Get Ready for Your 'Daily Glitch'—The NYSE, WSJ and United Were Just the Beginning

“Glitch” is clearly the word of the moment, after a series of pesky little technical problems forced United Airlines to ground flights, halted New York Stock Exchange trading and took down The Wall Street Journal website homepage all on the same day. If that wasn’t enough technical trouble, Seattle’s 911 system went down briefly. And a couple of NASA spacecraft also suffered “glitches” in recent days.

We deal routinely with glitches these days — a Wi-Fi connection goes down, an app freezes, a plug-in (usually Shockwave) stops responding, an email doesn’t load properly — which may help explain why, aside from lots of grumbling from delayed airline passengers, the reaction to Wednesday’s glitches was rather muted. The NYSE problems were reportedly caused by a “configuration issue” after a software update and United blamed its problem on “degraded network connectivity.” We see those issues every day, just not on as large a scale.

But that’s the problem.

At the risk of sounding like a high school term paper, let us note that the Merriam-Webster definition of glitch is “an unexpected and usually minor problem; especially: a minor problem with a machine or device (such as a computer).” The full definition describes it as a minor problem that causes a temporary setback.

Sure, Wednesday’s setbacks were all temporary. The Wall Street Journal site came back up quickly. Seattle’s 911 service was restored. Action on the NYSE itself was stopped for nearly four hours, but even then traders were still able to buy and sell NYSE-listed stocks on other exchanges. United grounded about 3,500 flights, which meant some people missed a wedding or a crucial business meeting. That will take time to sort out, but it will get sorted out.

In aggregate, though, the problems add up — and the word “glitch” only minimizes what can be much bigger, more serious issues..

Stock exchanges have suffered from a series of stoppage-causing glitches in recent years, pointing to the value of having trading spread across numerous exchanges. United’s tech breakdown “marked the latest in a series of airline delays and cancellations in the last few years that experts blame on massive, interconnected computer systems that lack sufficient staff and financial backing,” the Los Angeles Times reports. Just ask any of the roughly 400,000 United passengers whose travel plans were messed up if this was a little glitch. Or maybe check with the engineers who had to troubleshoot and rebuild the HealthCare.gov site after its glitch-laden launch.

It may be some relief that these latest outages weren’t the result of external attacks, but as sociologist Zeynep Tufecki, an assistant professor at the School of Information at the University of North Carolina, writes at The Message, “The big problem we face isn’t coordinated cyber-terrorism, it’s that software sucks. Software sucks for many reasons, all of which go deep, are entangled, and expensive to fix.”

These foul-ups are now mundane, and to some extent they may be inevitable as we rely more and more on complicated computer systems in every aspect of our lives. That’s the real issue, and it’s a lot bigger than a glitch.

Chart of the Day: SALT in the GOP’s Wounds

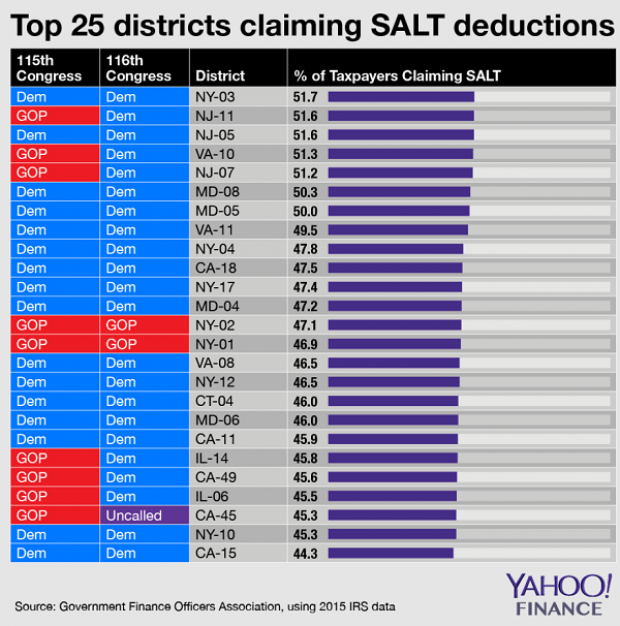

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

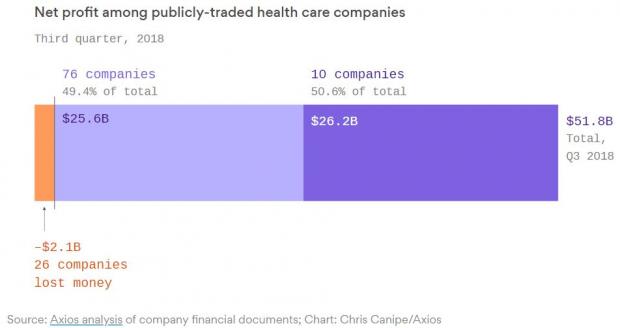

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

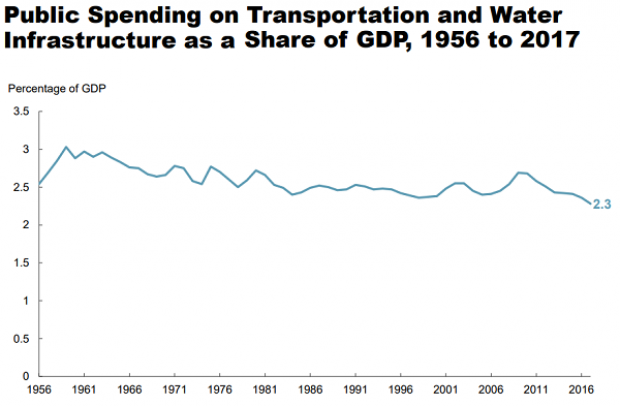

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.