Millennials Like Saving Money, Want to Save More

Millennials have impressive financial habits when compared to baby boomers, according to a new Retirement Saving & Spending Study by T. Rower Price. Millennials like to save, with many taking advantage of 401(k) plans while still paying down debt. On average, millennials are saving nearly as much for retirement -- 8 percent of their incomes -- as baby boomers, who are saving an average of 9 percent. And in the past 12 months, millennials are saving a higher percentage of their incomes than baby boomers when it comes to 401(k) contributions.

The research is based on online interviews with 1,505 millennials and 514 baby boomers with 401(k)s, and includes both workers and retirees.

Overall, millennials in the study report they are in surprisingly good financial shape. Eighty-eight percent say they are living within their means and 74 percent are more comfortable saving and investing extra money than spending it. However, many millennials are pessimistic about Social Security: Sixty percent expect Social Security to go bankrupt before they retire.

Here’s what else the survey reveals:

Millennials like to save, and they’d save more if they could.

Saving for retirement and paying down debt are equally important to millennials, who rank both goals as a top priority. For those who say they are not saving enough, 23 percent cited student loans as a major contributing factor.

Related Link: ‘Irresponsible’ Millennials Saving More Than Almost Every Other Group

Millennials like auto-enrollment plans.

Seventy-nine percent of the millennials who were auto-enrolled in 401(k) plans were satisfied with auto-enrollment. When it comes to 401(k) matches, 59 percent of millennials set their 401(k) contribution rate to take full advantage of their employers’ matches.

They’re open to advice and more likely to ask for help if they need it.

If faced with a sudden financial emergency, 55 percent of millennials said they’d seek the help of family and friends, compared to 24 percent of baby boomers. Millennials were also much more likely to admit they could benefit from help with spending and debt management.

They find it hard to save when they make less money.

Non-savers made less money and carried more student debt. The median personal income of non-savers was $28,000, compared to $57,000 for savers. Thirty-nine percent of the non-savers have trouble meeting their monthly expenses.

Men save more.

Millennial women are less likely to save in 401(k)s, even if they are eligible, and when they do, they save less than men. The average 401(k) balance for women participating in their 401(k) is $38,000, compared to an average 401(k) balance of $74,000 for men. Of those who are already participating in 401(k)s, only 41 percent of the savers are women.

Related link: Here Are 7 Ways People Screw Up Their 401(k)s

Tax Refunds Rebound

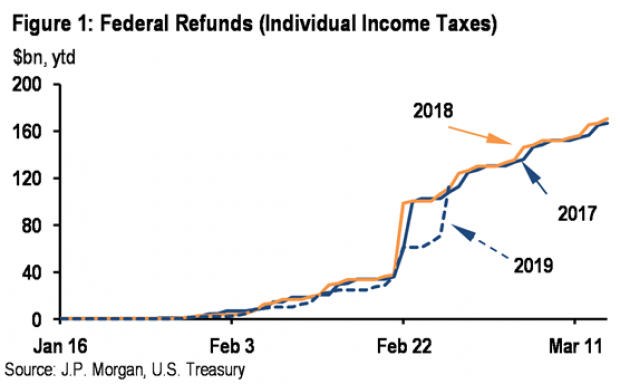

Smaller refunds in the first few weeks of the current tax season were shaping up to be a political problem for Republicans, but new data from the IRS shows that the value of refund checks has snapped back and is now running 1.3 percent higher than last year. The average refund through February 23 last year was $3,103, while the average refund through February 22 of 2019 was $3,143 – a difference of $40. The chart below from J.P. Morgan shows how refunds performed over the last 3 years.

Number of the Day: $22 Trillion

The total national debt surpassed $22 trillion on Monday. Total public debt outstanding reached $22,012,840,891,685.32, to be exact. That figure is up by more than $1.3 trillion over the past 12 months and by more than $2 trillion since President Trump took office.

