Trouble for Tesla: Why Consumer Reports Says Its Model S Was ‘Undriveable’

Consumer Reports in 2013 gave the Telsa Model S the highest rating of any vehicle in its history. This year’s review did not go as well for Elon Musk’s company.

The venerable magazine had to delay testing of the company’s newest model because its drivers couldn’t open the doors on the $127,000 sedan, temporarily making the car “undriveable.”

The door handles on the Model S P85 retract automatically and lay flush against the vehicle when they are not in use. Once the vehicle receives a signal from the key fob, the handles move to allow people to grip them. Unfortunately, the door handles stopped working after Consumer Reports testers had the vehicle for 27 days and had driven just over 2,300 miles.

That malfunction caused other problems, the magazine says: “[S]ignificantly, the car wouldn't stay in Drive, perhaps misinterpreting that the door was open due to the issue with the door handle.”

Consumer Reports’ troubles aren’t unique. The non-profit’s car reliability survey found that the Model S has had a far higher than average number of problems with doors, locks and latches, according to the organization’s website.

The testing experience wasn’t all bad, though, because the automaker’s customer service is top notch. A technician was sent to the Consumer Reports Auto Test Center the morning after the problem was reported and quickly diagnosed the problem.

“Our car needed a new door-handle control module — the part inside the door itself that includes the electronic sensors and motors to operate the door handle and open the door,” Consumer Reports says. “The whole repair took about two hours and was covered under the warranty.”

Eric Lyman, vice president of industry insights at TrueCar, told The Fiscal Times that the speed in which Tesla addressed that issue will earn it more kudos from customers who have seen carmakers drag their feet in making needed repairs. The door handle issue isn’t a big deal, he said.

“Telsa is still a relatively new automaker,” he said. “The reality is that we see this kind of thing happen all of the time. This is pretty normal in the course of business in the auto industry.”

The timing of the mishap comes as Telsa is struggling to repair its credibility with Wall Street after the electric vehicle maker’s disappointing earnings performance. Bloomberg News reported last week that the Palo Alto, Calif.-based company might have to raise money because of what one analyst described as its “eye watering” cash burn rate, or else it might run out of money in the next three quarters.

The electric vehicle maker also is facing increased competition from more established rivals. General Motors (GM), for instance, recently unveiled a Chevrolet Bolt concept car that is set to hit the market in 2017 with a projected price of about $30,000 and a battery range of 200 miles. The next generation Nissan Leaf, another electric vehicle, will hit the market at about the same time.

For now, Tesla’s biggest challenge may in convincing consumers to buy electric vehicles while oil remains cheap.

Deficit Hits $738.6 Billion in First 8 Months of Fiscal Year

The U.S. budget deficit grew to $738.6 billion in the first eight months of the current fiscal year – an increase of $206 billion, or 38.8%, over the deficit recorded during the same period a year earlier. Bloomberg’s Sarah McGregor notes that the big increase occurred despite a jump in tariff revenues, which have nearly doubled to $44.9 billion so far this fiscal year. But that increase, which contributed to an overall increase in revenues of 2.3%, was not enough to make up for the reduced revenues from the Republican tax cuts and a 9.3% increase in government spending.

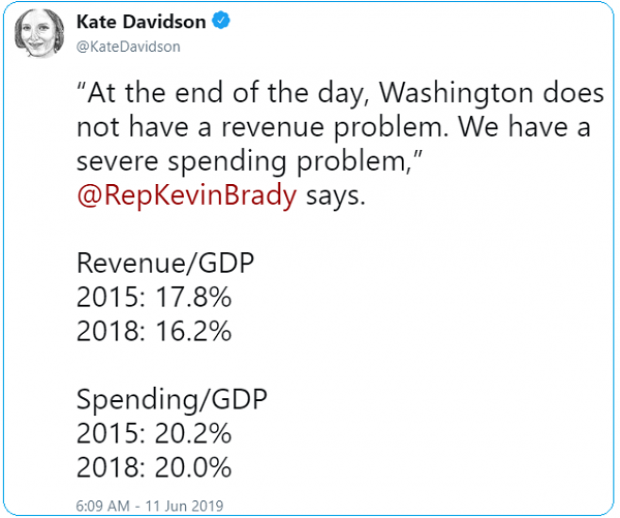

Tweet of the Day: Revenues or Spending?

Rep. Kevin Brady (R-TX), ranking member of the House Ways and Means Committee and one of the authors of the 2017 Republican tax overhaul, told The Washington Post’s Heather Long Tuesday that the budget deficit is driven by excess spending, not a shortfall in revenues in the wake of the tax cuts. The Wall Street Journal’s Kate Davidson provided some inconvenient facts for Brady’s claim in a tweet, pointing out that government revenues as a share of GDP have fallen significantly since 2015, while spending has remained more or less constant.

Chart of the Day: The Decline in IRS Audits

Reviewing the recent annual report on tax statistics from the IRS, Robert Weinberger of the Tax Policy Center says it “tells a story of shrinking staff, fewer audits, and less customer service.” The agency had 22% fewer personnel in 2018 than it did in 2010, and its enforcement budget has fallen by nearly $1 billion, Weinberger writes. One obvious effect of the budget cuts has been a sharp reduction in the number of audits the agency has performed annually, which you can see in the chart below.

Number of the Day: $102 Million

President Trump’s golf playing has cost taxpayers $102 million in extra travel and security expenses, according to an analysis by the left-leaning HuffPost news site.

“The $102 million total to date spent on Trump’s presidential golfing represents 255 times the annual presidential salary he volunteered not to take. It is more than three times the cost of special counsel Robert Mueller’s investigation that Trump continually complains about. It would fund for six years the Special Olympics program that Trump’s proposed budget had originally cut to save money,” HuffPost’s S.V. Date writes.

Date says the White House did not respond to HuffPost’s requests for comment.

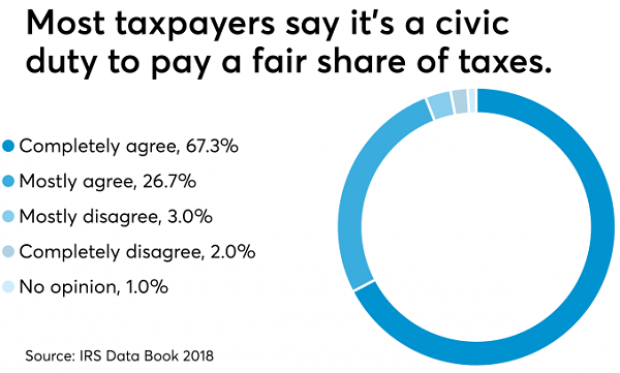

Americans See Tax-Paying as a Duty

The IRS may not be conducting audits like it used to, but according to the agency’s Data Book for 2018, most Americans still believe it’s not acceptable to cheat on your taxes. About 67% of respondents to an IRS opinion survey “completely agree” that it’s a civic duty to pay “a fair share of taxes,” and another 26% “mostly agree,” bringing the total in agreement to over 90%. Accounting Today says that attitude has been pretty consistent over the last decade.