CVS Quit Selling Cigarettes, but It’s Found a Patch for Sales

CVS executives knew that some of their sales would go up in smoke when they decided last year to stop selling cigarettes. The press release announcing that all 7,600 CVS stores nationwide would stop selling all tobacco products acknowledged that sales would take a hit. Still, the company said, “This is the right thing to do.”

The costs of the decision are now becoming clear. CVS Health’s general merchandise sales slumped 7.8 percent last quarter on a same-store basis, the company said Tuesday. The company claims non-pharmacy sales would have stayed the same if tobacco sales — and the other products cigarette buyers added to their baskets — were removed from sales figures for the same quarter in 2014.

Related: Why Smoking Is Even Worse Than We Thought

Same-store sales in the pharmacy category climbed 4.1 percent, boosting overall same-store sales growth to 0.5 percent compared with the second quarter of last year, down from a 1.2 percent year-over-year increase the previous quarter. Net revenue overall grew by 7.4 percent to $37.2 billion, helped by pharmacy services revenue that surged 11.9 percent ($2.6 billion) to $24.4 billion. The company has reportedly increased its market share in the health and beauty categories (it did, however, narrow its full-year earnings forecast).

So even as the move to drop cigarettes has cost the company, its bet on health as the source of future growth may be starting to pay off. CVS stock dropped in the wake of its earnings announcement, but shares are still up more than 15 percent on the year and 44 percent over the past 12 months.

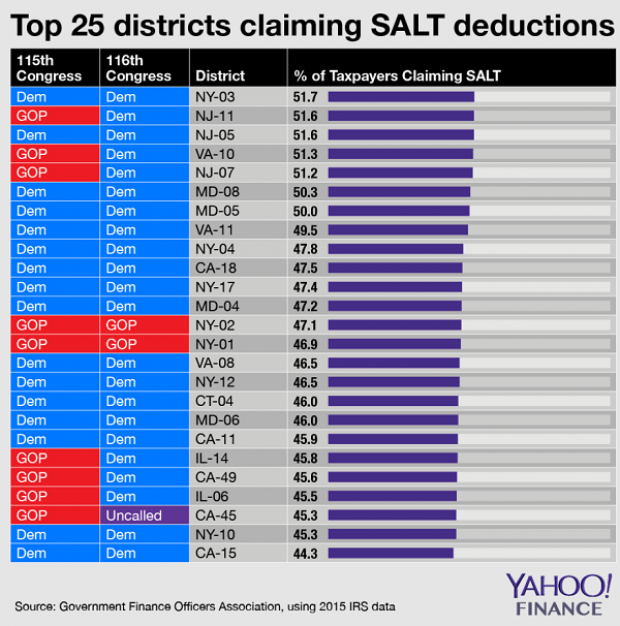

Chart of the Day: SALT in the GOP’s Wounds

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

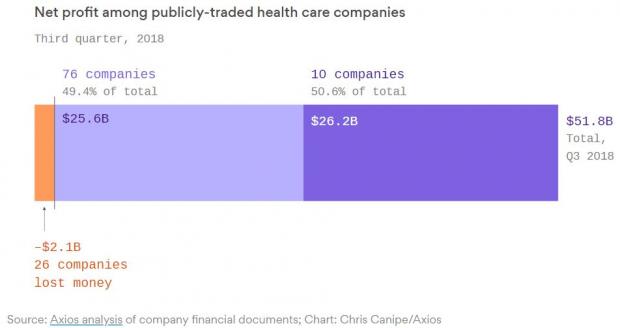

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

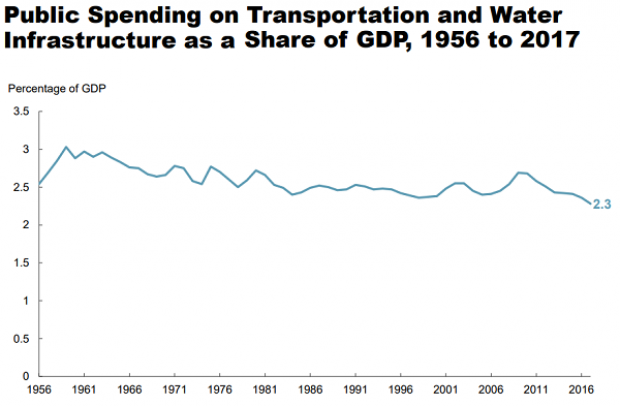

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.