The 2016 Presidential Debates Could Become a Slugfest

Few could doubt the impact of nationally televised presidential debates after Republican Mitt Romney set President Obama back on his heels in their first encounter in October 2012.

Romney was articulate and aggressive while Obama appeared frazzled and very much off his game. Romney’s commanding performance helped the former Massachusetts governor briefly energize his floundering campaign and regain its momentum.

Related: Clinton Plays the Gender Card as a Campaign Strategy -

Moreover, with home viewership topping 67 million, the debate -- moderated by Jim Lehrer, the former news anchor for the PBS News Hour – broke a 32-year gross viewership record dating back to the first debate between Democratic President Jimmy Carter and Republican challenger Ronald Reagan in 1980.

Yet amid dramatic changes in political campaign tactics and fundraising and the way Americans consume the news, these televised general election presidential debates actually are suffering from diminished reach.

A new study issued on Wednesday by the Annenberg Public Policy Center at the University of Pennsylvania seemed to compare presidential debates to TV entertainment. Their assessment: the more than two-decade old debate format is to blame for the low viewership among millennials, although baby boomer viewers have increased.

Related: Why Marco Rubio Might Just Beat Hillary Clinton

So what to do? In an era when large audiences pay far more attention to “Game of Thrones,” “House of Cards,” “Master Chef” and “So You Think You Can Dance” than to increasingly lengthy presidential campaign seasons, how can the political parties and the National Presidential Debate Commission jazz up the debates to attract and keep a wider audience?

The Annenberg panel, of course, stops well short of recommending the equivalent of no-holds barred political mudwrestling to heighten audience engagement and sustained interest. The goal, the group says, is to expand and enrich debate content and produce a better informed group of voters.

To that end, the advisory group appears anxious to get rid of the moderator or middle man as much as possible and allow the two candidates to set the agenda and duke it out. They want to get rid of the one or more prominent journalists who set the ground rules and determine the pace and course of the evening’s discussion.

Related: GOP Prunes the 2016 Primary Debates Down to Nine

If, for example, Hillary Clinton were to slam, say, Marco Rubio in a debate, Rubio shouldn’t have to wait patiently for his opportunity to reply but should be allowed to jump in with a rejoinder. Think of it as the resurrection of CNN’s Crossfire.

To add a smidgeon of Jeopardy to the proceedings, each candidate would have a total of 45 minutes to spend to make their case or defend it.

While the candidates would have plenty of opportunity to get their political messages across, they would also have to respond quickly to attacks. A well-scripted candidate wouldn’t necessarily do well in that setting, and the possibility of “oops” moments would be increased. Welcome to reality TV, Beltway style.

Related: The GOP Hunger Games: Who Will Make the Debate Cut?

Ah….but dead air is not an option, so a filibuster is off the table. No answer, rebuttal or question could exceed three minutes, according to the panel. When a candidate runs out of total time, he or she has exhausted the right to speak. Remaining time at the end of the moderator-posed topics can be used for a closing statement.

The recommendations are advisory only and it will be up to the presidential debate commission and the national parties to iron out the final ground rules next year.

Two-Thirds of Parents Are Making This Big Financial Mistake

More than a third of Americans with young children don’t have any life insurance, and another third have policies with payouts of less than $100,000, according to a new analysis by Bankrate.com

The survey found that 42 percent of all Americans haven’t purchased life insurance, and about half of those with insurance have policies worth $100,000 or less, including 25 percent of those with a household income over $75,000.

Of course not everyone needs life insurance, but people who have family members depending on them financially should have a policy. The amount you need varies, depending on your future financial obligations, outstanding debts, and current assets.

Related: How to Calculate Your Life Insurance in 3 Easy Steps

Part of the reason for inadequate coverage could be that people underestimate the benefits they’re receiving from work (which don’t roll over from job to job), or they’re failing to update their policy after major life changes like the birth of a child or the purchase of a home.

Another factor: They’re misinformed about the price of life insurance. Eight in 10 consumers have incorrect ideas about the price of life insurance, with millennials overestimating the cost by 213 percent and Gen Xers overestimating it by 119 percent, according insurer trade organization LIMRA.

In addition to your age and health, the price of life insurance could be impacted by your credit history, driving record, and lifestyle.

The LIMRA study found that 30 percent of Americans think they need more life insurance, but more than half said it was unlikely that they’d purchase a policy in the next year.

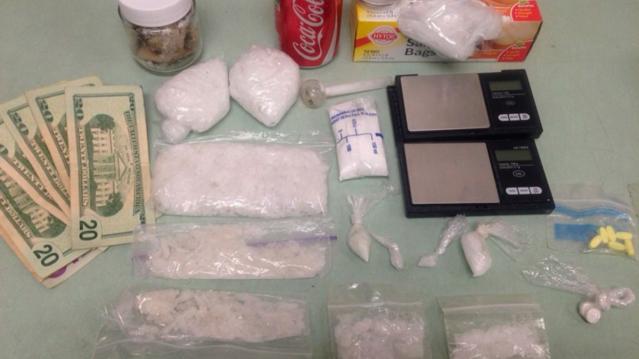

The Rapidly Rising Death Toll of the Heroin Epidemic

The death toll from the heroin epidemic has been climbing dramatically in recent years — and the annual rate of overdose deaths nearly doubled between 2011 and 2013, according to a new CDC study.

From 2002 through 2013, heroin use in the United States rose by 63 percent, and the rate of abuse or dependence climbed a staggering 90 percent. Deaths from heroin-related overdoses nearly quadrupled, with more than 8,200 people dying in 2013 alone.

