CVS Quit Selling Cigarettes, but It’s Found a Patch for Sales

CVS executives knew that some of their sales would go up in smoke when they decided last year to stop selling cigarettes. The press release announcing that all 7,600 CVS stores nationwide would stop selling all tobacco products acknowledged that sales would take a hit. Still, the company said, “This is the right thing to do.”

The costs of the decision are now becoming clear. CVS Health’s general merchandise sales slumped 7.8 percent last quarter on a same-store basis, the company said Tuesday. The company claims non-pharmacy sales would have stayed the same if tobacco sales — and the other products cigarette buyers added to their baskets — were removed from sales figures for the same quarter in 2014.

Related: Why Smoking Is Even Worse Than We Thought

Same-store sales in the pharmacy category climbed 4.1 percent, boosting overall same-store sales growth to 0.5 percent compared with the second quarter of last year, down from a 1.2 percent year-over-year increase the previous quarter. Net revenue overall grew by 7.4 percent to $37.2 billion, helped by pharmacy services revenue that surged 11.9 percent ($2.6 billion) to $24.4 billion. The company has reportedly increased its market share in the health and beauty categories (it did, however, narrow its full-year earnings forecast).

So even as the move to drop cigarettes has cost the company, its bet on health as the source of future growth may be starting to pay off. CVS stock dropped in the wake of its earnings announcement, but shares are still up more than 15 percent on the year and 44 percent over the past 12 months.

It’s Official: No Government Shutdown – for Now

President Trump signed a short-term continuing resolution today to fund the federal government through Friday, December 22.

Bloomberg called the maneuver “a monumental piece of can kicking,” which is no doubt the case, but at least you’ll be able to visit your favorite national park over the weekend.

Here's to small victories!

Greenspan Has a Warning About the GOP Tax Plan

The Republican tax cuts won’t do much for economic growth, former Federal Reserve Chair Alan Greenspan told CNBC Wednesday, but they will damage the country’s fiscal situation while creating the threat of stagflation. "This is a terrible fiscal situation we've got ourselves into," Greenspan said. "The administration is doing tax cuts and a spending decrease, but he's doing them in the wrong order. What we need right now is to focus totally on reducing the debt."

The US Economy Hits a Sweet Spot

“The U.S. economy is running at its full potential for the first time in a decade, a new milestone for an expansion now in its ninth year,” The Wall Street Journal reports. But the milestone was reached, in part, because the Congressional Budget Office has, over the last 10 years, downgraded its estimate of the economy’s potential output. “Some economists think more slack remains in the job market than October’s 4.1% unemployment rate would suggest. Also, economic output is still well below its potential level based on estimates produced a decade ago by the CBO.”

The New York Times Drums Up Opposition to the Tax Bill

The New York Times editorial board took to Twitter Wednesday “to urge the Senate to reject a tax bill that hurts the middle class & the nation's fiscal health.”

Using the hashtag #thetaxbillshurts, the NYT Opinion account posted phone numbers for Sens. Susan Collins, Bob Corker, Jeff Flake, James Lankford, John McCain, Lisa Murkowski and Jerry Moran. It urged readers to call the senators and encourage them to oppose the bill.

In an editorial published Tuesday night, the Times wrote that “Republican senators have a choice. They can follow the will of their donors and vote to take money from the middle class and give it to the wealthiest people in the world. Or they can vote no, to protect the public and the financial health of the government.”

Like what you're reading? Sign up for our free newsletter.

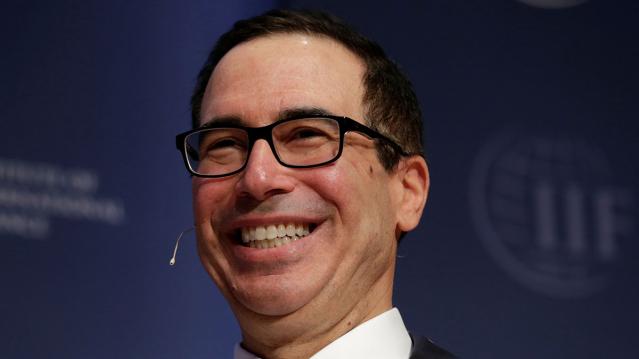

Can Trump Succeed Where Mnuchin and Cohn Have Flopped?

President Trump met with members of the Senate Finance Committee Monday and is scheduled to attend Senate Republicans’ weekly policy lunch and make a personal push for the tax plan on Tuesday. Will he be a more effective salesman than surrogates in his administration?

Politico’s Annie Karni and Eliana Johnson report that both Democrats and Republicans say Mnuchin and chief economic adviser Gary Cohn have repeatedly botched their tax pitches, “in part due to their own backgrounds” as wealthy Goldman Sachs alums. “House Speaker Paul Ryan earlier this month asked the White House not to send Mnuchin to the Hill to talk with Republican lawmakers about the bill, according to two people familiar with the discussions — though Ryan has praised the Treasury secretary’s ability to improve the legislation itself,” Karni and Johnson write.