The New Billionaires: Younger, Self-Made, More Diverse

Quick, picture a billionaire.

Chances are you conjured up an older, white man who inherited his fortune. That stereotype was pretty accurate for the past century, but times are changing.

Cultural and economic shifts over the past decade are realigning the demographics of the world’s 1 percent, and the billionaires of the future will be self-made, younger, and more diverse, according to a new report from UBS and PwC.

Last year, two-thirds of the world’s billionaires were self-made, compared with just 43 percent of billionaires 20 years ago. The report projects that the trend toward more self-made billionaires will continue get stronger over the next 5 to 10 years, peaking at about 70 percent of the billionaire population.

Related: Playgrounds of the Very Rich and Famous—A 2015 Guide

While two-thirds of current billionaires are over age 60, the average age is getting younger, thanks to both wealth transfers from the older generation and the growth of self-made billionaires.

In addition to getting younger, the report finds that billionaires are also increasingly more diverse. From 2003 to 2013, the number of female billionaires rose from 44 to 116. That’s still less than 10 percent, but it’s a number that’s growing fast.

Part of the trend toward diversity among billionaires is the explosive growth of wealth in Asia. In the first quarter of 2015, China created a new billionaire almost every week. The authors of the report expect that Asia will overtake the United States as the center of billionaire growth in the next decade.

Coming Soon: Deductible Relief Day!

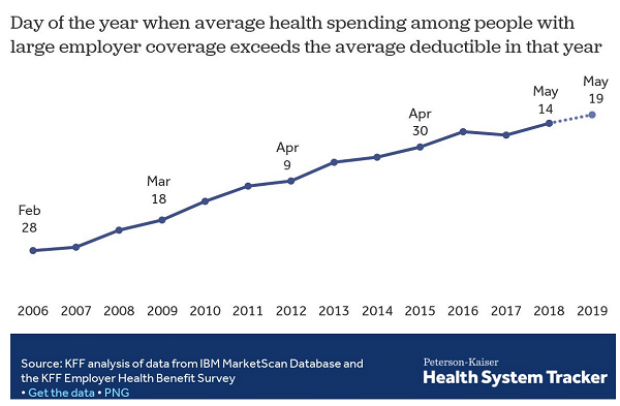

You may be familiar with the concept of Tax Freedom Day – the date on which you have earned enough to pay all of your taxes for the year. Focusing on a different kind of financial burden, analysts at the Kaiser Family Foundation have created Deductible Relief Day – the date on which people in employer-sponsored insurance plans have spent enough on health care to meet the average annual deductible.

Average deductibles have more than tripled over the last decade, forcing people to spend more out of pocket each year. As a result, Deductible Relief Day is “getting later and later in the year,” Kaiser’s Larry Levitt said in a tweet Thursday.

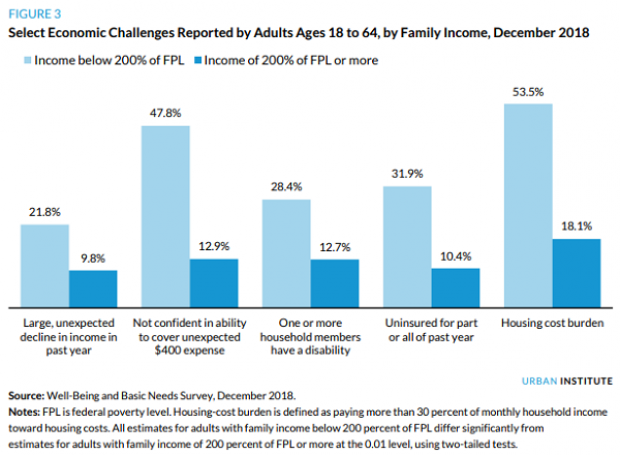

Chart of the Day: Families Still Struggling

Ten years into what will soon be the longest economic expansion in U.S. history, 40% of families say they are still struggling, according to a new report from the Urban Institute. “Nearly 4 in 10 nonelderly adults reported that in 2018, their families experienced material hardship—defined as trouble paying or being unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties for the previous year,” the report says. “Among adults in families with incomes below twice the federal poverty level (FPL), over 60 percent reported at least one type of material hardship in 2018.”

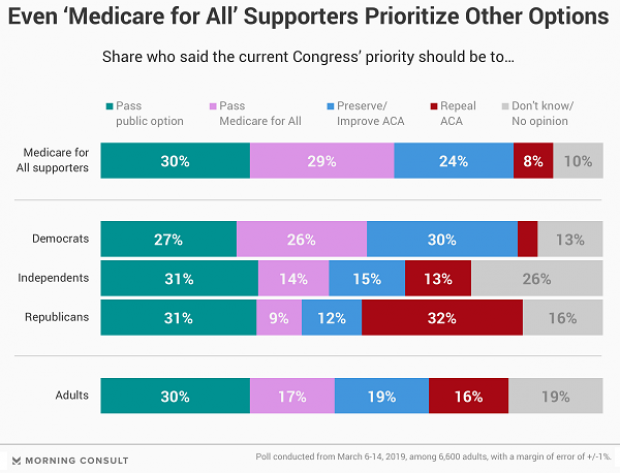

Chart of the Day: Pragmatism on a Public Option

A recent Morning Consult poll 3,073 U.S. adults who say they support Medicare for All shows that they are just as likely to back a public option that would allow Americans to buy into Medicare or Medicaid without eliminating private health insurance. “The data suggests that, in spite of the fervor for expanding health coverage, a majority of Medicare for All supporters, like all Americans, are leaning into their pragmatism in response to the current political climate — one which has left many skeptical that Capitol Hill can jolt into action on an ambitious proposal like Medicare for All quickly enough to wrangle the soaring costs of health care,” Morning Consult said.

Chart of the Day: The Explosive Growth of the EITC

The Earned Income Tax Credit, a refundable tax credit for low- to moderate-income workers, was established in 1975, with nominal claims of about $1.2 billion ($5.6 billion in 2016 dollars) in its first year. According to the Tax Policy Center, by 2016 “the total was $66.7 billion, almost 12 times larger in real terms.”

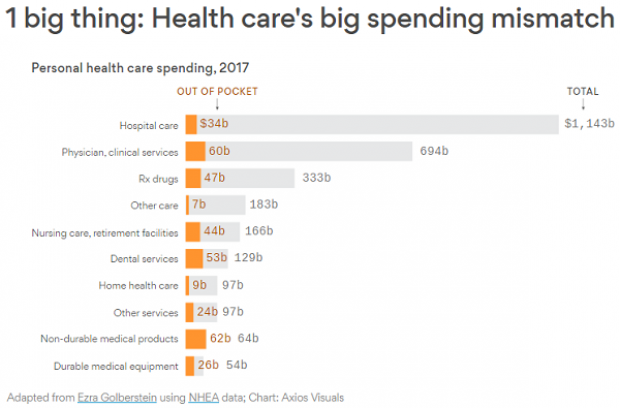

Chart of the Day: The Big Picture on Health Care Costs

“The health care services that rack up the highest out-of-pocket costs for patients aren't the same ones that cost the most to the health care system overall,” says Axios’s Caitlin Owens. That may distort our view of how the system works and how best to fix it. For example, Americans spend more out-of-pocket on dental services ($53 billion) than they do on hospital care ($34 billion), but the latter is a much larger part of national health care spending as a whole.