Feeling Flush, More Parents Open Their Wallets for College Spending

As lingering financial fears from the recession fade, more parents are willing and able to open their wallets to pay for their children’s educations.

Parents have become the top source of college funding for the first time since 2010. According to a new report from private student loan lender Sallie Mae’s, parental income and savings covered 32 percent of college costs in the academic year 2014-15, while scholarships and grants covered 30 percent.

Families spent an average of $24,164 on college this year, a 16 percent rise in spending from the previous year and the largest increase since 2009-10. The money spent covers costs of tuition, books, and living expenses.

Related: Average Family Has Saved Enough to Send One Kid to College for Half a Year

The report details how fewer parents fear the worst when it comes to the risks associated with college. Fewer parents are worried that their child won’t find a job after graduation, that their income will decline because of layoffs, and that there will be an increase in student loan rates. As confidence has increased, fewer families are using cost-saving techniques, such as having students live at home.

Another factor contributing to the willingness of parents to spend on education is the improving stock market. The average size of a 529 account, the popular college savings investment plan, continues to grow after the recession caused a downturn, hitting a balance of $20,474 as of December 1, 2014. That figure tumbled to $10,690 at the end of 2008, according to data from the College Savings Plan Network.

Although parents may be feeling better about paying for college, the basic trend of increasing prices continues, and loans are still a big part of the funding picture. Between 2001 and 2012, average undergraduate tuition almost doubled, causing an average real rate increase of 3.5 percent each year. Nearly 71 percent of college graduates left school with student loan debt this year, up from 54 percent 20 years prior. The average debt was $35,000 in 2015, an increase of 34 percent from 2010, student loan-tracker Edvisors has found.

How Snapchat Wants to Win the 2016 Election

Snapchat is getting a lot of attention for its presidential ambitions.

In an effort to both appeal to the youth vote and bolster its events coverage built on a growing volume of video posted by its users, the app recently posted a job opening for a Content Analyst in Politics & News.

The new hire will curate photos and videos for the app’s “Our Story” curated events coverage of the presidential race and other news events. That stories feature has already proven to be a massive success. On average, Snapchat’s Our Stories draws around 20 million people in a 24-hour window, director of partnerships at Snapchat, Ben Schwerin, told Re/code. The three-day story in April about Coachella, the music festival, generated 40 million unique visitors.

Political events might not be draws on that same scale, but Snapchat apparently believes its massive influence with younger Americans could attract millions millennials to engage in the political process at a time when voter turnout is at its lowest levels since World War II. In the 2012 mid-term election, the national turnout rate was 35.9 percent. Of that, only 13 percent were between the ages of 18 and 29.

Related: Can ‘Project Lightning’ Give Twitter a Fresh Jolt?

Boasting more than 100 million daily users, Snapchat is valued at $16 billion — giving it the reach and the financial clout to become a force in 2016 campaign coverage. About 60 percent of U.S. smartphone users aged between 13 and 24 have used the app, according to The Financial Times. The largest demographic of users is between the ages of 18 and 24 (45 percent), followed by those between 25 and 34 (26 percent).

To capitalize on that user base, Snapchat recently hired former CNN political reporter Peter Hamby to oversee its expanding news team. Snapchat wants to promote content from debates, rallies, appearances and other election events and allow users to follow along. But this isn’t purely an experiment in civic participation. Candidates can pay for political ads to appear on the social media app.

The social media app has an ace up its sleeve to incentivize candidates to purchase ads. The app already has age-gating technology and a form of geographic targeting. Originally put into place to make sure underage kids wouldn’t see alcohol ads, the age gate could be used to reach only voting-age users. The geographic targeting allows Our Stories to only be viewable by people in the same city or area, so politicians could target specific areas, especially ones in a tight race.

Snapchat, best known as the service that allows users to send disappearing photos, claims that ads inserted into “Our Stories” have an advantage over other social media advertisements because they leave more lasting impressions.

If campaigns buy into that and turn to Snapchat as a way to connect with a hard-to-reach demographic, the social media company could be the big winner in the 2016 election.

