Jamie Dimon Is Now a Billionaire

The vast majority of the billionaires in the U.S. made their money in one of two ways—they started a company, or they inherited their fortune or business.

But Jamie Dimon, chairman and CEO of JPMorgan Chase, has shown another path to riches. As a corporate manager, he may have amassed enough stock and boosted the share price enough to join the 10-figure club.

According to Bloomberg, Dimon is now worth $1.1 billion. His stake in JPMorgan through shares and options is worth $485 million and he also has real estate valued at $32 million. In addition, he has wealth from "an investment portfolio seeded by proceeds" from his previous stint at Citigroup.

Related: America’s Highest Paid CEO: It’s Not Who You Think

While highly unusual, Dimon isn't the first billionaire professional manager or executive who gained his wealth from stock in a company he didn't found or take public. The first manager-billionaire in the U.S. was believed to be Roberto Goizueta, CEO of Coca-Cola during the 1980s and 1990s. During his tenure, Coca-Cola's stock jumped more than 70-fold and Goizueta had stock and options totaling more than $1 billion.

More recently, the billionaire managers have been from finance. James Cayne, the colorful CEO and chairman of Bear Stearns became a billionaire on paper—before Bear Stearns collapsed during the financial crisis.

Richard Fuld, CEO of Lehman Brothers, also became a paper billionaire in 2007—before the investment bank became the largest bankruptcy in U.S. history in 2008.

Plenty of other finance chiefs have become billionaires—from hedge-funders to private-equity kings Steve Schwarzman and David Rubenstein. Citi founder Sandy Weill was a billionaire, but he created the company.

So while he may not be the first, Dimon may make history another way—by becoming the first manager-billionaire in finance to run a bank that thrives for decades after his leadership.

This article originally appeared on CNBC.

Read more from CNBc.

CNBC Charts the top 100 firms

Shift from slaes to planning fuels fee-only business

Harvard Receives Laegest Ever Gift

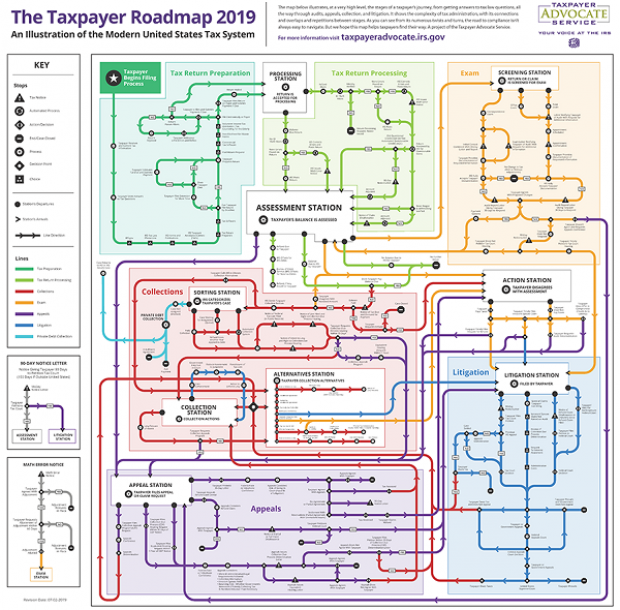

Map of the Day: Navigating the IRS

The Taxpayer Advocate Service – an independent organization within the IRS whose roughly 1,800 employees both assist taxpayers in resolving problems with the tax collection agency and recommend changes aimed at improving the system – released a “subway map” that shows the “the stages of a taxpayer’s journey.” The colorful diagram includes the steps a typical taxpayer takes to prepare and file their tax forms, as well as the many “stations” a tax return can pass through, including processing, audits, appeals and litigation. Not surprisingly, the map is quite complicated. Click here to review a larger version on the taxpayer advocate’s site.

