Former CBO Chief: Congress Never Meant to Limit Obamacare Subsidies

A Supreme Court ruling expected this summer will determine whether the federal government can subsidize the insurance costs of individuals in states that did not establish their own health care exchanges under the Affordable Care Act.

Douglas Elmendorf was the director of the Congressional Budget Office when Congress debated the bill, and on Tuesday he provided some ammunition to backers of the law who insist that that Congress did not intend to prevent payments of subsidies to consumers in states using the federal exchange.

Related: How Obamacare Could Be Squeezing Consumer Spending

In an interview with CNBC’s John Harwood at the Peter G. Peterson Foundation’s 2015 Fiscal Summit*, Elmendorf said that before the ACA passed, the CBO analyzed the bill for members of Congress, many of whom were powerfully opposed to it. At the time, he said, there was a common understanding on Capitol Hill that the subsidies would be available to states regardless of the status of their exchanges.

“That analysis was subject to a lot of very intense scrutiny and a lot of questions,” he said. “My colleagues and I can remember no occasion on which anybody asked why we were expecting subsidies to be paid in all states regardless of whether they established exchanges or not. And if people had not had this common understanding…then I’m sure we would have had a lot of questions about that.”

Pressed by Harwood, Elmendorf added, “My colleagues and I talked to a lot of people, with a lot of questions about nearly every aspect of the analysis that we did…and we could not remember anybody asking us any questions about what would happen in the federal exchange different from what would happen in the state exchanges.”

Even so, the language of the law states that the subsidies would apply to exchanges “established by the State” and the Supreme Court will decide how literally those words must be interpreted.

*Pete Peterson also funds The Fiscal Times.

Coming Soon: Deductible Relief Day!

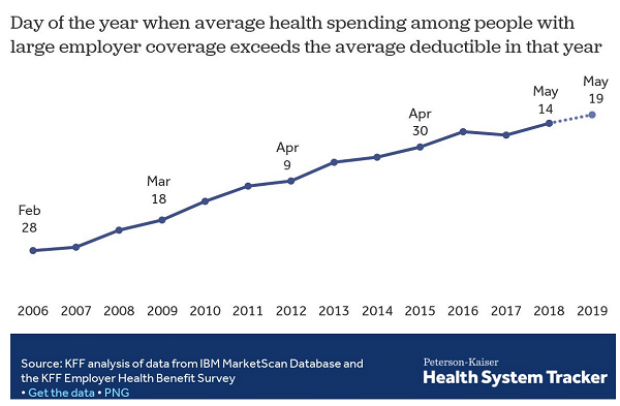

You may be familiar with the concept of Tax Freedom Day – the date on which you have earned enough to pay all of your taxes for the year. Focusing on a different kind of financial burden, analysts at the Kaiser Family Foundation have created Deductible Relief Day – the date on which people in employer-sponsored insurance plans have spent enough on health care to meet the average annual deductible.

Average deductibles have more than tripled over the last decade, forcing people to spend more out of pocket each year. As a result, Deductible Relief Day is “getting later and later in the year,” Kaiser’s Larry Levitt said in a tweet Thursday.

