This Match Is Going Public

An IPO for Those Who Think Love and Money Is a Match

The Match Group, home of the hugely popular dating apps and sites Tinder, Match, Chemistry, OurTime, and OkCupid, will issue an IPO in the fourth quarter. Mashable is calling it “the world’s flirtiest IPO.” Barry Diller’s InterActive Corp. (IAC), which owns the Match Group and a slew of other Internet brands, also appointed Joey Levin, formerly the CEO of IAC’s Search & Applications, CEO of IAC.

Back in 1995 when Match.com first debuted, people were skeptical of online dating, but today, dating apps and sites are big business. According to IBISWorld, dating sites are expected to bring in $1.17 billion in revenue this year, with apps totaling another $628.8 million. Online dating accounts for 48.7 percent of the revenue from U.S. dating services, but mobile dating apps such as Tinder are on the rise with 26.2 percent of the market.

Related: The Startup That Turned Down $30 Million from Mark Cuban

The largest dating service companies are the Match Group, eHarmony, Zoosk, Plenty of Fish, and Spark Networks. The Match Group leads the category, with nearly 22 percent share of the market. The Wall Street Journal reported the Match Group accounted for nearly one-third, or 29 percent, of IAC’s overall revenue in 2014. In the most recent quarter, the Match Group’s revenue was $239.2 million, or 30 percent of IAC’s revenue of $772.5 million.

With their portfolio of dating sites in more than 200 countries the Match Group is well positioned to market to the large generation of millennials worldwide. More than 7 million people sign up for their products every month.

Related: Love at First Byte: The Magic of Online Dating

As for what the Match Group’s ticker symbol might be on the stock exchange, the company’s lips are sealed. Many of the good ones are already taken. LOV belongs to rival Spark Networks, owner of JDate.com, ChristianMingle.com, and BlackSingles.com. DATE is the ticker symbol for Jiayuan, China’s largest dating site. LUV is taken by Southwest Airlines. Arrythmia Research Technology has HRT.

Apparently KISS is still available—if the Match Group gets lucky.

Stat of the Day: 0.2%

The New York Times’ Jim Tankersley tweets: “In order to raise enough revenue to start paying down the debt, Trump would need tariffs to be ~4% of GDP. They're currently 0.2%.”

Read Tankersley’s full breakdown of why tariffs won’t come close to eliminating the deficit or paying down the national debt here.

Number of the Day: 44%

The “short-term” health plans the Trump administration is promoting as low-cost alternatives to Obamacare aren’t bound by the Affordable Care Act’s requirement to spend a substantial majority of their premium revenues on medical care. UnitedHealth is the largest seller of short-term plans, according to Axios, which provided this interesting detail on just how profitable this type of insurance can be: “United’s short-term plans paid out 44% of their premium revenues last year for medical care. ACA plans have to pay out at least 80%.”

Number of the Day: 4,229

The Washington Post’s Fact Checkers on Wednesday updated their database of false and misleading claims made by President Trump: “As of day 558, he’s made 4,229 Trumpian claims — an increase of 978 in just two months.”

The tally, which works out to an average of almost 7.6 false or misleading claims a day, includes 432 problematics statements on trade and 336 claims on taxes. “Eighty-eight times, he has made the false assertion that he passed the biggest tax cut in U.S. history,” the Post says.

Number of the Day: $3 Billion

A new analysis by the Department of Health and Human Services finds that Medicare’s prescription drug program could have saved almost $3 billion in 2016 if pharmacies dispensed generic drugs instead of their brand-name counterparts, Axios reports. “But the savings total is inflated a bit, which HHS admits, because it doesn’t include rebates that brand-name drug makers give to [pharmacy benefit managers] and health plans — and PBMs are known to play games with generic drugs to juice their profits.”

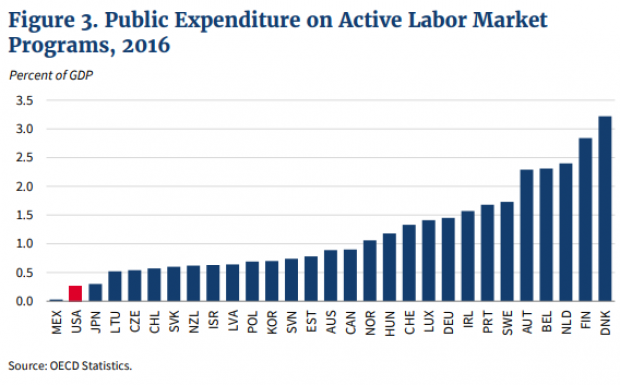

Chart of the Day: Public Spending on Job Programs

President Trump announced on Thursday the creation of a National Council for the American Worker, charged with developing “a national strategy for training and retraining workers for high-demand industries,” his daughter Ivanka wrote in The Wall Street Journal. A report from the president’s National Council on Economic Advisers earlier this week made it clear that the U.S. currently spends less public money on job programs than many other developed countries.