The CDC report says that heroin use has increased across most demographic groups — men and women, most age groups, and across all income levels. Rates of heroin use are still highest among men, those ages 18 to 25, people with income less than $20,000 a year, people in urban areas, and those who do not have health insurance or are on Medicaid. But other groups are turning to the drug, too. “Some of the greatest increases occurred in demographic groups with historically low rates of heroin use: women, the privately insured and people with higher incomes,” the CDC says.

The heroin trend isn’t happening in isolation, the CDC study says. Almost all heroin users — 96 percent — also took at least one other drug, and 61 percent used at least three other drugs. Abuse or dependence on opioid painkillers is the strongest risk-factor for heroin use or addiction, the report says, with cocaine addiction also high on the list. People who are addicted to prescription opioid painkillers are 40 times more likely to use or be addicted to heroin, and 45 percent of people who used heroin were also addicted to painkillers.

Another key reason is that heroin is becoming cheaper and more widely available. According to the DEA, the increase in heroin seizures in the U.S. from 2010 and 2014 rose 81 percent, from 2,763 kilograms to 5,014 kilograms. More and more law enforcement agencies are identifying heroin as their primary drug threat, but the CDC report suggests that health care workers focus on reducing the abuse of painkillers by improving prescribing practices.

The study also recommends that states increase access to “medication-assisted treatment” programs that use methadone, buprenorphine and naltrexone along with behavioral counseling. And it says the rapid rise in heroin-related deaths highlights an “urgent need” to broaden access to naloxone, a drug that can reverse the effects of heroin and opioid overdose.

Here’s Why Economists Are Worried About A New Housing Bubble

After posting their 39th consecutive month of year-over-year price gains, home prices in 33 states and the District of Columbia are at or within 10 percent of record highs, according to a report issued today by CoreLogic.

Home prices increased 6.3 percent year-over-year in May, and 1.7 percent month-over-month. Relatively low mortgage rates have helped fuel the price gains. In cities like San Francisco, where there is limited supply and high demand, prices are growing at a double-digit clip.

Prices are so high in certain areas that some economists are starting to worry about localized bubbles. The number of homes on the market is increasing slightly. Total housing inventory at the end of may reached 2.29 million houses, 1.8 percent more than this time last year, according to the National Association of Realtors. That’s a 5.1-month supply, giving sellers a slight edge in today’s market. (A six-month supply is considered a healthy market.)

Related: Get ready for Another Real Estate Bubble

South Carolina saw the biggest price gains, with homes showing annual appreciation of 10.3 percent. Other states showing big gains were Colorado (9.8 percent) and Washington (8.8 percent), CoreLogic reports.

High prices have also spurred builders to start constructing new single-family homes, sales of which increased 23 percent year-over-year in May.

While most states have seen price gains, five states (Massachusetts, Connecticut, Maryland, Mississippi, and Louisiana) saw local home prices fall in May.

CoreLogic economists expect prices to increase 5.1 percent year-over-year in June and 0.8 percent month to month.

Looking for Likes? When to Post on Facebook for Maximum Attention

Trying to decide when to post photo updates to your “Summer 2015” album so the maximum number of people click through, comment on, and like your filtered selfies? Look no further. A new study conducted by the social media analytics firm Klout can tell you the best time and day of the week to post on Facebook and Twitter, depending where you are in the world.

The study found that posting in the late morning and early afternoons on Tuesdays and Wednesdays tends to generate the most engagement. Thursdays tend to be quiet, Fridays are quieter still, and the weekends are the quietest. On Mondays, the activity level begins to ramp up again as the work week begins and bored office workers take social media breaks.

Optimal times also depend on location. Tokyo peaks at the earliest time among cities studied, between 7 a.m. and 9 a.m. Paris has a high level of engagement once in the morning and once in the afternoon. In San Francisco, between 9 a.m. and 10 a.m. is ideal for posting. The most favorable time in New York is just before noon. London peaks the latest, with users becoming fully engaged on Twitter and Facebook only in the early afternoon.

Thinking about posting a picture of your cute new nephew at night? Don’t even bother if you want maximum engagement from your followers and friends. While one explanation is that fewer people are online at night, another is that most likes, shares, and comments occur within a short window of time after someone posts something. Researchers of the study found the majority of reactions were within the first two hours of posting time.

Using a sample set of half a million active users and more than 25 million messages over 56 days, the report boasts a reaction gain of up to 4 percent on Twitter and 17 percent on Facebook when the recommended posting times are used.

Why We All Buy Tide: The 10 Biggest Advertisers in the U.S.

The 200 top national advertisers spent a record $137.8 billion last year trying to get you to buy more of their goods and services, an increase of 2 percent over 2013, according to Ad Age’s latest annual spending review.

That total was slightly more than the GDP of Hungary last year, but the growth rate was the lowest since 2009, as advertisers looked to get the most for their money. Internet display advertising among those 200 marketing Goliaths dropped by 13.3 percent.

Overall, 38 marketers spent more than $1 billion on advertising last year. Procter & Gamble remains the country’s (and the world’s) largest advertiser. It shelled out $4.6 billion in the U.S. alone to promote brands such as Crest, Duracell, Pampers and Tide — or well over $1 billion more than the next biggest spender. P&G’s CFO recently revealed plans to cut ad spending by as much as $500 million, though.

Here’s Ad Age’s list of the 10 biggest advertisers in the U.S. last year: