Bloomberg for President? Today There Was a Telling Tweet

Who is the only person who could nail the Democratic nomination for president if Hillary Rodham Clinton falters? According to USA Today columnist Michael Wolff, it’s not declared candidate Sen. Bernie Sanders of Vermont or about-to-declare former Maryland Gov. Martin O’Malley or progressive champion Sen. Elizabeth Warren of Massachusetts.

Nobody has the cash — which Wolff pegs at close to $2 billion — that would be required to mount a competitive race except for one potential candidate who been down the “will he or won’t he?” road before: former New York Mayor Michael Bloomberg. Wolff calls the self-made billionaire the obvious and only alternative because of his money, first and foremost, but also because of his “progressive social conscience with pro-growth-economic views.”

Related: Is America Ready for a Liberal Rock ‘n Roll President?

Of course, there is no reason to take Wolff seriously. Since leaving City Hall, Bloomberg has been busy reestablishing his direct control over Bloomberg L.P., the financial data and media behemoth he founded, and he hasn’t even offered a tease about possibly running.

But this morning, the Wolff column was tweeted out by Kevin Sheekey, who managed Bloomberg’s three winning campaigns for mayor. Sheekey, a former deputy mayor, is currently head of government relations and communications at Bloomberg.

“Next February say, if the sky falls in on Hillary — one or more of the storm-cloud scenarios breaking over her head — would Michael Bloomberg step up?” Wolff asks.

Kevin Sheekey probably knows the answer.

Coming Soon: Deductible Relief Day!

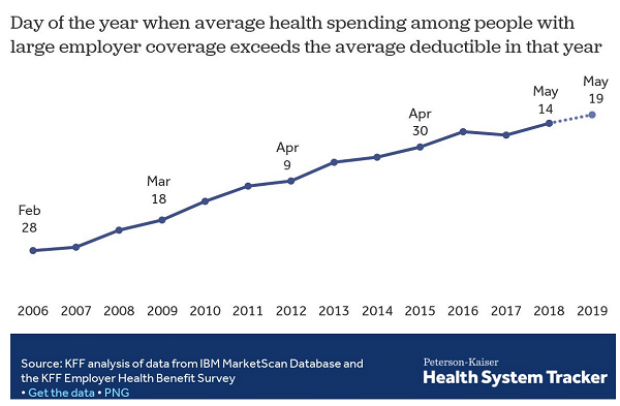

You may be familiar with the concept of Tax Freedom Day – the date on which you have earned enough to pay all of your taxes for the year. Focusing on a different kind of financial burden, analysts at the Kaiser Family Foundation have created Deductible Relief Day – the date on which people in employer-sponsored insurance plans have spent enough on health care to meet the average annual deductible.

Average deductibles have more than tripled over the last decade, forcing people to spend more out of pocket each year. As a result, Deductible Relief Day is “getting later and later in the year,” Kaiser’s Larry Levitt said in a tweet Thursday.

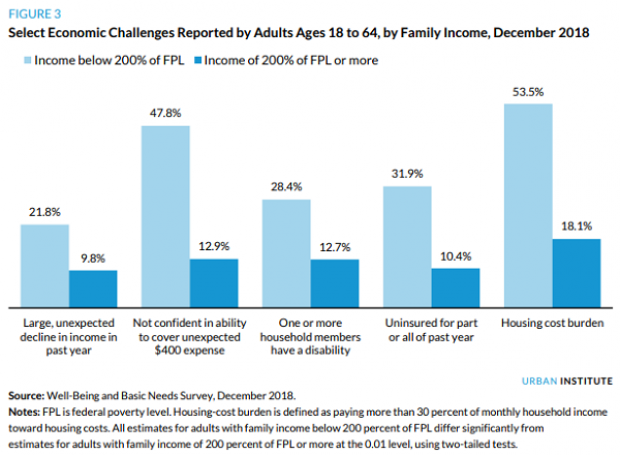

Chart of the Day: Families Still Struggling

Ten years into what will soon be the longest economic expansion in U.S. history, 40% of families say they are still struggling, according to a new report from the Urban Institute. “Nearly 4 in 10 nonelderly adults reported that in 2018, their families experienced material hardship—defined as trouble paying or being unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties for the previous year,” the report says. “Among adults in families with incomes below twice the federal poverty level (FPL), over 60 percent reported at least one type of material hardship in 2018.”

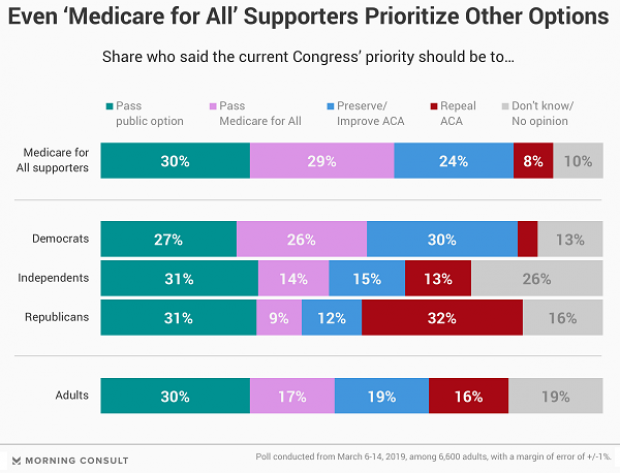

Chart of the Day: Pragmatism on a Public Option

A recent Morning Consult poll 3,073 U.S. adults who say they support Medicare for All shows that they are just as likely to back a public option that would allow Americans to buy into Medicare or Medicaid without eliminating private health insurance. “The data suggests that, in spite of the fervor for expanding health coverage, a majority of Medicare for All supporters, like all Americans, are leaning into their pragmatism in response to the current political climate — one which has left many skeptical that Capitol Hill can jolt into action on an ambitious proposal like Medicare for All quickly enough to wrangle the soaring costs of health care,” Morning Consult said.

Chart of the Day: The Explosive Growth of the EITC

The Earned Income Tax Credit, a refundable tax credit for low- to moderate-income workers, was established in 1975, with nominal claims of about $1.2 billion ($5.6 billion in 2016 dollars) in its first year. According to the Tax Policy Center, by 2016 “the total was $66.7 billion, almost 12 times larger in real terms.”

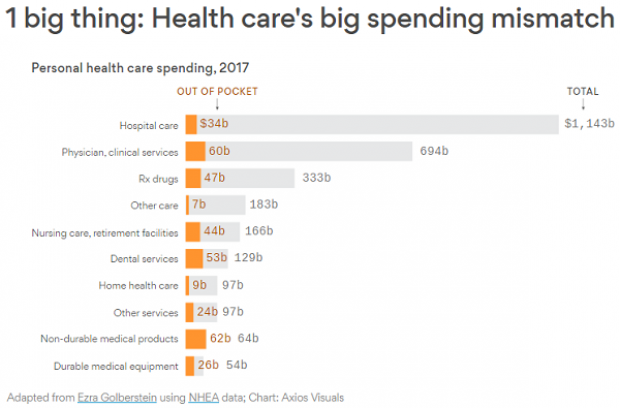

Chart of the Day: The Big Picture on Health Care Costs

“The health care services that rack up the highest out-of-pocket costs for patients aren't the same ones that cost the most to the health care system overall,” says Axios’s Caitlin Owens. That may distort our view of how the system works and how best to fix it. For example, Americans spend more out-of-pocket on dental services ($53 billion) than they do on hospital care ($34 billion), but the latter is a much larger part of national health care spending as a whole.