The 2016 Presidential Debates Could Become a Slugfest

Few could doubt the impact of nationally televised presidential debates after Republican Mitt Romney set President Obama back on his heels in their first encounter in October 2012.

Romney was articulate and aggressive while Obama appeared frazzled and very much off his game. Romney’s commanding performance helped the former Massachusetts governor briefly energize his floundering campaign and regain its momentum.

Related: Clinton Plays the Gender Card as a Campaign Strategy -

Moreover, with home viewership topping 67 million, the debate -- moderated by Jim Lehrer, the former news anchor for the PBS News Hour – broke a 32-year gross viewership record dating back to the first debate between Democratic President Jimmy Carter and Republican challenger Ronald Reagan in 1980.

Yet amid dramatic changes in political campaign tactics and fundraising and the way Americans consume the news, these televised general election presidential debates actually are suffering from diminished reach.

A new study issued on Wednesday by the Annenberg Public Policy Center at the University of Pennsylvania seemed to compare presidential debates to TV entertainment. Their assessment: the more than two-decade old debate format is to blame for the low viewership among millennials, although baby boomer viewers have increased.

Related: Why Marco Rubio Might Just Beat Hillary Clinton

So what to do? In an era when large audiences pay far more attention to “Game of Thrones,” “House of Cards,” “Master Chef” and “So You Think You Can Dance” than to increasingly lengthy presidential campaign seasons, how can the political parties and the National Presidential Debate Commission jazz up the debates to attract and keep a wider audience?

The Annenberg panel, of course, stops well short of recommending the equivalent of no-holds barred political mudwrestling to heighten audience engagement and sustained interest. The goal, the group says, is to expand and enrich debate content and produce a better informed group of voters.

To that end, the advisory group appears anxious to get rid of the moderator or middle man as much as possible and allow the two candidates to set the agenda and duke it out. They want to get rid of the one or more prominent journalists who set the ground rules and determine the pace and course of the evening’s discussion.

Related: GOP Prunes the 2016 Primary Debates Down to Nine

If, for example, Hillary Clinton were to slam, say, Marco Rubio in a debate, Rubio shouldn’t have to wait patiently for his opportunity to reply but should be allowed to jump in with a rejoinder. Think of it as the resurrection of CNN’s Crossfire.

To add a smidgeon of Jeopardy to the proceedings, each candidate would have a total of 45 minutes to spend to make their case or defend it.

While the candidates would have plenty of opportunity to get their political messages across, they would also have to respond quickly to attacks. A well-scripted candidate wouldn’t necessarily do well in that setting, and the possibility of “oops” moments would be increased. Welcome to reality TV, Beltway style.

Related: The GOP Hunger Games: Who Will Make the Debate Cut?

Ah….but dead air is not an option, so a filibuster is off the table. No answer, rebuttal or question could exceed three minutes, according to the panel. When a candidate runs out of total time, he or she has exhausted the right to speak. Remaining time at the end of the moderator-posed topics can be used for a closing statement.

The recommendations are advisory only and it will be up to the presidential debate commission and the national parties to iron out the final ground rules next year.