Coming Soon: Free Wi-Fi From Google’s Sidewalk Labs

Google’s latest startup wants to use technology to improve city life.

Google is about to hit the streets with Sidewalk Labs, a Google startup that will focus on developing new technologies to improve urban life. Billing itself as an “urban innovation company,” Sidewalk Labs was founded to tackle urban problems such as housing, pollution, energy consumption, and transportation with the goal of making cities “more efficient, responsive, flexible and resilient.”

The first project? In New York City, LinkNYC will replace aging pay phones with slim, aluminum pillars that provide free high-speed Wi-Fi. The hubs also will allow people to charge their mobile devices and look up directions on touch screens. Qualcomm will be the wireless provider

Related: Why Google’s Internet Balloons May Be a $10 Billion Business

According to the Federal Communications Commission, 17 percent of the population, or 55 million people, in the United States don’t have access to high-speed broadband. Sidewalk Labs hopes that projects like LinkNYC can help bridge that gap.

For the LinkNYC initiative, Google acquired and merged two companies -- Control Group and Titan -- into a new venture called Intersection, which aims to provide free, public Wi-Fi in cities around the world using such familiar urban infrastructure as bus stops and pay phones.

Related: Google Spends More Than Any Other Tech Giant to Influence Congress

Daniel L. Doctoroff, a former Bloomberg CEO and deputy mayor for New York City, has been tapped to head Sidewalk Labs. Doctoroff, who conceived the idea for Sidewalk Labs with a Google team headed by CEO Larry Page, told Wired, “The vision really is to make cities connected places where you can walk down any street and have access to free ultra high speed Wi-Fi. The possibilities from there are just endless.”

Just don’t give us any automated, self-driving taxis, please.

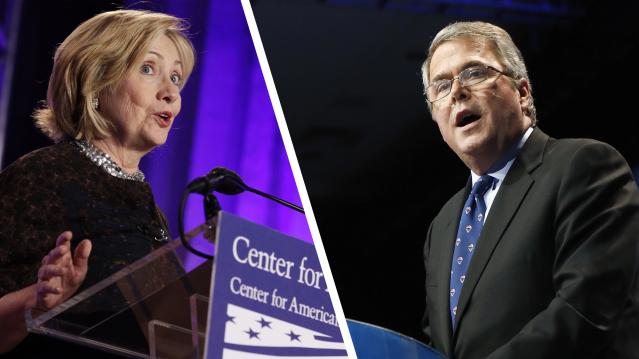

Presidential Candidates Respond to SCOTUS Obamacare Ruling

The Supreme Court’s 6-3 ruling Thursday may have kept the health care law and its insurance subsidies in place, but that doesn’t mean Republican efforts to “repeal and replace” the law are done. Major GOP presidential candidates took to Twitter following the Supreme Court’s announcement to blast the high court’s decision. Here are their responses and those from the Democratic candidates.

I am disappointed in the Burwell decision, but this is not the end of the fight against ObamaCare. http://t.co/3yaEVF1TaW

— Jeb Bush (@JebBush) June 25, 2015

Yes! SCOTUS affirms what we know is true in our hearts & under the law: Health insurance should be affordable & available to all. -H

— Hillary Clinton (@HillaryClinton) June 25, 2015

Despite the Court’s decision, ObamaCare is still a bad law that is having a negative impact on our country and on millions of Americans.

— Marco Rubio (@marcorubio) June 25, 2015

Justice Scalia got it right! "Words no longer have meaning if an Exchange that is not established by a State is "established by the State."

— Dr. Rand Paul (@RandPaul) June 25, 2015

I remain fully committed to the repeal of Obamacare—every single word of it. And, in 2017, we will do exactly that https://t.co/6i4WzLFzKR

— Ted Cruz (@tedcruz) June 25, 2015

#ObamaCare ruling is judicial tyranny. http://t.co/Di6WjxOc3y

— Gov. Mike Huckabee (@GovMikeHuckabee) June 25, 2015

Now that this ideological attempt to stop #ACA failed, we must redouble our efforts to bring health care to every person in this nation.

