How a Smart Home Can Save You Time and Money

More than a quarter of Americans have smart home products and they report that the devices save them an average of 30 minutes a day and more than $1,000 per year, according to a new report by Coldwell Banker and CNET.

Adoption of smart home products is even higher among millennials, with more than half embracing the technology. Additionally, parents of young children are twice as likely to have installed smart home products than non-parents.

“Smart home technology is catching on because it is literally changing the way we live in our homes,” Coldwell Banker Chief Marketing Officer Sean Blankenship said in a statement. “Not only is it shifting the financial perception of the home, but it is also transforming our emotional connection to our homes.”

Related: Want a Smarter Home? You Don’t Have to Wait

More than eight in 10 of those surveyed said they’d be more likely to buy a home if it included smart technology like connected lights, thermostats or security systems. Nearly three-quarters said that smart home products provide peace of mind when it comes to home security.

Those numbers are expected to grow as technology gets better and cheaper, and millennials start purchasing and upgrading homes in larger numbers. A 2013 report by the Organization for Economic Co-Operation and development found that a four-person family had about 10 connected devices, but projected that number to grow to about 25 in five years and as many as 50 in 10 years.

Top Reads from the Fiscal Times:

- Clinton Attempts to Cure the Email Blues. Again.

- Did Kasich Just Do an About-Face on Climate Change?

- While Trump Whirls and Rages, Cruz Stays the Course

GOP Tax Cuts Getting Less Popular, Poll Finds

Friday marked the six-month anniversary of President Trump’s signing the Republican tax overhaul into law, and public opinion of the law is moving in the wrong direction for the GOP. A Monmouth University survey conducted earlier this month found that 34 percent of the public approves of the tax reform passed by Republicans late last year, while 41 percent disapprove. Approval has fallen by 6 points since late April and disapproval has slipped 3 points. The percentage of people who aren’t sure how they feel about the plan has risen from 16 percent in April to 24 percent this month.

Other findings from the poll of 806 U.S. adults:

- 19 percent approve of the job Congress is doing; 67 percent disapprove

- 40 percent say the country is heading in the right direction, up from 33 percent in April

- Democrats hold a 7-point edge in a generic House ballot

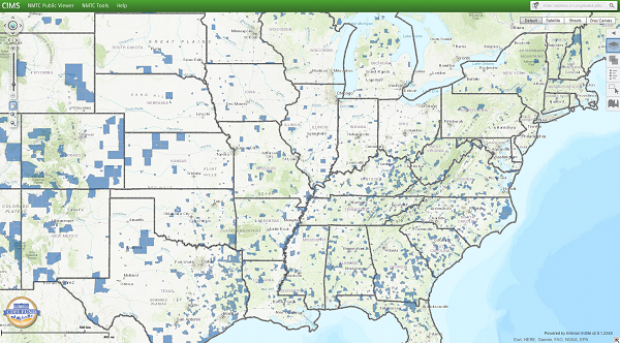

Special Tax Break Zones Defined for All 50 States

The U.S. Treasury has approved the final group of opportunity zones, which offer tax incentives for investments made in low-income areas. The zones were created by the tax law signed in December.

Bill Lucia of Route Fifty has some details: “Treasury says that nearly 35 million people live in the designated zones and that census tracts in the zones have an average poverty rate of about 32 percent based on figures from 2011 to 2015, compared to a rate of 17 percent for the average U.S. census tract.”

Click here to explore the dynamic map of the zones on the U.S. Treasury website.

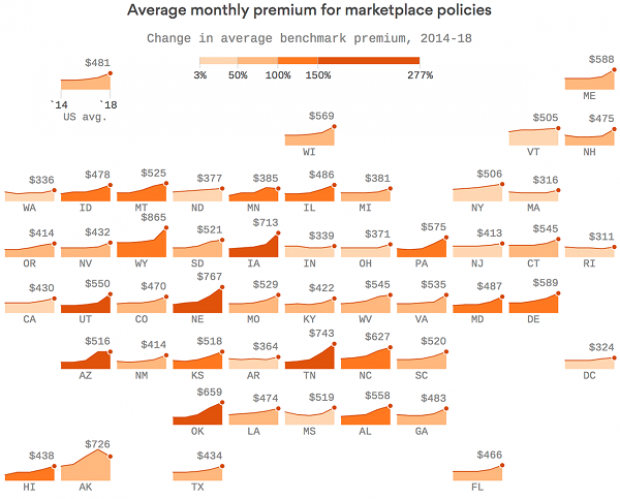

Map of the Day: Affordable Care Act Premiums Since 2014

Axios breaks down how monthly premiums on benchmark Affordable Care Act policies have risen state by state since 2014. The average increase: $481.

Obamacare Repeal Would Lead to 17.1 Million More Uninsured in 2019: Study

A new analysis by the Urban Institute finds that if the Affordable Care Act were eliminated entirely, the number of uninsured would rise by 17.1 million — or 50 percent — in 2019. The study also found that federal spending would be reduced by almost $147 billion next year if the ACA were fully repealed.

Your Tax Dollars at Work

Mick Mulvaney has been running the Consumer Financial Protection Bureau since last November, and by all accounts the South Carolina conservative is none too happy with the agency charged with protecting citizens from fraud in the financial industry. The Hill recently wrote up “five ways Mulvaney is cracking down on his own agency,” and they include dropping cases against payday lenders, dismissing three advisory boards and an effort to rebrand the operation as the Bureau of Consumer Financial Protection — a move critics say is intended to deemphasize the consumer part of the agency’s mission.

Mulvaney recently scored a small victory on the last point, changing the sign in the agency’s building to the new initials. “The Consumer Financial Protection Bureau does not exist,” Mulvaney told Congress in April, and now he’s proven the point, at least when it comes to the sign in his lobby (h/t to Vox and thanks to Alan Zibel of Public Citizen for the photo, via Twitter).