Charter to Buy Time Warner Cable: Winners and Losers

Charter Communications on Tuesday said it will acquire Time Warner Cable in a deal valued at more than $55 billion. Charter will also buy Bright House Networks, a smaller cable company, for $10.4 billion. The two deals combined will make Charter into the second-largest cable and broadband provider in the U.S., with about 24 million subscribers, behind only Comcast, which has about 27 million subscribers.

WINNERS

Time Warner shareholders: An extra $10 billion over the $45.2 billion Comcast had offered sure makes for a nice payday after the earlier deal got scrapped. “Time Warner Cable has succeeded in extracting a fantastic price for its shareholders, far exceeding our expectations,” Morningstar strategist Michael Hodel wrote Tuesday. Hedge fund managers John Paulson of Paulson & Co. and Chris Hohn of Children’s Investment Fund Management reportedly both had sizable holdings in Time Warner Cable.

Time Warner Cable subscribers: The company’s service is reviled by customers. Charter’s isn’t exactly beloved, either, and subscribers may not see any immediate changes, but Charter promises that the deal will translate into faster broadband for subscribers and more free public Wi-Fi. Whether it actually does or not, the deal seems to spell the end of the Time Warner Cable name. Subscribers won’t miss it.

John Malone: The Liberty Media billionaire finally gets the megadeal he’s been looking for to make Charter Communications into a major industry power. If the deals goes through, the company would become the second-largest cable and broadband provider in the country, with some 24 million total subscribers.

Related: Charter and Time Warner Cable Merger: It’s All About Broadband

LOSERS

Comcast: At least CEO Brian Rogers was graceful about the prospect of a larger competitor. "This deal makes all the sense in the world,” he said in a statement. “I would like to congratulate all the parties."

Television content providers: One rationale for the deal is that the scale of the combined company will afford it more leverage in its negotiations with programmers.

Cable customers and online video watchers? The proposed deal still concerns consumer advocates like those at public interest group Free Press. “The issue of the cable industry's power to harm online video competition, which is what ultimately sank Comcast’s consolidation plans, are very much at play in this deal,” said Derek Turner, research director for Free Press. “Ultimately, this merger is yet another example of the poor incentives Wall Street’s quarterly-result mentality creates. Charter would rather take on an enormous amount of debt to pay a premium for Time Warner Cable than build fiber infrastructure, improve service for its existing customers or bring competition into new communities.”

Trump and Schumer Will Try to Scrap the Debt Ceiling

The president and the Senate Democratic leader agreed to seek out a more permanent debt ceiling solution that would end the perpetual cycle of fiscal standoffs. “There are a lot of good reasons to do that, so certainly that’s something that will be discussed," Trump said Thursday. It might not be easy, though, as conservatives see the borrowing limit as a way to keep government spending in check. Paul Ryan said Thursday he opposes doing away with the debt ceiling.

Is a Fix for Obamacare Taking Shape?

Senators on the Committee on Health, Education, Labor and Pensions heard from governors Thursday in the second of four scheduled hearings on stabilizing Obamacare. The common theme emerging from the testimony was flexibility: "Returning control to the states is prudent policy but also prudent politics," said Utah Gov. Gary Herbert, a Republican. He was joined by Democrat John Hickenlooper of Colorado, who said that states need room to innovate and learn from their mistakes. Much of what the governors said was in line with what the Senate panel is already considering, including the continuation of cost-sharing subsidies to insurance companies. (CBS News, Axios)

Senate Approves Trump's Deal with Dems. Will the House Go Along?

The Senate on Thursday voted to fund the government and increase the federal borrowing limit through December 8 as part of a deal that also included $15.25 billion in hurricane disaster relief funding and a short-term extension of the National Flood Insurance Program. The bill passed by a vote of 80-to-17, with only Republicans voting against the bill.

The package now goes back to the House, where it likely faces more strenuous resistance. The Republican Study Committee, a conservative caucus with more than 155 members, on Thursday announced it opposed the deal because it does not include spending cuts. Rep. Mark Walker, the group's chairman, sent a letter to House Speaker Paul Ryan listing 19 policy changes to "address the growing debt burden" or "begin draining the swamp" that could win conservative support for raising the debt ceiling. Some Democrats may also vote against the deal to signal their frustration with an agreement that they say weakened their hand in trying to protect undocumented immigrants who were brought into the country as children.

White House Backs Off Shutdown Threat…for Now

“Believe me, if we have to close down our government, we’re building that wall,” President Trump said of his planned border wall with Mexico 10 days ago. Just two days later, though, White House officials told Congress that a short-term spending bill to fund the government into December wouldn’t have to include $1.6 billion for the wall, The Washington Post reports.

Trump still wants money for the wall to be included in a December budget bill, and he could follow through on his shutdown threat at that point. For now, though, an agreement on a “continuing resolution” to keep the government running after September 30 seems likelier, allowing Congress to deal with some of the other pressing issues it faces this month.

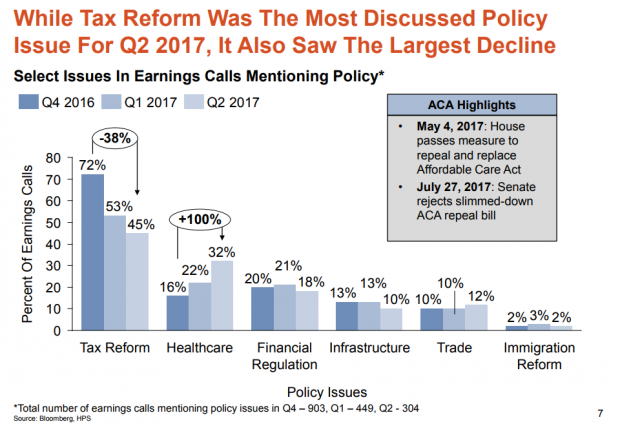

Which Trump Agenda Items Are Companies Talking About With Wall Street?

Hamilton Place Strategies, a public affairs consulting firm, analyzed transcripts of earnings calls by publicly traded U.S. companies over the last three quarters. They found that tax reform was the policy issue companies discussed most on those calls with Wall Street analysts — but that mentions of the subject dropped by 38 percent from the fourth quarter of 2016 to the second quarter of 2017. Overall, the percentage of earnings calls mentioning government or policy issues fell from 41 percent to 16 percent. Health-care reform saw the largest increase.

Does this mean that businesses have given up on tax reform this year? Perhaps. More likely, it's simply the result of a lack of action on the tax overhaul. Hamilton Place notes that mentions of tax policy peaked in February just after the Senate Finance Committee advanced Treasury Secretary Steven Mnuchin's nomination and have spiked after other tax-related announcements. So mentions of tax reform on earnings calls could surge again the fall.

One other note about what businesses have been discussing: Calls mentioning President Trump fell by 84 percent from January to late August.

08312017_HPS_Chart_of_the_day.PNG