Taylor Swift Gets Apple Music to Pay Up

On Sunday morning, Taylor Swift took Apple to task for the royalty agreement on its news music streaming service. Her open letter on Tumblr, titled “To Apple, Love Taylor,” said, “I’m sure you are aware that Apple Music will be offering a free 3 month trial to anyone who signs up for the service. I’m not sure you know that Apple Music will not be paying writers, producers, or artists for those three months. I find it to be shocking, disappointing and completely unlike this historically progressive and generous company.”

Related Link: How the Video Game Industry Is Failing Its Fans

“Three months is a long time to go unpaid, and it is unfair to ask anyone to work for nothing,” the pop singer argued on the behalf of music-makers everywhere, many of whom had voiced their discontent with the royalty policy. She concluded her letter saying, “We don’t ask you for free iPhones. Please don’t ask us to provide you with our music for no compensation.”

It was a sentiment shared by many independent music artists and producers. Just a few weeks earlier, the American Association for Independent Music had chimed in, “Since a sizable percentage of Apple’s most voracious music consumers are likely to initiate their free trials at launch, we are struggling to understand why rights holders would authorize their content on the service before October 1st.”

It took less than 24 hours for the “historically progressive and generous company” to respond via Twitter, and it didn’t wait until morning to make its announcement. Eddy Cue, Apple’s senior vice president of Internet Software and Services, personally called Swift to deliver the news before tweeting at 11:29 p.m., “#AppleMusic will pay artists for streaming, even during customers’ free trial period.”

Cue followed up with a feel-good response a minute later: “We hear you @taylorswift13 and indie artists. Love, Apple.” Later, Cue said that the company will pay artists on a per stream basis during the free trial period, although Cue declined to say what the rate would be. Once the free introductory period is over, Apple Music will pay music owners 71.5 percent of Apple Music’s overall subscription revenue in the United States.

Swift tweeted her response and addressed it to her fans and supporters: “I am elated and relieved. Thank you for your words of support today. They listened to us.”

Related Link: Apple Muscles Into Streaming Music Market

Swift’s crusade on social media showed the increasing weight that collective opinions on Twitter, Instagram and Facebook can have to force a change in corporate policy and direction. In a comic echo of that power, BuzzFeed promptly put together a list of 18 more issues Swift could fix through the power of social media, ranging from the battery life of iPhones to the size of Pringles cans.

Apple Music is launching on June 30, offering users a free, three-month subscription period. After that, the service will charge $9.99 a month for individuals and $14.99 a month for families with up to six members.

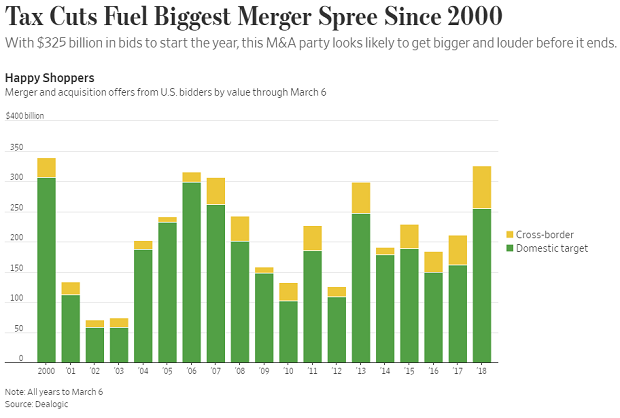

Chart of the Day: A Buying Binge Driven by Tax Cuts

The Wall Street Journal reports that the tax cuts and economic environment are prompting U.S. companies to go on a buying binge: “Mergers and acquisitions announced by U.S. acquirers so far in 2018 are running at the highest dollar volume since the first two months of 2000, according to Dealogic. Thomson Reuters, which publishes slightly different numbers, puts it at the highest since the start of 2007.”

Number of the Day: 5.5 Percent

Health care spending in the U.S. will grow at an average annual rate of 5.5 percent from 2017 through 2026, according to new estimates published in Health Affairs by the Office of the Actuary at the Centers for Medicare and Medicaid Services (CMS).

The projections mean that health care spending would rise as a share of the economy from 17.9 percent in 2016 to 19.7 percent in 2026.

Trump Clearly Has No Problem with Debt and Deficits

A self-proclaimed “king of debt,” President Trump has produced a budget that promises red ink as far as the eye can see. With last year's $1.5 trillion tax cut reducing revenues, the White House gave up even trying to pretend that its budget would balance anytime soon, and even the rosy economic projections contained in the budget couldn’t produce enough revenues, however fanciful, to cover the shortfall.

The Trump budget spends as much over 10 years as any budget produced by President Barack Obama, according to Jim Tankersley of The New York Times. And it projects total deficits of more than $7 trillion over the next decade — "a number that could double if the administration turns out to be overestimating economic growth and if the $3 trillion in spending cuts the White House has floated do not materialize in Congress,” Tankersley says.

Trump — who once promised to both balance the budget and pay down the national debt — isn’t the only one throwing off the shackles of fiscal restraint. Republicans as a whole appear to be embracing a new set of economic preferences defined by lower taxes and higher spending, in what Bloomberg describes as a “striking turnabout” in attitudes toward deficits and the national debt.

But some conservatives tell Tankersley that the GOP's core beliefs on spending and debt remain intact — and that spending on Social Security and Medicare, the primary drivers of the national debt, are all that matters when it comes to implementing fiscal restraint.

“They know that right now, a fundamental reform of entitlements won’t happen," John H. Cochrane, an economist at Stanford University’s Hoover Institution, tells Tankersley. "So, they have avoided weekly chaos and gotten needed military spending through by opening the spending bill, and they got an important reduction in growth-distorting marginal corporate rates through by accepting a bit more deficits. They know that can’t be the end of the story.”

Democrats, of course, have warned that the next chapter in the tale will involve big cuts to Social Security and Medicare. Even before we get there, though, Tankersley questions whether the GOP approach stands up to scrutiny: "This is a bit like saying, only regular exercise will keep America from having a fatal heart attack, so, you know, it's ok to eat a few more hamburgers now."

Part of the Shutdown-Ending Deal: $31 Billion More in Tax Cuts

Margot Sanger-Katz and Jim Tankersley in The New York Times: “The deal struck by Democrats and Republicans on Monday to end a brief government shutdown contains $31 billion in tax cuts, including a temporary delay in implementing three health care-related taxes.”

“Those delays, which enjoy varying degrees of bipartisan support, are not offset by any spending cuts or tax increases, and thus will add to a federal budget deficit that is already projected to increase rapidly as last year’s mammoth new tax law takes effect.”

IRS Paid $20 Million to Collect $6.7 Million in Tax Debts

Congress passed a law in 2015 requiring the IRS to use private debt collection agencies to pursue “inactive tax receivables,” but the financial results are not encouraging so far, according to a new taxpayer advocate report out Wednesday.

In fiscal year 2017, the IRS received $6.7 million from taxpayers whose debts were assigned to private collection agencies, but the agencies were paid $20 million – “three times the amount collected,” the report helpfully points out.

Like what you're reading? Sign up for our free newsletter.