In a Black Eye for Wearable Tech, Nike Giving Refunds for FuelBand

If you thought that the calorie count and steps tracked by your Nike FuelBand were inaccurate, you may have been right.

Nike and Apple have agreed to settle a class action lawsuit claiming that the companies made misleading statements regarding the product’s ability to accurately track calories and steps, according to a website maintained by settlement administrator Gilardi & Co.

The companies have denied the allegations and claim they broke no laws, but they have agreed to a settlement in which Nike will give consumers who join the class action suit by January $15 or a $25 Nike gift card. The total cost of the refunds could reach more than $2 million.

Related: Why No One is Actually Buying Wearable Tech

Anyone who purchased a FuelBand from January 19, 2012 through June 17, 2015 is eligible for the refund.

Last year, Nike began shifting its focus away from producing FuelBands, choosing instead to focus on apps, including one for the Apple watch, that support fitness tracking. The company has said it has more than 60 million digital fitness software users.

The FuelBand was an early entrant into what has become a crowded field or wearable fitness trackers, despite questions about their accuracy. However smart watches, which offer built-in fitness trackers along with other apps, may soon eclipse the demand for that standalone products.

A report released last year by tech analysts Juniper Research projected that revenue from wearable tech, would increase from $4.5 billion in 2014 to more than $53 billion in 2019.

Tax Refunds Rebound

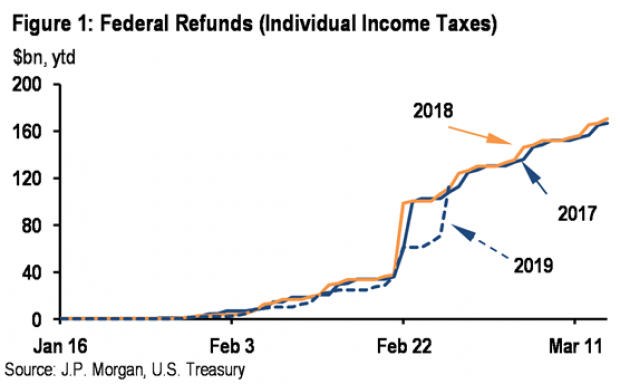

Smaller refunds in the first few weeks of the current tax season were shaping up to be a political problem for Republicans, but new data from the IRS shows that the value of refund checks has snapped back and is now running 1.3 percent higher than last year. The average refund through February 23 last year was $3,103, while the average refund through February 22 of 2019 was $3,143 – a difference of $40. The chart below from J.P. Morgan shows how refunds performed over the last 3 years.

Number of the Day: $22 Trillion

The total national debt surpassed $22 trillion on Monday. Total public debt outstanding reached $22,012,840,891,685.32, to be exact. That figure is up by more than $1.3 trillion over the past 12 months and by more than $2 trillion since President Trump took office.

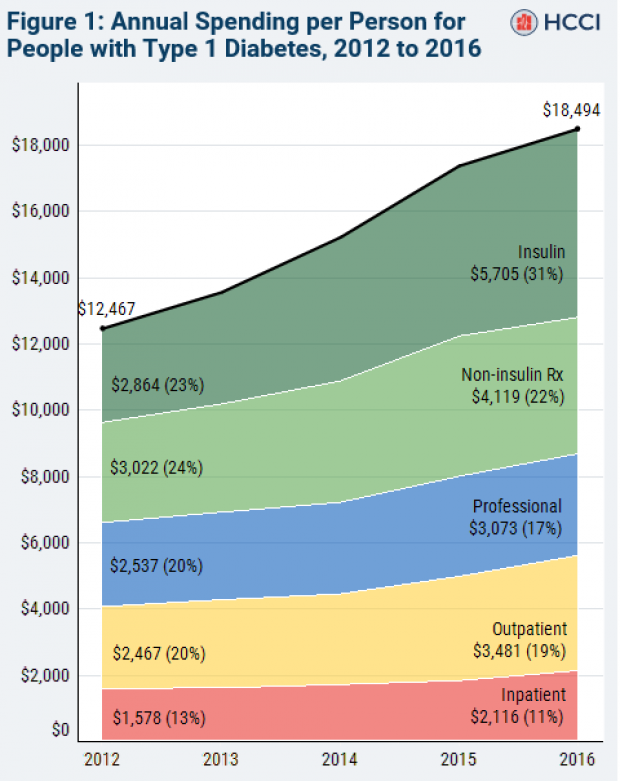

Chart of the Week: The Soaring Cost of Insulin

The cost of insulin used to treat Type 1 diabetes nearly doubled between 2012 and 2016, according to an analysis released this week by the Health Care Cost Institute. Researchers found that the average point-of-sale price increased “from $7.80 a day in 2012 to $15 a day in 2016 for someone using an average amount of insulin (60 units per day).” Annual spending per person on insulin rose from $2,864 to $5,705 over the five-year period. And by 2016, insulin costs accounted for nearly a third of all heath care spending for those with Type 1 diabetes (see the chart below), which rose from $12,467 in 2012 to $18,494.

Chart of the Day: Shutdown Hits Like a Hurricane

The partial government shutdown has hit the economy like a hurricane – and not just metaphorically. Analysts at the Committee for a Responsible Federal Budget said Tuesday that the shutdown has now cost the economy about $26 billion, close to the average cost of $27 billion per hurricane calculated by the Congressional Budget Office for storms striking the U.S. between 2000 and 2015. From an economic point of view, it’s basically “a self-imposed natural disaster,” CRFB said.

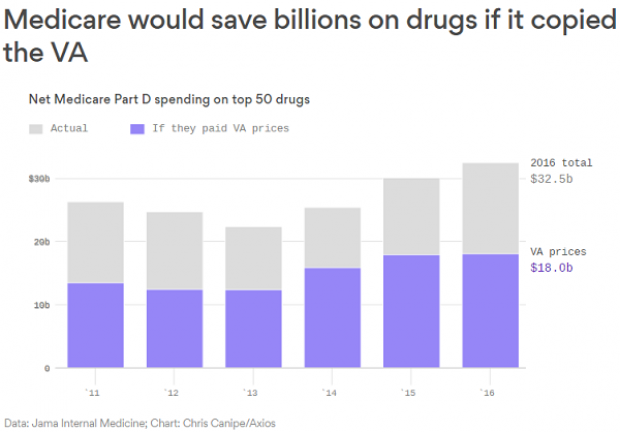

Chart of the Week: Lowering Medicare Drug Prices

The U.S. could save billions of dollars a year if Medicare were empowered to negotiate drug prices directly with pharmaceutical companies, according to a paper published by JAMA Internal Medicine earlier this week. Researchers compared the prices of the top 50 oral drugs in Medicare Part D to the prices for the same drugs at the Department of Veterans Affairs, which negotiates its own prices and uses a national formulary. They found that Medicare’s total spending was much higher than it would have been with VA pricing.

In 2016, for example, Medicare Part D spent $32.5 billion on the top 50 drugs but would have spent $18 billion if VA prices were in effect – or roughly 45 percent less. And the savings would likely be larger still, Axios’s Bob Herman said, since the study did not consider high-cost injectable drugs such as insulin.