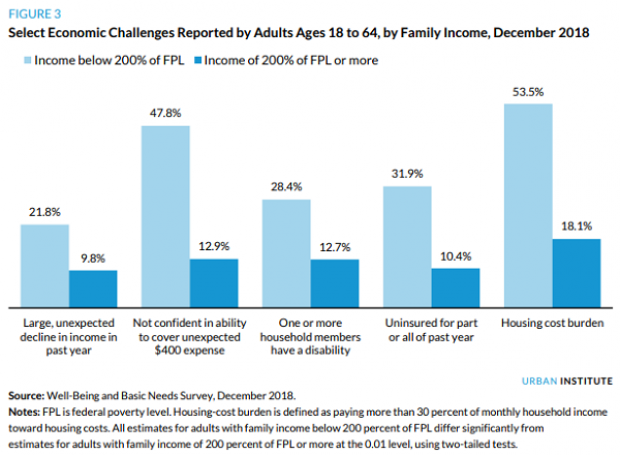

Chart of the Day: Families Still Struggling

Ten years into what will soon be the longest economic expansion in U.S. history, 40% of families say they are still struggling, according to a new report from the Urban Institute. “Nearly 4 in 10 nonelderly adults reported that in 2018, their families experienced material hardship—defined as trouble paying or being unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties for the previous year,” the report says. “Among adults in families with incomes below twice the federal poverty level (FPL), over 60 percent reported at least one type of material hardship in 2018.”

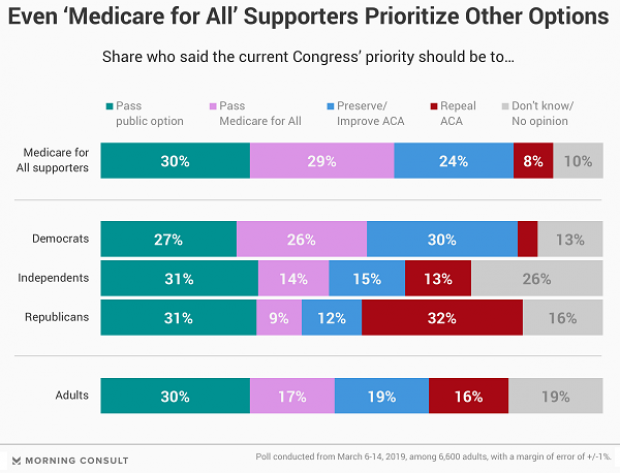

Chart of the Day: Pragmatism on a Public Option

A recent Morning Consult poll 3,073 U.S. adults who say they support Medicare for All shows that they are just as likely to back a public option that would allow Americans to buy into Medicare or Medicaid without eliminating private health insurance. “The data suggests that, in spite of the fervor for expanding health coverage, a majority of Medicare for All supporters, like all Americans, are leaning into their pragmatism in response to the current political climate — one which has left many skeptical that Capitol Hill can jolt into action on an ambitious proposal like Medicare for All quickly enough to wrangle the soaring costs of health care,” Morning Consult said.

Chart of the Day: The Explosive Growth of the EITC

The Earned Income Tax Credit, a refundable tax credit for low- to moderate-income workers, was established in 1975, with nominal claims of about $1.2 billion ($5.6 billion in 2016 dollars) in its first year. According to the Tax Policy Center, by 2016 “the total was $66.7 billion, almost 12 times larger in real terms.”

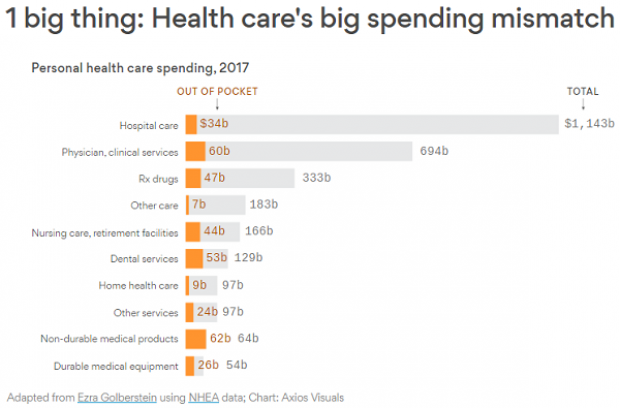

Chart of the Day: The Big Picture on Health Care Costs

“The health care services that rack up the highest out-of-pocket costs for patients aren't the same ones that cost the most to the health care system overall,” says Axios’s Caitlin Owens. That may distort our view of how the system works and how best to fix it. For example, Americans spend more out-of-pocket on dental services ($53 billion) than they do on hospital care ($34 billion), but the latter is a much larger part of national health care spending as a whole.