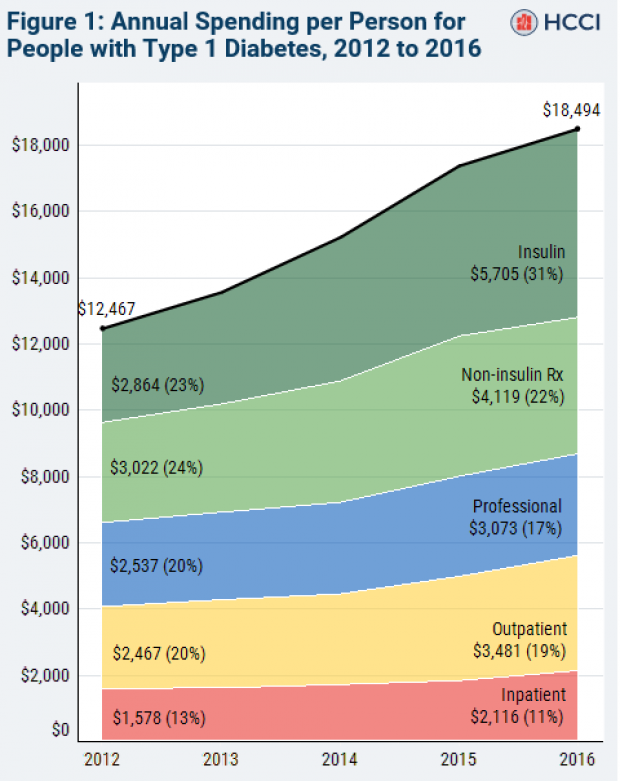

Chart of the Week: The Soaring Cost of Insulin

The cost of insulin used to treat Type 1 diabetes nearly doubled between 2012 and 2016, according to an analysis released this week by the Health Care Cost Institute. Researchers found that the average point-of-sale price increased “from $7.80 a day in 2012 to $15 a day in 2016 for someone using an average amount of insulin (60 units per day).” Annual spending per person on insulin rose from $2,864 to $5,705 over the five-year period. And by 2016, insulin costs accounted for nearly a third of all heath care spending for those with Type 1 diabetes (see the chart below), which rose from $12,467 in 2012 to $18,494.

Chart of the Day: Shutdown Hits Like a Hurricane

The partial government shutdown has hit the economy like a hurricane – and not just metaphorically. Analysts at the Committee for a Responsible Federal Budget said Tuesday that the shutdown has now cost the economy about $26 billion, close to the average cost of $27 billion per hurricane calculated by the Congressional Budget Office for storms striking the U.S. between 2000 and 2015. From an economic point of view, it’s basically “a self-imposed natural disaster,” CRFB said.

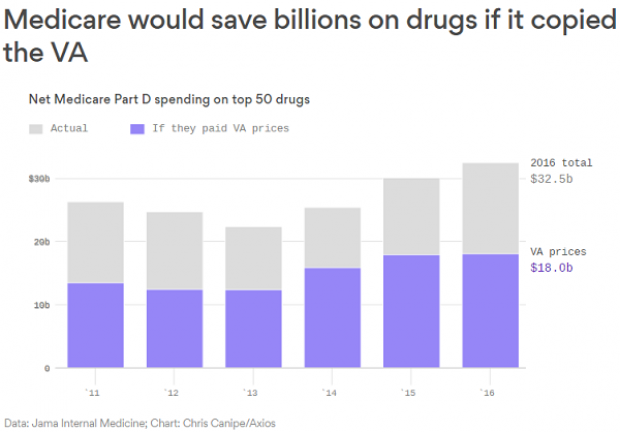

Chart of the Week: Lowering Medicare Drug Prices

The U.S. could save billions of dollars a year if Medicare were empowered to negotiate drug prices directly with pharmaceutical companies, according to a paper published by JAMA Internal Medicine earlier this week. Researchers compared the prices of the top 50 oral drugs in Medicare Part D to the prices for the same drugs at the Department of Veterans Affairs, which negotiates its own prices and uses a national formulary. They found that Medicare’s total spending was much higher than it would have been with VA pricing.

In 2016, for example, Medicare Part D spent $32.5 billion on the top 50 drugs but would have spent $18 billion if VA prices were in effect – or roughly 45 percent less. And the savings would likely be larger still, Axios’s Bob Herman said, since the study did not consider high-cost injectable drugs such as insulin.