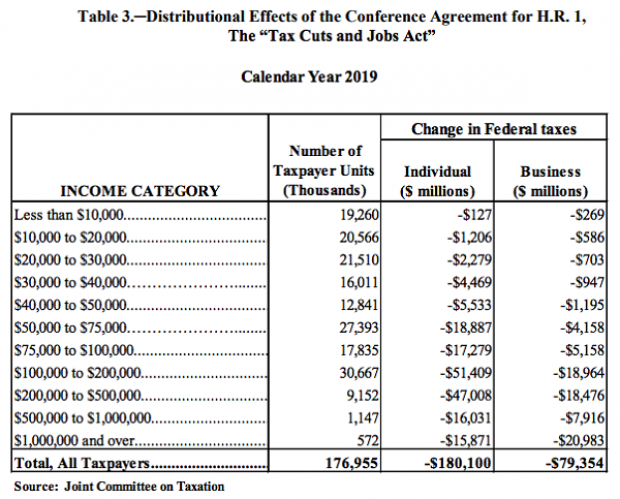

Majority of Tax Cuts Going to Filers Earning More Than $100K: JCT

Ahead of a House Ways and Means Committee hearing scheduled for Wednesday, the Joint Committee on Taxation prepared an analysis of the distributional effects of the 2017 Republican tax bill. The New York Times’ Jim Tankersley highlighted the fact that according to the JCT analysis, about 75 percent of the individual and business benefits of the tax cuts will go to filers earning more than $100,000 in 2019. And nearly half of the benefits will flow to filers earning over $200,000.

The Trump Budget's $1.2 Trillion in 'Phantom Revenues'

President Trump’s 2020 budget includes up to $1.2 trillion in “potentially phantom revenues” — money that comes from taxes the administration opposes or from tax hikes that face strong opposition from businesses, The Wall Street Journal’s Richard Rubin reports, citing data from the Committee for a Responsible Federal Budget. That total, covering 2020 through 2029, includes as much as $390 billion in taxes created under the Affordable Care Act, which the president wants to repeal.

The $1.2 trillion in questionable revenue projections is in addition to the White House budget’s projected deficits of $7.3 trillion for the 10-year period. That total is itself questionable, given that the president’s budget relies on optimistic assumptions about economic growth and some unrealistic spending cuts, meaning that the deficits could be significantly higher than projected.

Republicans Push Ahead on Medicaid Restrictions

The Trump administration on Friday approved Ohio’s request to impose work requirements on Medicaid recipients. Starting in 2021, the state will require most able-bodied adults aged 19 to 49 to either work, go to school, be in job training or volunteer for 80 hours a month in order to receive Medicaid benefits. Those who fail to meet the requirements over 60 days will be removed from the system, although they can reapply immediately.

The new work requirements include exemptions for pregnant women, caretakers and those living in counties with high unemployment rates and will apply only to those covered through the expansion of Medicaid under the Affordable Care Act. There are currently about 540,000 people on Medicaid in Ohio who receive coverage through the expansion, according to Kaitlin Schroeder of The Dayton Daily News, compared to roughly 2.6 million Medicaid recipients in the state overall.

Once implemented, the work requirements are expected to result in 36,000 people losing their Medicaid eligibility, according to state officials, though critics say the reductions could be significantly larger. Similar work requirements in Arkansas pushed 18,000 people off the Medicaid rolls in six months.

A larger GOP project: The creation of new work requirements is part of a larger effort by Republicans to limit the expansion of Medicaid, says The Wall Street Journal’s Stephanie Armour. Since the Affordable Care Act passed in 2010, 36 states have expanded their Medicaid programs under the ACA and the number of people in the program has grown by 50 percent, from roughly 50 million to about 75 million. But many red-state governors have expressed concerns about the cost of Medicaid expansion and worries about a lack of self-sufficiency among the able-bodied poor, and are embracing new limitations on the program for both fiscal and political reasons.

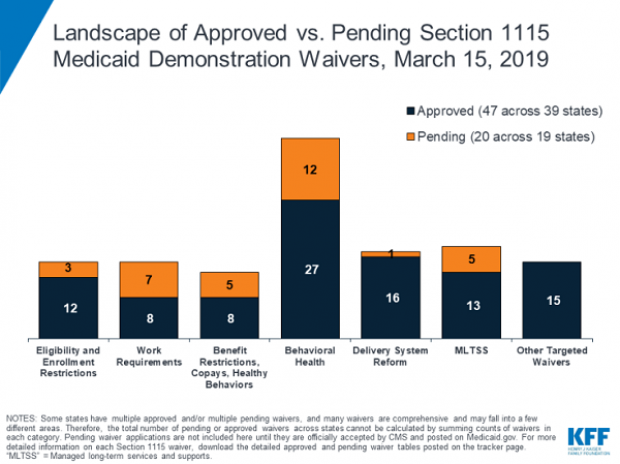

In 2017, the White House in 2017 gave states the green light to explore ways to limit the reach and expense of their Medicaid programs. Governors have proposed a variety of new rules, which require waivers from the federal government to enact. Kentucky, for example, wants to drug-test Medicaid recipients, and Utah wants a partial expansion and a cap on payments. Kaiser Health News summarizes the variety of waivers states have requested, which are governed by Section 1115 of the Social Security Act, in the chart below.

