Can ‘Project Lightning’ Give Twitter a Fresh Jolt?

The ubiquitous blue bird associated with Twitter (TWTR) has been incessantly chirping out new announcements this month as the social media phenom tries to pick itself back up after being slammed for weak earnings growth and the underperformance of its stock.

Projections from data firm eMarketer call for the Twitter monthly user base to grow at a measly 14.1 percent this year, compared with more than 30 percent growth two years ago, according to Reuters.

While the news last week that CEO Dick Costolo was relinquishing the corner office was not a shock since he has offered to resign in the past, the appointment of co-founder and former chief executive Jack Dorsey as provisional CEO caused a stir in the business and tech worlds. Not only is Dorsey the CEO of his own mobile payments startup, Square, but he was reportedly removed from his role as CEO of Twitter in 2008.

The shakeup caused a brief spike in the company’s shares, but the stock is now back to where it had been before the announcement — and if it’s going to climb higher, investors may to need to see some other changes, too.

That’s where the slew of product announcements comes in. The latest, revealed yesterday on Buzzfeed, is called Project Lightning. Essentially, if there’s a hot topic that people are tweeting about — either prescheduled events, breaking news or ongoing events — Twitter has created an easy way for users to view the most popular and relevant tweets, images and videos, without having to sift through every tedious comment and retweet. Twitter will have a team of editors select the tweets they think will be most popular on the stories they see as the biggest of the moment.

The goal is to make Twitter easier to use and more engaging for an audience that isn’t necessarily interested in actively tweeting. (Twitter’s stock jumped more than 4 percent Friday in response to the new product announcement, its best day in months.) Similarly, Twitter is trying to bring down other obstacles to using its service. The same day the news was released about Costolo, Twitter also announced the removal of the 140-character limit on the direct messages feature. Getting rid of the limit is a step by the company to keep up with rival social networks and messaging apps, like Facebook and WhatsApp.

Related: Instagram Takes Steps to Open Platform to Advertisers

At the same time it tries to draw in users, Twitter executives know they must do more to attract advertisers. Six ad executives surveyed recently by Reuters said they spend more money on rival platforms because they have more users, better data to target consumers and create more effective ad content. To combat that perception, Twitter this week announced a push to bring in advertisers by rolling out video ads that will automatically play in a user’s timeline. Though initially muted, if a user clicks on the video it will switch to full-screen mode with sound. Advertisers will only be charged when a user has watched at least three seconds of the video on a full screen.

Both Facebook and Instagram offer an almost identical ad feature.

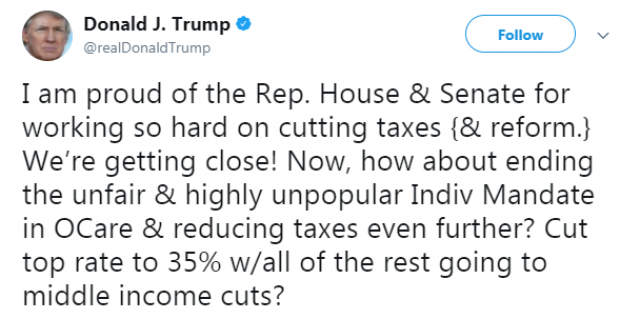

Trump: Repeal the Obamacare Mandate to Cut the Top Tax Rate

President Trump repeated his call Monday to repeal the Affordable Care Act’s individual mandate as part of the tax bill. In a tweet — geotagged from Pennsylvania, not the Philippines , where Trump currently is — Trump added that the billions in savings from ending the mandate should be used to cut the top marginal rate to 35 percent and the rest on cuts for the middle class.

The Congressional Budget Office said last week that eliminating the mandate would save $338 billion over the next decade.

The current version of the House tax bill keeps the top individual income tax rate at 39.6 percent, while the Senate bill lowers it to 38.5 percent. However, mandate repeal is not currently part of either tax bill, and, as The New York Times notes, “repeal of the individual mandate was not on the list of 355 amendments that the [Senate Finance Committee] released on Sunday night.”

Tax Reform Is Hard, but the GOP Could Have Made This Easier

The Tax Policy Center’s William G. Gale writes that the GOP’s approach to the tax bill combines a $5.8 trillion tax cut with a $4.3 trillion tax increase to offset the costs. There may have been an easier way. “What if the House GOP simply tried to cut business and individual taxes by $1.5 trillion. No offsets needed. They could have distributed small tax cuts to middle-income individuals by, say, modestly expanding the earned income tax credit and raising the standard deduction. And they could have trimmed the top corporate tax rate by a few percentage points. It would not have been base-broadening tax reform, but neither is the current bill. ... Tax reform is never easy, but crafting the bill this way has vastly increased the challenge of passing it.”

Alan Greenspan: Deal with the National Debt Before Cutting Taxes

Former Federal Reserve Chairman Alan Greenspan is warning that sharply cutting taxes right now would be an economic “mistake.”

In an interview with Maria Bartiromo on the Fox Business Network Thursday, the 91-year-old Greenspan said it’s more important for President Trump and Congress to put the nation on a sustainable fiscal path by addressing rising entitlement spending driven by the aging of the U.S. population.

“Frankly, I think what we ought to be concerned about is the fact the federal debt is rising at a very rapid pace, and there’s nothing in this bill that will essentially stop that from happening," Greenspan said. "So my view is that we’re premature on fiscal stimulus, whether it’s tax cuts or expenditure increases. We’ve got to get the debt stabilized before we can even think in those terms.”

GOP’s Estate-Tax Repeal Details Would Save Super-Rich Tens of Billions Extra

It’s no surprise that the House Republicans’ tax bill includes the eventual repeal of the estate tax, a long-held GOP goal. But The Washington Post’s Glenn Kessler highlights an unexpectedly generous aspect of the current bill: It “allows the beneficiaries of estates to not pay capital gains taxes on the increase in value of assets held by the estates. That has not been a feature of most previous estate-tax bills.”

Currently, estates face a federal tax if they’re valued at more than $5.49 million for individuals or almost $11 million for couples. But, for tax purposes, the value of assets passed on to heirs gets “stepped-up” or reset to their value at the time of death. Kessler’s example: “Imagine a home that had been purchased for $250,000 but was now worth $1 million. The ‘stepped-up basis’ would be $1 million. If the heirs sold the house for $1.1 million, they would only owe capital-gains tax on the $100,000 difference, not the $850,000 difference from the original purchase price.”

The GOP bill repeals the estate tax, but also keeps the stepped-up basis — a seemingly small detail that creates a huge tax shelter. It means that heirs of large estates would save tens of billions of dollars a year when they sell assets that have appreciated in value over time — or, as Kessler puts it, that the bill will allow “tens of billions of untapped capital gains to remain beyond the reach of the U.S. government.”

Republicans Are Still Coming After Obamacare’s Individual Mandate

Speaker Paul Ryan said Sunday that House Republicans are still considering a repeal of the Obamacare individual mandate as part of their tax bill. "We have an active conversation with our members and a whole host of ideas on things to add to this bill. And that’s one of the things that’s being discussed," Ryan said on Fox News. President Trump touted the idea in a tweet last week, and Sens. Tom Cotton and Rand Paul have recently spoken in favor of using the tax bill to eliminate the mandate. The move would save the government $416 billion over 10 years as roughly 15 million people go without insurance due to lower spending on subsidies and health care services, according to the CBO. Those savings could be appealing as Republicans look for revenues in their revised tax bill. But if the controversial repeal of the mandate isn’t included in the tax bill, the White House is reportedly ready to roll out an executive order weakening the requirement that taxpayers provide proof of insurance to avoid paying a penalty.