— Martin O'Malley (@MartinOMalley) June 25, 2015

Americans deserve better than what we’re getting with Obamacare. It’s time we repealed and replaced it! http://t.co/1EHfbVKBMa

— Rick Perry (@GovernorPerry) June 25, 2015

It is outrageous that the Supreme Court once again rewrote ObamaCare to save this deeply flawed law https://t.co/NBAnohFTW7

— Carly Fiorina (@CarlyFiorina) June 25, 2015

RT If you agree. We need real leadership in Washington, and Congress needs to repeal and replace #ObamaCare. #SCOTUScare - SKW

— Scott Walker (@ScottWalker) June 25, 2015

NEWS: Sen. Bernie Sanders' statement on Supreme Court decision upholding #ACA http://t.co/AUQgEHqUsi pic.twitter.com/PjyEillVBa

— Bernie Sanders (@SenSanders) June 25, 2015

Deeply disappointed by #SCOTUS ruling. Fundamental increase of govt control. I'm working to ensure next Pres repeals and replaces #Obamacare

— Dr. Ben Carson (@RealBenCarson) June 25, 2015

Today's Supreme Court ruling is another reminder that if we want to get rid of #Obamacare, we must elect a conservative President #RICK2016

— Rick Santorum (@RickSantorum) June 25, 2015This Is America’s Biggest Financial Fear

More than 60 percent of Americans are losing sleep at night because of financial concerns, and the biggest concern is that they’re not saving enough for retirement, according to a new report from CreditCards.com.

The second-biggest worry is about the cost of education, with half of those between the ages of 18 and 29 saying that concern keeps them up at night.

The percentage of Americans worried about education costs has been growing for the past eight years and is the only category that has become a bigger problem since the Great Recession. “Unless something slows the rapid rise in college costs, this could soon be Americans’ biggest financial fear,” CreditCards.com senior analyst Matt Schultz said in a statement.

Related: 12 Smart Money Moves Millennials Should Make Right Now

That echoes a Gallup poll released in April, which found that 73 percent of parents with kids under age 18 ranked paying for college as a financial worry, more than were concerned about saving for retirement or covering medical expenses.

Nearly one in three Americans are losing sleep because of medical bills, 27 percent are worried about their mortgage or rent payment, and 21 percent fret over credit card debt.

Older Americans and those with higher incomes seem to have fewer financial anxieties than younger generations. Less than half of those age 65 or older are losing sleep over their finances, versus more than two thirds of adults 64 or younger. Of those making less than $75,000 per year, 69 percent had financial worries, compared to just 51 percent of those making more than $75,000.

Millennials Still Don’t Trust the Stock Market

Goldman Sachs has released the latest in a long line of surveys about millennials and money. The findings won’t shock you if you’ve seen other such surveys: millennials get financial advice from their parents, they’re less concerned with privacy, they still want to own a home … someday.

But one familiar finding may be worth highlighting. Even as the stock market reaches record highs, millennials by and large remain wary of investing. Fewer than 20 percent of those surveyed by Goldman said that stocks are “the best way to save for the future.” Another 45 percent said they’re willing to dip a toe in the market or to put money into low-risk options. More than a third of those surveyed said they don’t know enough about stocks or felt that the market is too volatile or too stacked against small investors.

Part of that may because many millennials haven’t yet reached the life stage or the level of financial stability that would lead them to consider investing. But the lingering scars of the recession are evident in the results, too — and financial institutions clearly have a long way go to restore the public’s confidence in them. For example, Gallup just published a report called, “Why It’s Still Cool to Hate Banks.”

Related: The Rise of a New Economic Underclass—Millennial Men

Goldman didn’t release the details about how many millennials it surveyed or when (and it hadn’t yet responded to an email asking for those details by the time of publication), but the results it got are broadly in line with those of earlier surveys. And they’re another reminder that not everyone is benefitting from the stock market’s record-setting rally. Millennials are still missing out.

Here is a chart produced by Goldman Sachs summarizing the results of their survey: