What Your Smartphone Knows That Your Mother Doesn’t

Can Your Smartphone Be Used to Detect Depression?

It’s always there, in your pocket or purse or on your desk, quietly collecting information. And apparently, when it comes to depression, there’s quite a lot your smartphone knows about you.

According to a small study from Northwestern Medicine, that data from your smartphone can predict with eerie 87 percent accuracy whether you’re suffering from depression or not.

The telling signs: You spend more time on your smartphone and less time leaving the house, and you visit very few places each day.

Related: Smartphone Notifications Are Killing Our Concentration

The researchers used Craigslist to find 40 test subjects between the ages of 19 and 58, and outfitted their smartphones with an app to monitor their location and usage. The individuals took a questionnaire that measured signs of depression; half of the subjects had troubling symptoms and half did not. Using GPS, the phones tracked the subjects’ movements and locations every five minutes. The subjects also were asked questions about their mood at different points during the day.

These factors were then correlated with the test subjects’ original depression test scores. And the results were uncanny. Depressed people used their phones more often and for longer periods of time —an average of 68 minutes a day. By comparison, the individuals who didn’t show signs of depression spent only 17 minutes on theirs. Researchers attributed the increased use of the phone to task avoidance, another symptom of depressed people.

Perhaps more significant than the findings of this small study — only 28 of the 40 subjects had enough data to be studied — is the potential the researchers felt that smartphones could play in future medical diagnosis.

When loaded up with the correct sensors, the smartphone can be used to detect a person’s emotional states, and monitor moods, without the user having to utter a word. It also has the ability to offer suggestions to reinforce positive behaviors when depression is detected. The results of the study were published in the Journal of Medical Internet Research yesterday, but one conclusion was becoming increasingly evident even before the report came out: Smartphones — and the sensors they now contain — just keep getting smarter.

Deficit Hits $738.6 Billion in First 8 Months of Fiscal Year

The U.S. budget deficit grew to $738.6 billion in the first eight months of the current fiscal year – an increase of $206 billion, or 38.8%, over the deficit recorded during the same period a year earlier. Bloomberg’s Sarah McGregor notes that the big increase occurred despite a jump in tariff revenues, which have nearly doubled to $44.9 billion so far this fiscal year. But that increase, which contributed to an overall increase in revenues of 2.3%, was not enough to make up for the reduced revenues from the Republican tax cuts and a 9.3% increase in government spending.

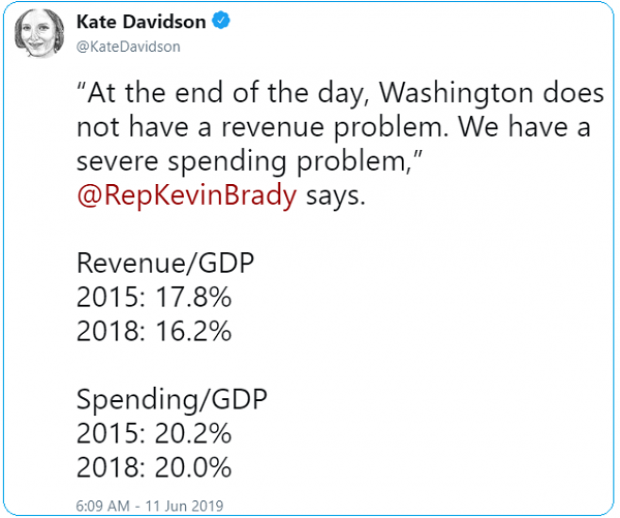

Tweet of the Day: Revenues or Spending?

Rep. Kevin Brady (R-TX), ranking member of the House Ways and Means Committee and one of the authors of the 2017 Republican tax overhaul, told The Washington Post’s Heather Long Tuesday that the budget deficit is driven by excess spending, not a shortfall in revenues in the wake of the tax cuts. The Wall Street Journal’s Kate Davidson provided some inconvenient facts for Brady’s claim in a tweet, pointing out that government revenues as a share of GDP have fallen significantly since 2015, while spending has remained more or less constant.

Chart of the Day: The Decline in IRS Audits

Reviewing the recent annual report on tax statistics from the IRS, Robert Weinberger of the Tax Policy Center says it “tells a story of shrinking staff, fewer audits, and less customer service.” The agency had 22% fewer personnel in 2018 than it did in 2010, and its enforcement budget has fallen by nearly $1 billion, Weinberger writes. One obvious effect of the budget cuts has been a sharp reduction in the number of audits the agency has performed annually, which you can see in the chart below.

Number of the Day: $102 Million

President Trump’s golf playing has cost taxpayers $102 million in extra travel and security expenses, according to an analysis by the left-leaning HuffPost news site.

“The $102 million total to date spent on Trump’s presidential golfing represents 255 times the annual presidential salary he volunteered not to take. It is more than three times the cost of special counsel Robert Mueller’s investigation that Trump continually complains about. It would fund for six years the Special Olympics program that Trump’s proposed budget had originally cut to save money,” HuffPost’s S.V. Date writes.

Date says the White House did not respond to HuffPost’s requests for comment.

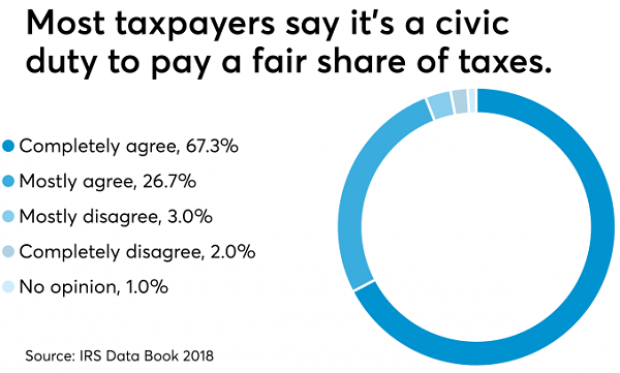

Americans See Tax-Paying as a Duty

The IRS may not be conducting audits like it used to, but according to the agency’s Data Book for 2018, most Americans still believe it’s not acceptable to cheat on your taxes. About 67% of respondents to an IRS opinion survey “completely agree” that it’s a civic duty to pay “a fair share of taxes,” and another 26% “mostly agree,” bringing the total in agreement to over 90%. Accounting Today says that attitude has been pretty consistent over the last decade.