This May Be the Best Frequent Flier Perk Ever

Forget about getting bumped up to first class. Delta Airlines is now bumping its best customers off commercial flights entirely -- and onto private jets.

The program got off the ground last week, according to Bloomberg, with its first flight traveling from Cincinnati to Atlanta.

To be eligible for the upgrade, fliers must have at least 125,000 miles in travel and $15,000 in annual spending with the airline. The bump costs an extra $300 to $800.

In addition to improving the loyalty among some of Delta’s best customers, the program has a side benefit for Delta, allowing it to get some value from positioning flights, known as “empty legs,” which make up about 30 percent of industry flying.

Delta and other airlines have been shifting their loyalty programs in ways that make it easier for elite flyers to earn rewards and more difficult for more irregular customers.

Related: Rethinking airline points strategy with the Points Guy

Starting in June 2016, Delta will issue rewards based on the amount of money spent rather than miles traveled, and the airline may change the number of miles necessary to book a flight based on demand and other factors.

Analysts say that other airlines may follow suit. Airline reward programs have been unsuccessful in fostering loyalty among patrons, many of whom book flights based on cost and convenience rather than brand preference. Only 44 percent of travelers and 40 percent of business travelers fly at least three-quarters of their miles on their preferred airline, reports Deloitte.

Delta’s reward program ranked 9th on U.S. News’ annual ranking of the best airline rewards programs, released this week, receiving 3.1 stars out of 5. Alaska Airlines was ranked first.

Trump and Schumer Will Try to Scrap the Debt Ceiling

The president and the Senate Democratic leader agreed to seek out a more permanent debt ceiling solution that would end the perpetual cycle of fiscal standoffs. “There are a lot of good reasons to do that, so certainly that’s something that will be discussed," Trump said Thursday. It might not be easy, though, as conservatives see the borrowing limit as a way to keep government spending in check. Paul Ryan said Thursday he opposes doing away with the debt ceiling.

Is a Fix for Obamacare Taking Shape?

Senators on the Committee on Health, Education, Labor and Pensions heard from governors Thursday in the second of four scheduled hearings on stabilizing Obamacare. The common theme emerging from the testimony was flexibility: "Returning control to the states is prudent policy but also prudent politics," said Utah Gov. Gary Herbert, a Republican. He was joined by Democrat John Hickenlooper of Colorado, who said that states need room to innovate and learn from their mistakes. Much of what the governors said was in line with what the Senate panel is already considering, including the continuation of cost-sharing subsidies to insurance companies. (CBS News, Axios)

Senate Approves Trump's Deal with Dems. Will the House Go Along?

The Senate on Thursday voted to fund the government and increase the federal borrowing limit through December 8 as part of a deal that also included $15.25 billion in hurricane disaster relief funding and a short-term extension of the National Flood Insurance Program. The bill passed by a vote of 80-to-17, with only Republicans voting against the bill.

The package now goes back to the House, where it likely faces more strenuous resistance. The Republican Study Committee, a conservative caucus with more than 155 members, on Thursday announced it opposed the deal because it does not include spending cuts. Rep. Mark Walker, the group's chairman, sent a letter to House Speaker Paul Ryan listing 19 policy changes to "address the growing debt burden" or "begin draining the swamp" that could win conservative support for raising the debt ceiling. Some Democrats may also vote against the deal to signal their frustration with an agreement that they say weakened their hand in trying to protect undocumented immigrants who were brought into the country as children.

White House Backs Off Shutdown Threat…for Now

“Believe me, if we have to close down our government, we’re building that wall,” President Trump said of his planned border wall with Mexico 10 days ago. Just two days later, though, White House officials told Congress that a short-term spending bill to fund the government into December wouldn’t have to include $1.6 billion for the wall, The Washington Post reports.

Trump still wants money for the wall to be included in a December budget bill, and he could follow through on his shutdown threat at that point. For now, though, an agreement on a “continuing resolution” to keep the government running after September 30 seems likelier, allowing Congress to deal with some of the other pressing issues it faces this month.

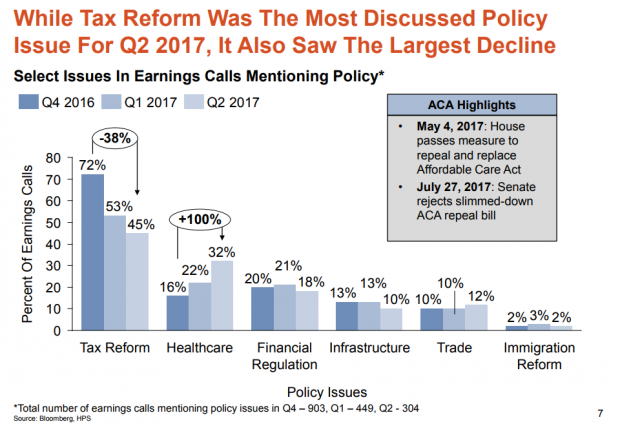

Which Trump Agenda Items Are Companies Talking About With Wall Street?

Hamilton Place Strategies, a public affairs consulting firm, analyzed transcripts of earnings calls by publicly traded U.S. companies over the last three quarters. They found that tax reform was the policy issue companies discussed most on those calls with Wall Street analysts — but that mentions of the subject dropped by 38 percent from the fourth quarter of 2016 to the second quarter of 2017. Overall, the percentage of earnings calls mentioning government or policy issues fell from 41 percent to 16 percent. Health-care reform saw the largest increase.

Does this mean that businesses have given up on tax reform this year? Perhaps. More likely, it's simply the result of a lack of action on the tax overhaul. Hamilton Place notes that mentions of tax policy peaked in February just after the Senate Finance Committee advanced Treasury Secretary Steven Mnuchin's nomination and have spiked after other tax-related announcements. So mentions of tax reform on earnings calls could surge again the fall.

One other note about what businesses have been discussing: Calls mentioning President Trump fell by 84 percent from January to late August.

08312017_HPS_Chart_of_the_day.PNG