The Washington Post Closes a Window on Hackers and Big Government

The Washington Post is pushing back against government surveillance, hackers and other nosy folks trying to get a peek at you and your data.

Starting Tuesday it will begin to encrypt parts of its website to make it more difficult to track the reading habits of visitors. The encryption will apply to the Post’s homepage, stories on the site’s national security page and The Switch, its technology policy blog.

A display icon of a small lock in the web address bar will signal readers that pages are encrypted. In addition, the secure pages will start with the letters “https,” rather than the standard “http.”

The encryption also has the potential to make it tougher for governments to censor content. If censors are monitoring website traffic, they can see only the domain a person is visiting, not the specific page. A country would have to block the entire website if it wanted to block content.

The Post acknowledges that the additional security measures could make online advertising less attractive to companies. Advertisers might also be driven away by having to make sure their content is also secure, an extra step some companies might not be willing to take.

The Post is the first major news organization to introduce such security measures. Last fall, The New York Times published a blog post imploring websites to implement secure connections, but it has yet to follow through on its own challenge.

However, other smaller news sources, such as the Intercept and TechDirt, use https technology by default.

Encrypted traffic is becoming increasingly common for many sites, including online banking and web-based email services. Earlier this month, the Obama administration ordered all public federal websites to begin using https technology by the end of 2016.

The social media giant Facebook announced in early June that users could encrypt notifications sent from the website to a user’s personal email address, protecting potentially sensitive emails. Facebook – as well as hackers, spies and others -- will be denied access to the user’s private encryption key.

This move prevents hackers who have accessed a user’s email inbox from being able to understand emails from Facebook without knowing their private key. While a user’s activity on the actual site will not be encrypted, this announcement could be the first in a series of moves to protect Facebooks’ user privacy.

Apple and Google have also implemented more security measures for user privacy over the last year.

Trump: Repeal the Obamacare Mandate to Cut the Top Tax Rate

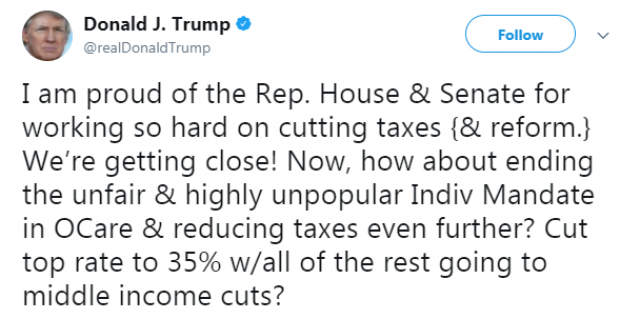

President Trump repeated his call Monday to repeal the Affordable Care Act’s individual mandate as part of the tax bill. In a tweet — geotagged from Pennsylvania, not the Philippines , where Trump currently is — Trump added that the billions in savings from ending the mandate should be used to cut the top marginal rate to 35 percent and the rest on cuts for the middle class.

The Congressional Budget Office said last week that eliminating the mandate would save $338 billion over the next decade.

The current version of the House tax bill keeps the top individual income tax rate at 39.6 percent, while the Senate bill lowers it to 38.5 percent. However, mandate repeal is not currently part of either tax bill, and, as The New York Times notes, “repeal of the individual mandate was not on the list of 355 amendments that the [Senate Finance Committee] released on Sunday night.”

Tax Reform Is Hard, but the GOP Could Have Made This Easier

The Tax Policy Center’s William G. Gale writes that the GOP’s approach to the tax bill combines a $5.8 trillion tax cut with a $4.3 trillion tax increase to offset the costs. There may have been an easier way. “What if the House GOP simply tried to cut business and individual taxes by $1.5 trillion. No offsets needed. They could have distributed small tax cuts to middle-income individuals by, say, modestly expanding the earned income tax credit and raising the standard deduction. And they could have trimmed the top corporate tax rate by a few percentage points. It would not have been base-broadening tax reform, but neither is the current bill. ... Tax reform is never easy, but crafting the bill this way has vastly increased the challenge of passing it.”

Alan Greenspan: Deal with the National Debt Before Cutting Taxes

Former Federal Reserve Chairman Alan Greenspan is warning that sharply cutting taxes right now would be an economic “mistake.”

In an interview with Maria Bartiromo on the Fox Business Network Thursday, the 91-year-old Greenspan said it’s more important for President Trump and Congress to put the nation on a sustainable fiscal path by addressing rising entitlement spending driven by the aging of the U.S. population.

“Frankly, I think what we ought to be concerned about is the fact the federal debt is rising at a very rapid pace, and there’s nothing in this bill that will essentially stop that from happening," Greenspan said. "So my view is that we’re premature on fiscal stimulus, whether it’s tax cuts or expenditure increases. We’ve got to get the debt stabilized before we can even think in those terms.”

GOP’s Estate-Tax Repeal Details Would Save Super-Rich Tens of Billions Extra

It’s no surprise that the House Republicans’ tax bill includes the eventual repeal of the estate tax, a long-held GOP goal. But The Washington Post’s Glenn Kessler highlights an unexpectedly generous aspect of the current bill: It “allows the beneficiaries of estates to not pay capital gains taxes on the increase in value of assets held by the estates. That has not been a feature of most previous estate-tax bills.”

Currently, estates face a federal tax if they’re valued at more than $5.49 million for individuals or almost $11 million for couples. But, for tax purposes, the value of assets passed on to heirs gets “stepped-up” or reset to their value at the time of death. Kessler’s example: “Imagine a home that had been purchased for $250,000 but was now worth $1 million. The ‘stepped-up basis’ would be $1 million. If the heirs sold the house for $1.1 million, they would only owe capital-gains tax on the $100,000 difference, not the $850,000 difference from the original purchase price.”

The GOP bill repeals the estate tax, but also keeps the stepped-up basis — a seemingly small detail that creates a huge tax shelter. It means that heirs of large estates would save tens of billions of dollars a year when they sell assets that have appreciated in value over time — or, as Kessler puts it, that the bill will allow “tens of billions of untapped capital gains to remain beyond the reach of the U.S. government.”

Republicans Are Still Coming After Obamacare’s Individual Mandate

Speaker Paul Ryan said Sunday that House Republicans are still considering a repeal of the Obamacare individual mandate as part of their tax bill. "We have an active conversation with our members and a whole host of ideas on things to add to this bill. And that’s one of the things that’s being discussed," Ryan said on Fox News. President Trump touted the idea in a tweet last week, and Sens. Tom Cotton and Rand Paul have recently spoken in favor of using the tax bill to eliminate the mandate. The move would save the government $416 billion over 10 years as roughly 15 million people go without insurance due to lower spending on subsidies and health care services, according to the CBO. Those savings could be appealing as Republicans look for revenues in their revised tax bill. But if the controversial repeal of the mandate isn’t included in the tax bill, the White House is reportedly ready to roll out an executive order weakening the requirement that taxpayers provide proof of insurance to avoid paying a penalty.