A Made-Up Holiday That Could Help Your Kids Go to College

Marketers are great at making up holidays—and who doesn’t love having an excuse to eat donuts on National Donut Day or pizza on National Pizza Day?

Most of these special days, however, tend to take a toll on both our wallets and our waistlines. Today may be an exception: The personal finance and college saving industries have dubbed today 529 Day (Get it? 5/29), a day to celebrate saving for college via tax-favored 529 plans.

Americans could benefit from any impetus to save more for higher education. The average American family that’s saving for college put away about $2,600 last year and has a total of just over $10,000 socked away for education, according to Sallie Mae’s annual How America Saves for College report. That’s the lowest amount since the survey began in 2009 — or about enough to send one kid to college for one semester at today’s prices.

Related: Top-rated 529 Plans Probably Are Not For You

Many states are “celebrating” the day with everything from waived enrollment fees to discounted admission to local baseball games. (Each plan is sponsored by a state but run by financial firms.) Check out this interactive map to find out if your state is offering any incentives today.

Contributions to a 529 plan are made after federal taxes, but the money grows tax-free as long as the proceeds are used for education costs. Some states also offer tax breaks on contributions.

The average cost of attending public college this year is $19,000. For private college it’s $33,000, according to The College Board. So there’s no time like today to start saving.

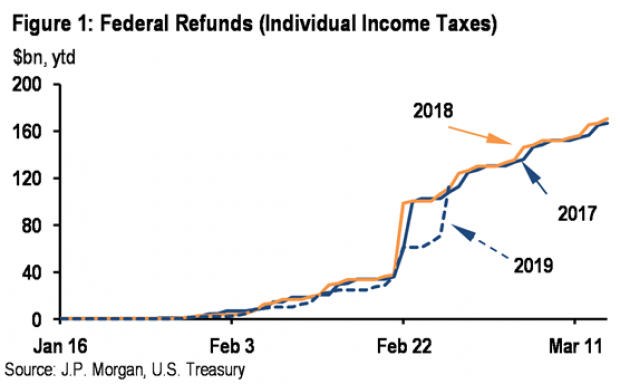

Tax Refunds Rebound

Smaller refunds in the first few weeks of the current tax season were shaping up to be a political problem for Republicans, but new data from the IRS shows that the value of refund checks has snapped back and is now running 1.3 percent higher than last year. The average refund through February 23 last year was $3,103, while the average refund through February 22 of 2019 was $3,143 – a difference of $40. The chart below from J.P. Morgan shows how refunds performed over the last 3 years.

Number of the Day: $22 Trillion

The total national debt surpassed $22 trillion on Monday. Total public debt outstanding reached $22,012,840,891,685.32, to be exact. That figure is up by more than $1.3 trillion over the past 12 months and by more than $2 trillion since President Trump took office.

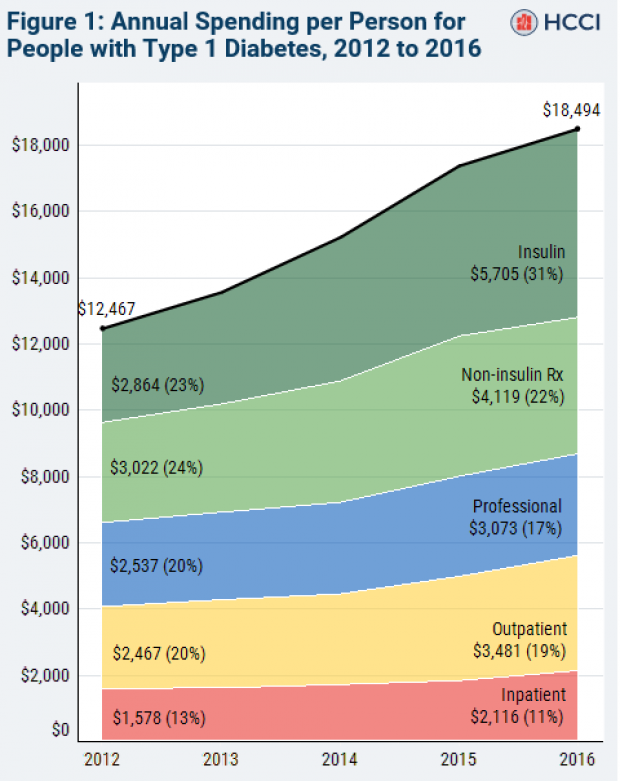

Chart of the Week: The Soaring Cost of Insulin

The cost of insulin used to treat Type 1 diabetes nearly doubled between 2012 and 2016, according to an analysis released this week by the Health Care Cost Institute. Researchers found that the average point-of-sale price increased “from $7.80 a day in 2012 to $15 a day in 2016 for someone using an average amount of insulin (60 units per day).” Annual spending per person on insulin rose from $2,864 to $5,705 over the five-year period. And by 2016, insulin costs accounted for nearly a third of all heath care spending for those with Type 1 diabetes (see the chart below), which rose from $12,467 in 2012 to $18,494.

Chart of the Day: Shutdown Hits Like a Hurricane

The partial government shutdown has hit the economy like a hurricane – and not just metaphorically. Analysts at the Committee for a Responsible Federal Budget said Tuesday that the shutdown has now cost the economy about $26 billion, close to the average cost of $27 billion per hurricane calculated by the Congressional Budget Office for storms striking the U.S. between 2000 and 2015. From an economic point of view, it’s basically “a self-imposed natural disaster,” CRFB said.

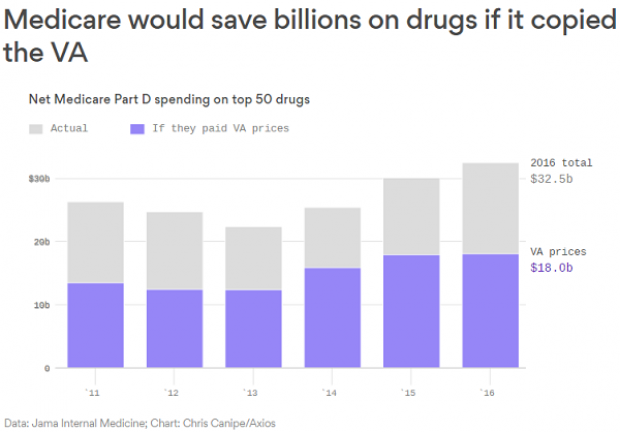

Chart of the Week: Lowering Medicare Drug Prices

The U.S. could save billions of dollars a year if Medicare were empowered to negotiate drug prices directly with pharmaceutical companies, according to a paper published by JAMA Internal Medicine earlier this week. Researchers compared the prices of the top 50 oral drugs in Medicare Part D to the prices for the same drugs at the Department of Veterans Affairs, which negotiates its own prices and uses a national formulary. They found that Medicare’s total spending was much higher than it would have been with VA pricing.

In 2016, for example, Medicare Part D spent $32.5 billion on the top 50 drugs but would have spent $18 billion if VA prices were in effect – or roughly 45 percent less. And the savings would likely be larger still, Axios’s Bob Herman said, since the study did not consider high-cost injectable drugs such as insulin.