Why ‘In a Relationship’ on Facebook Means More Than You Think

Worried about your relationship with your significant other? A quick look at your Facebook profile can tell you a lot about how you’re doing as a couple.

Listing yourself as “in a relationship” with your partner, posting photos of you and your partner together, and posting on your partner’s wall are all signs of a committed relationship, at least among college-age couples, according to a new study from the University of Wisconsin-Madison.

The study looked at 180 undergraduates who were in romantic relationships and asked them a number of questions about their relationship and looked at their Facebook profiles. Six months later, the researchers returned and asked the students whether they were still in that relationship.

The study results suggest that displaying a public commitment on Facebook, a highly public platform, is correlated with more enduring relationships between couples. These public displays of devotion actually help cement relationships as they develop over time.

However, not all couple-related activity on Facebook is good for a relationship. The number of mutual friends each couple had and the number of partner-initiated wall posts were negatively correlated with relationship commitment. In addition, joint affiliations, such as attending the same events or being in the same Facebook groups, was not associated with commitment.

As annoying as couples who broadcast their relationship all over Facebook might be, they’re more likely to be in it for the long haul. So consider blocking them if you’ve had enough of the online PDA, because as they study suggest, there’s probably going to be a whole lot more of it.

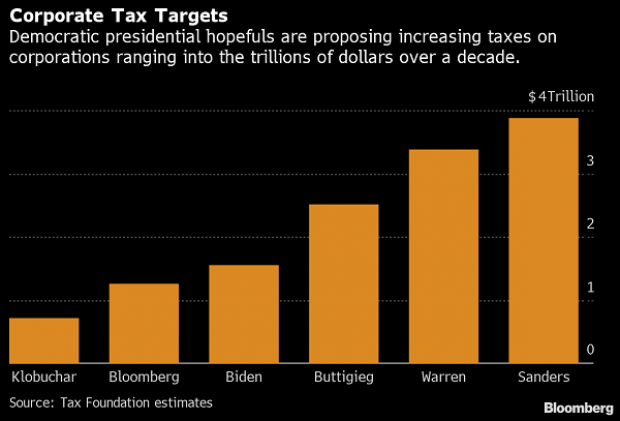

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

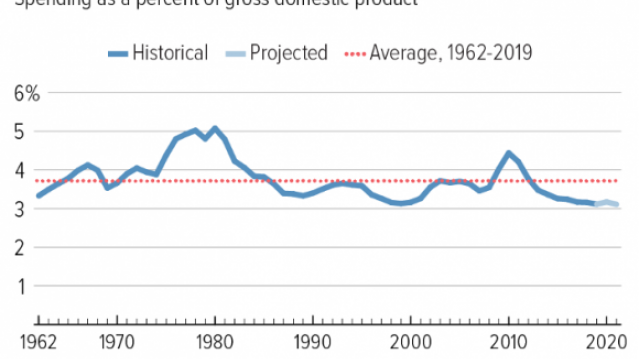

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

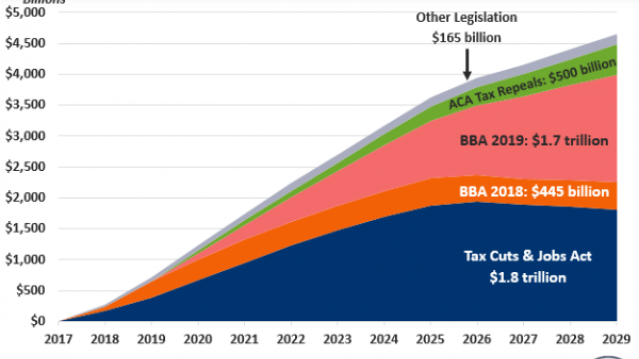

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

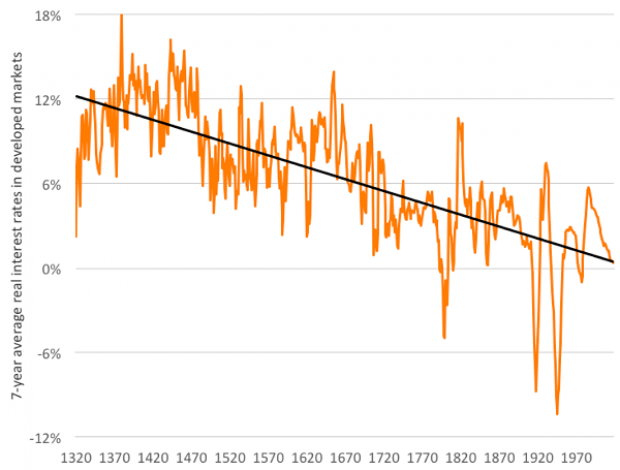

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

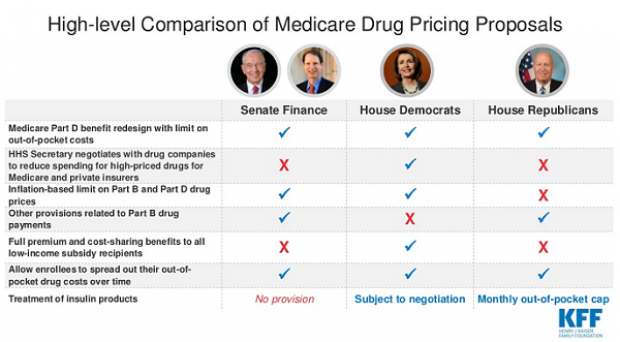

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.