Can ‘Project Lightning’ Give Twitter a Fresh Jolt?

The ubiquitous blue bird associated with Twitter (TWTR) has been incessantly chirping out new announcements this month as the social media phenom tries to pick itself back up after being slammed for weak earnings growth and the underperformance of its stock.

Projections from data firm eMarketer call for the Twitter monthly user base to grow at a measly 14.1 percent this year, compared with more than 30 percent growth two years ago, according to Reuters.

While the news last week that CEO Dick Costolo was relinquishing the corner office was not a shock since he has offered to resign in the past, the appointment of co-founder and former chief executive Jack Dorsey as provisional CEO caused a stir in the business and tech worlds. Not only is Dorsey the CEO of his own mobile payments startup, Square, but he was reportedly removed from his role as CEO of Twitter in 2008.

The shakeup caused a brief spike in the company’s shares, but the stock is now back to where it had been before the announcement — and if it’s going to climb higher, investors may to need to see some other changes, too.

That’s where the slew of product announcements comes in. The latest, revealed yesterday on Buzzfeed, is called Project Lightning. Essentially, if there’s a hot topic that people are tweeting about — either prescheduled events, breaking news or ongoing events — Twitter has created an easy way for users to view the most popular and relevant tweets, images and videos, without having to sift through every tedious comment and retweet. Twitter will have a team of editors select the tweets they think will be most popular on the stories they see as the biggest of the moment.

The goal is to make Twitter easier to use and more engaging for an audience that isn’t necessarily interested in actively tweeting. (Twitter’s stock jumped more than 4 percent Friday in response to the new product announcement, its best day in months.) Similarly, Twitter is trying to bring down other obstacles to using its service. The same day the news was released about Costolo, Twitter also announced the removal of the 140-character limit on the direct messages feature. Getting rid of the limit is a step by the company to keep up with rival social networks and messaging apps, like Facebook and WhatsApp.

Related: Instagram Takes Steps to Open Platform to Advertisers

At the same time it tries to draw in users, Twitter executives know they must do more to attract advertisers. Six ad executives surveyed recently by Reuters said they spend more money on rival platforms because they have more users, better data to target consumers and create more effective ad content. To combat that perception, Twitter this week announced a push to bring in advertisers by rolling out video ads that will automatically play in a user’s timeline. Though initially muted, if a user clicks on the video it will switch to full-screen mode with sound. Advertisers will only be charged when a user has watched at least three seconds of the video on a full screen.

Both Facebook and Instagram offer an almost identical ad feature.

The High Cost of Child Poverty

Childhood poverty cost $1.03 trillion in 2015, including the loss of economic productivity, increased spending on health care and increased crime rates, according to a recent study in the journal Social Work Research. That annual cost represents about 5.4 percent of U.S. GDP. “It is estimated that for every dollar spent on reducing childhood poverty, the country would save at least $7 with respect to the economic costs of poverty,” says Mark R. Rank, a co-author of the study and professor of social welfare at Washington University in St. Louis. (Futurity)

Do You Know What Your Tax Rate Is?

Complaining about taxes is a favorite American pastime, and the grumbling might reach its annual peak right about now, as tax day approaches. But new research from Michigan State University highlighted by the Money magazine website finds that Americans — or at least Michiganders — dramatically overstate their average tax rate.

In a survey of 978 adults in the Wolverine State, almost 220 people said they didn’t know what percentage of their income went to federal taxes. Of the people who did provide an answer, almost 85 percent overstated their actual rate, sometimes by a large margin. On average, those taxpayers said they pay 25.5 percent of their income in federal taxes. But the study’s authors estimated that their actual average tax rate was just under 14 percent.

The large number of people who didn’t want to venture a guess as to their tax rate and the even larger number who were wildly off both suggest to the researchers “that a very substantial portion of the population is uninformed or misinformed about average federal income-tax rates.”

Why don’t we know what we’re paying?

Part of the answer may be that our tax system is complicated and many of us rely on professionals or specialized software to prepare our filings. Money’s Ian Salisbury notes that taxpayers in the survey who relied on that kind of help tended to be further off in their estimates, after controlling for other factors.

Also, many people likely don’t understand the different types of taxes they pay. While the survey asked specifically about federal taxes, the tax rates people provided more closely matched their total tax rate, including federal, state, local and payroll taxes.

But our politics likely play a role here as well. People who believe that taxes on households like theirs should be lower and those who believe tax dollars are spent ineffectively tended to overstate their tax rates more.

“Since the time of Ronald Reagan, American[s] have been inundated with messages about how high taxes are,” one of the study’s authors told Salisbury. “The notion they are too high has become deeply ingrained.”

Wealthy Investors Are Worried About Washington, and the Debt

A new survey by the Spectrem Group, a market research firm, finds that almost 80 percent of investors with net worth between $100,000 and $25 million (not including their home) say that the U.S. political environment is their biggest concern, followed by government gridlock (76 percent) and the national debt (75 percent).

Trump’s Push to Reverse Parts of $1.3 Trillion Spending Bill May Be DOA

At least two key Republican senators are unlikely to support an effort to roll back parts of the $1.3. trillion spending bill passed by Congress last month, The Washington Post’s Mike DeBonis reported Monday evening. While aides to President Trump are working with House Majority Leader Kevin McCarthy (R-CA) on a package of spending cuts, Sens. Susan Collins (R-ME) and Lisa Murkowski (R-AK) expressed opposition to the idea, meaning a rescission bill might not be able to get a simple majority vote in the Senate. And Roll Call reports that other Republican senators have expressed significant skepticism, too. “It’s going nowhere,” Sen. Lindsey Graham said.

Goldman Sees Profit in the Tax Cuts

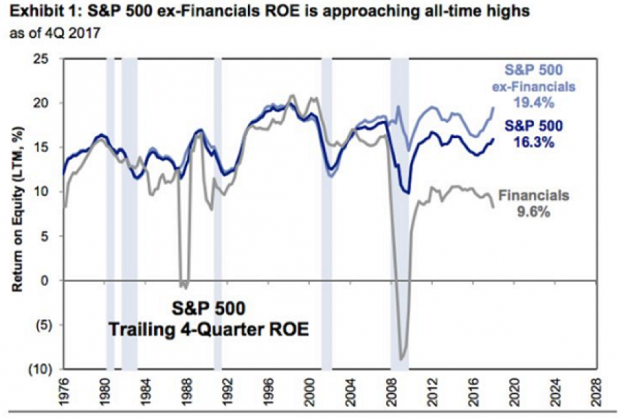

David Kostin, chief U.S. equity strategist at Goldman Sachs, said in a note to clients Friday cited by CNBC that companies in the S&P 500 can expect to see a boost in return on equity (ROE) thanks to the tax cuts. Return on equity should hit the highest level since 2007, Kostin said, providing a strong tailwind for stock prices even as uncertainty grows about possible conflicts over trade.

Return on equity, defined as the amount of net income returned as a percentage of shareholders’ equity, rose to 16.3 percent in 2016, and Kostin is forecasting an increase to 17.6 percent in 2018. "The reduction in the corporate tax rate alone will boost ROE by roughly 70 [basis points], outweighing margin pressures from rising labor, commodity, and borrow costs," Kostin wrote.