportunities.

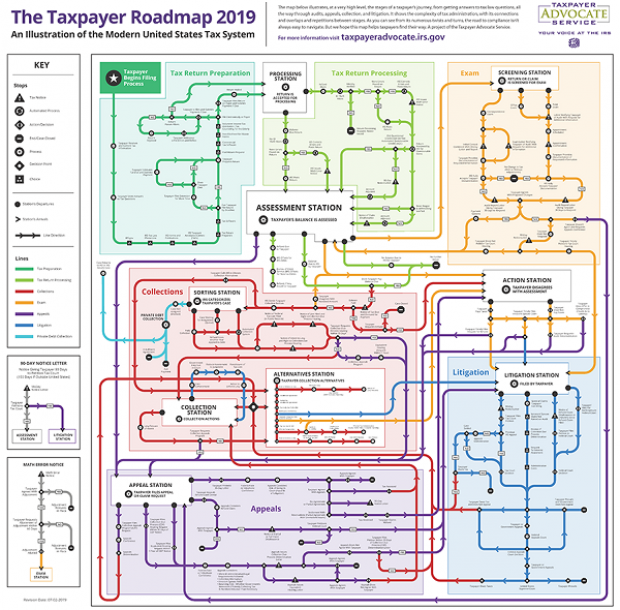

Map of the Day: Navigating the IRS

The Taxpayer Advocate Service – an independent organization within the IRS whose roughly 1,800 employees both assist taxpayers in resolving problems with the tax collection agency and recommend changes aimed at improving the system – released a “subway map” that shows the “the stages of a taxpayer’s journey.” The colorful diagram includes the steps a typical taxpayer takes to prepare and file their tax forms, as well as the many “stations” a tax return can pass through, including processing, audits, appeals and litigation. Not surprisingly, the map is quite complicated. Click here to review a larger version on the taxpayer advocate’s site.

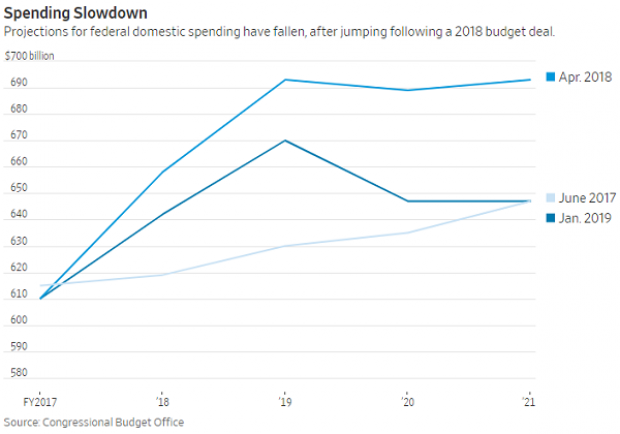

A Surprise Government Spending Slowdown

Economists expected federal spending to boost growth in 2019, but some of the fiscal stimulus provided by the 2018 budget deal has failed to show up this year, according to Kate Davidson of The Wall Street Journal.

Defense spending has come in as expected, but nondefense spending has lagged, and it’s unlikely to catch up to projections even if it accelerates in the coming months. Lower spending on disaster relief, the government shutdown earlier this year, and federal agencies spending less than they have been given by Congress all appear to be playing a role in the spending slowdown, Davidson said.

Number of the Day: $203,500

The Wall Street Journal’s Catherine Lucey reports that acting White House Chief of Staff Mick Mulvaney is making a bit more than his predecessors: “The latest annual report to Congress on White House personnel shows that President Trump’s third chief of staff is getting an annual salary of $203,500, compared with Reince Priebus and John Kelly, each of whom earned $179,700.” The difference is the result of Mulvaney still technically occupying the role of director of the White House Office of Management and Budget, where his salary level is set by law.

The White House told the Journal that if Mulvaney is made permanent chief of staff his salary would be adjusted to the current salary for an assistant to the president, $183,000.

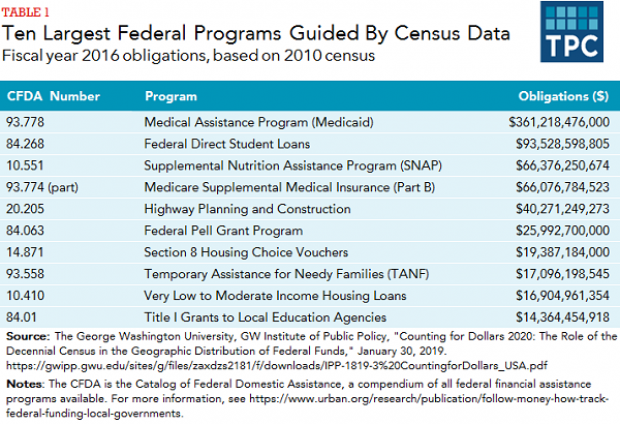

The Census Affects Nearly $1 Trillion in Spending

The 2020 census faces possible delay as the Supreme Court sorts out the legality of a controversial citizenship question added by the Trump administration. Tracy Gordon of the Tax Policy Center notes that in addition to the basic issue of political representation, the decennial population count affects roughly $900 billion in federal spending, ranging from Medicaid assistance funds to Section 8 housing vouchers. Here’s a look at the top 10 programs affected by the census:

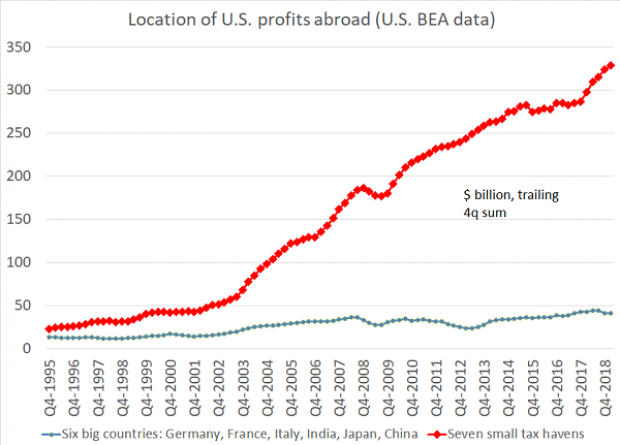

Chart of the Day: Offshore Profits Continue to Rise

Brad Setser, a former U.S. Treasury economist now with the Council on Foreign Relations, added another detail to his assessment of the foreign provisions of the Tax Cuts and Jobs Act: “A bit more evidence that Trump's tax reform didn't change incentives to offshore profits: the enormous profits that U.S. firms report in low tax jurisdictions continues to rise,” Setser wrote. “In fact, there was a bit of a jump up over the course of 2018.”