Tiny Bubbles, Big Business: How Seltzer Became the Hot New Drink

Struggling to decide between healthy but boring water and sweet, sugary soda, Americans are increasingly turning to fizzy water to quench their thirst.

Although soda remains the leader in the soft drink category, soda consumption has fallen for the 10th year in a row, to the lowest level since 1986, according to The Wall Street Journal. Americans have been dropping sugary soda for years due to health concerns, but lately even diet soda has been losing popularity over worries about artificial sweeteners.

Sales of fizzy water — the category includes such well-known brands as Perrier and San Pellegrino — have grown to about $1.5 billion a year, more than doubling since 2010, according to data from industry research firm Euromonitor quoted in The Washington Post.

Related: How Coke Beat Pepsi in the New Cola Ad War

One of the top new brands is National Beverage’s LaCroix Sparkling Water, whose dozen flavors of bubbly H20 seem to be aimed at millennials in particular. The brand’s bright, colorful cans convey an alternative vibe, and the drink’s Instagram is loaded with attractive young people hoisting a can at pools, beaches and other relaxing places.

National Beverage credited sparkling water as the main factor that grew the company’s stock 75 percent over the last five years. Sales of the LaCroix brand alone have grown to $175 million, almost tripling since 2009.

Another rapidly growing brand, Sparkling Ice, owned by Talking Rain Beverage Company, saw sales boom to more than $384 million in 2014 from $2.7 million in 2009.

Gary Hemphill, managing director and COO of research at Beverage Marketing, sees the sales of seltzer and sparkling water only increasing as consumer demand for healthier refreshments grows.

GOP Tax Cuts Getting Less Popular, Poll Finds

Friday marked the six-month anniversary of President Trump’s signing the Republican tax overhaul into law, and public opinion of the law is moving in the wrong direction for the GOP. A Monmouth University survey conducted earlier this month found that 34 percent of the public approves of the tax reform passed by Republicans late last year, while 41 percent disapprove. Approval has fallen by 6 points since late April and disapproval has slipped 3 points. The percentage of people who aren’t sure how they feel about the plan has risen from 16 percent in April to 24 percent this month.

Other findings from the poll of 806 U.S. adults:

- 19 percent approve of the job Congress is doing; 67 percent disapprove

- 40 percent say the country is heading in the right direction, up from 33 percent in April

- Democrats hold a 7-point edge in a generic House ballot

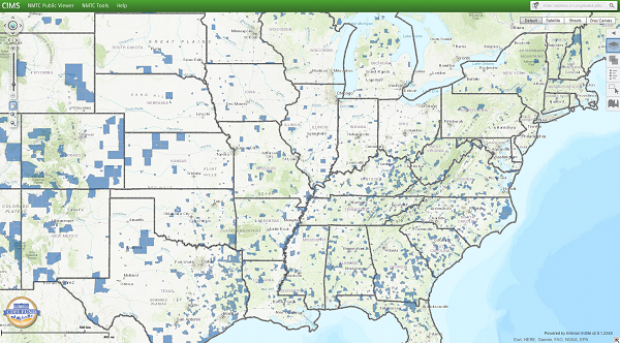

Special Tax Break Zones Defined for All 50 States

The U.S. Treasury has approved the final group of opportunity zones, which offer tax incentives for investments made in low-income areas. The zones were created by the tax law signed in December.

Bill Lucia of Route Fifty has some details: “Treasury says that nearly 35 million people live in the designated zones and that census tracts in the zones have an average poverty rate of about 32 percent based on figures from 2011 to 2015, compared to a rate of 17 percent for the average U.S. census tract.”

Click here to explore the dynamic map of the zones on the U.S. Treasury website.

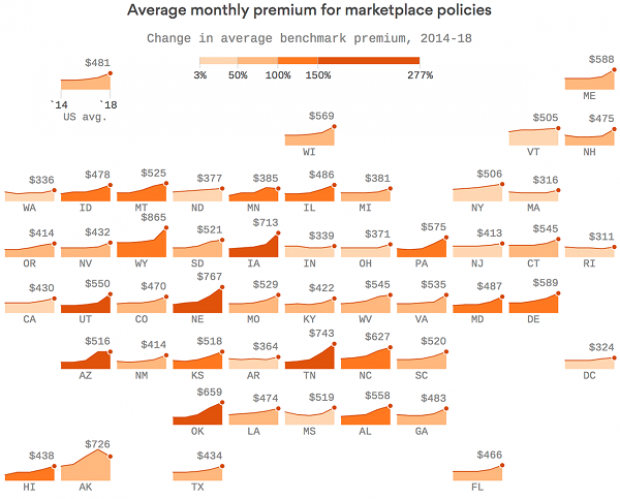

Map of the Day: Affordable Care Act Premiums Since 2014

Axios breaks down how monthly premiums on benchmark Affordable Care Act policies have risen state by state since 2014. The average increase: $481.

Obamacare Repeal Would Lead to 17.1 Million More Uninsured in 2019: Study

A new analysis by the Urban Institute finds that if the Affordable Care Act were eliminated entirely, the number of uninsured would rise by 17.1 million — or 50 percent — in 2019. The study also found that federal spending would be reduced by almost $147 billion next year if the ACA were fully repealed.

Your Tax Dollars at Work

Mick Mulvaney has been running the Consumer Financial Protection Bureau since last November, and by all accounts the South Carolina conservative is none too happy with the agency charged with protecting citizens from fraud in the financial industry. The Hill recently wrote up “five ways Mulvaney is cracking down on his own agency,” and they include dropping cases against payday lenders, dismissing three advisory boards and an effort to rebrand the operation as the Bureau of Consumer Financial Protection — a move critics say is intended to deemphasize the consumer part of the agency’s mission.

Mulvaney recently scored a small victory on the last point, changing the sign in the agency’s building to the new initials. “The Consumer Financial Protection Bureau does not exist,” Mulvaney told Congress in April, and now he’s proven the point, at least when it comes to the sign in his lobby (h/t to Vox and thanks to Alan Zibel of Public Citizen for the photo, via Twitter).