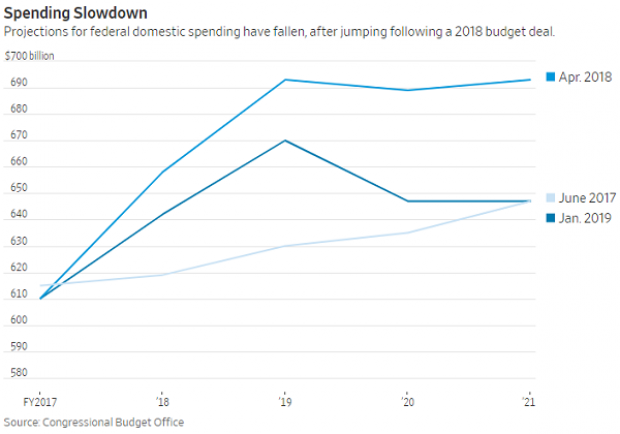

A Surprise Government Spending Slowdown

Economists expected federal spending to boost growth in 2019, but some of the fiscal stimulus provided by the 2018 budget deal has failed to show up this year, according to Kate Davidson of The Wall Street Journal.

Defense spending has come in as expected, but nondefense spending has lagged, and it’s unlikely to catch up to projections even if it accelerates in the coming months. Lower spending on disaster relief, the government shutdown earlier this year, and federal agencies spending less than they have been given by Congress all appear to be playing a role in the spending slowdown, Davidson said.

Number of the Day: $203,500

The Wall Street Journal’s Catherine Lucey reports that acting White House Chief of Staff Mick Mulvaney is making a bit more than his predecessors: “The latest annual report to Congress on White House personnel shows that President Trump’s third chief of staff is getting an annual salary of $203,500, compared with Reince Priebus and John Kelly, each of whom earned $179,700.” The difference is the result of Mulvaney still technically occupying the role of director of the White House Office of Management and Budget, where his salary level is set by law.

The White House told the Journal that if Mulvaney is made permanent chief of staff his salary would be adjusted to the current salary for an assistant to the president, $183,000.

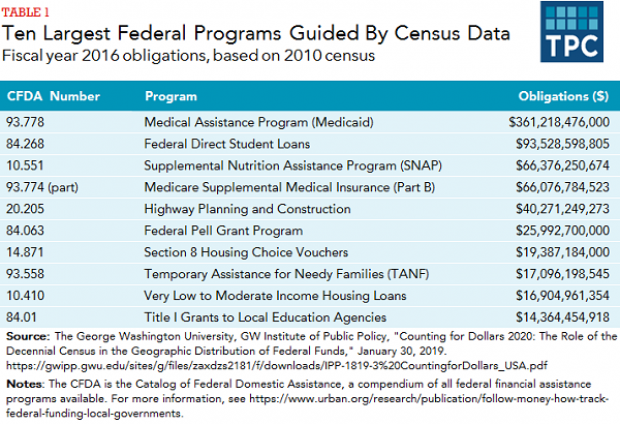

The Census Affects Nearly $1 Trillion in Spending

The 2020 census faces possible delay as the Supreme Court sorts out the legality of a controversial citizenship question added by the Trump administration. Tracy Gordon of the Tax Policy Center notes that in addition to the basic issue of political representation, the decennial population count affects roughly $900 billion in federal spending, ranging from Medicaid assistance funds to Section 8 housing vouchers. Here’s a look at the top 10 programs affected by the census:

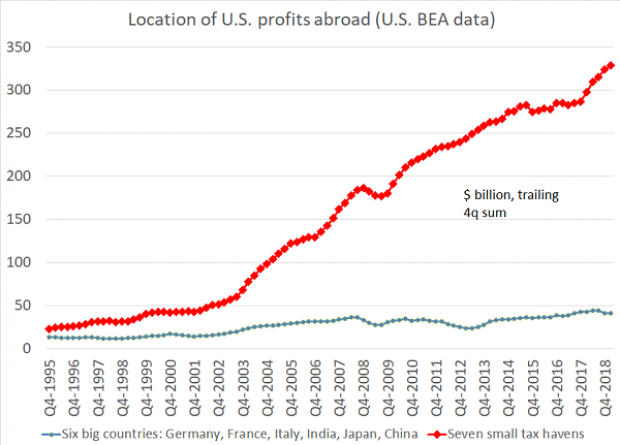

Chart of the Day: Offshore Profits Continue to Rise

Brad Setser, a former U.S. Treasury economist now with the Council on Foreign Relations, added another detail to his assessment of the foreign provisions of the Tax Cuts and Jobs Act: “A bit more evidence that Trump's tax reform didn't change incentives to offshore profits: the enormous profits that U.S. firms report in low tax jurisdictions continues to rise,” Setser wrote. “In fact, there was a bit of a jump up over the course of 2018.”