Legal challenges: Efforts to restrict Medicaid have received legal challenges, and U.S. District Judge James Boasberg blocked work requirements in Kentucky last year. The same judge, who has expressed doubts about the administration’s approach to Medicaid, will rule on the legality of work requirements in both Kentucky and Arkansas by April 1.

The bottom line: The Trump administration is seeking fundamental changes in how Medicaid works. Even if Boasberg rules against work requirements, expect the White House and Republican governors to continue to push for new limitations on the program.

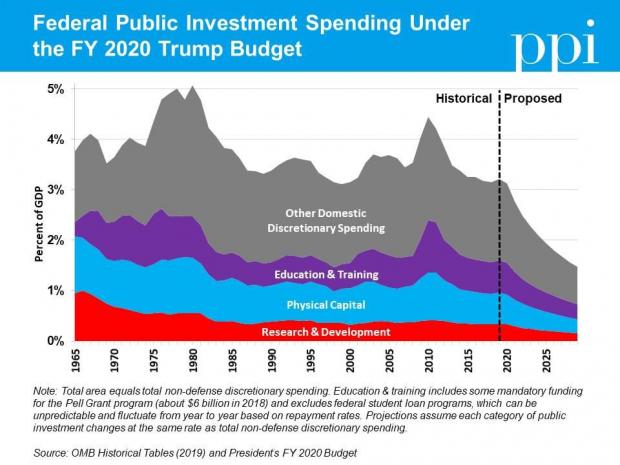

Chart of the Day: Trump's Huge Proposed Cuts to Public Investment

Ben Ritz of the Progressive Policy Institute slams President Trump’s new budget:

“It would dismantle public investments that lay the foundation for economic growth, resulting in less innovation. It would shred the social safety net, resulting in more poverty. It would rip away access to affordable health care, resulting in more disease. It would cut taxes for the rich, resulting in more income inequality. It would bloat the defense budget, resulting in more wasteful spending. And all this would add up to a higher national debt than the policies in President Obama’s final budget proposal.”

Here’s Ritz’s breakdown of Trump’s proposed spending cuts to public investment in areas such as infrastructure, education and scientific research:

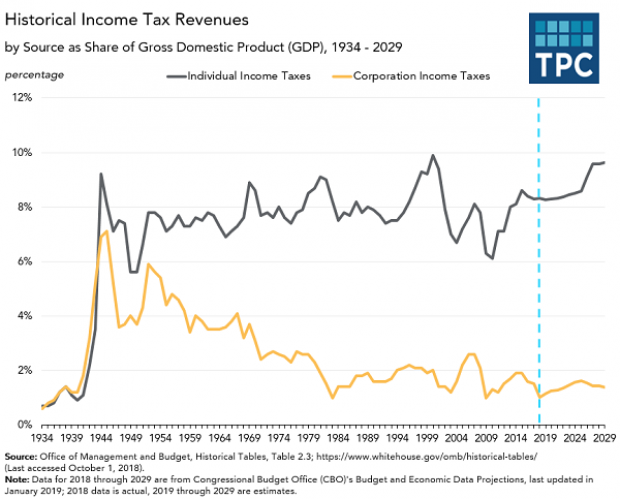

Chart of the Day: The Decline in Corporate Taxes

Since roughly the end of World War Two, individual income taxes in the U.S. have equaled about 8 percent of GDP. By contrast, the Tax Policy Center says, “corporate income tax revenues declined from 6% of GDP in 1950s to under 2% in the 1980s through the Great Recession, and have averaged 1.4% of GDP since then.”