Why Millennials Are Waiting So Long to Buy Their First Homes

They may finally be moving out of their parents’ basements, but don’t expect those boomerang kids to be taking out a mortgage any time soon.

Today’s first-time homebuyer rents for an average of six years before buying his or her first home, according to a new analysis by Zillow. Time spent renting has been marching mostly upward since the 1970s, when first-time buyers rented for just 2.6 years before purchasing a home.

Today’s first-time buyers are also more likely to be single and older (with an average age of 32.5) than previous generations.

“Millennials are delaying all kinds of major life decisions, like getting married and having kids, so it makes sense that they would also delay buying a home,” Zillow Chief Economist Svenja Gudell said in a statement.

Related: Found Your Dream Home? 7 Tips for Getting the Best Deal

Part of the reason for that delay could be that homes cost much more than they did decades ago. Today’s homebuyer makes roughly the same amount of money in inflation-adjusted terms as a buyer in the 1970s, but the homes that they’re purchasing are about 60 percent more expensive.

There are other roadblocks for first-timers. Limited inventory and strong competition make the home buying process difficult for property virgins and student debt can make it tougher to get a mortgage.

Those six years spent renting aren’t coming cheap, either. In 2013, almost half of all renters were spending more than 30 percent of their income on housing, with more than a quarter sending half their income to their landlord every month, according to the “State of the Nation’s Housing 2015” report issued in June by the Harvard Joint Center for Housing Studies. That makes it pretty tough to save for a down payment.

Top Reads from the Fiscal Times:

- Trump as Commander in Chief? Tune in for a Foreign Policy Reality Show

- Clinton’s Email Fail May Be Innocent, but Americans Still Don’t Trust Her

- As Obamacare Costs Rise, the GOP Has a Real Chance to Reform Health Care

GOP Tax Cuts Getting Less Popular, Poll Finds

Friday marked the six-month anniversary of President Trump’s signing the Republican tax overhaul into law, and public opinion of the law is moving in the wrong direction for the GOP. A Monmouth University survey conducted earlier this month found that 34 percent of the public approves of the tax reform passed by Republicans late last year, while 41 percent disapprove. Approval has fallen by 6 points since late April and disapproval has slipped 3 points. The percentage of people who aren’t sure how they feel about the plan has risen from 16 percent in April to 24 percent this month.

Other findings from the poll of 806 U.S. adults:

- 19 percent approve of the job Congress is doing; 67 percent disapprove

- 40 percent say the country is heading in the right direction, up from 33 percent in April

- Democrats hold a 7-point edge in a generic House ballot

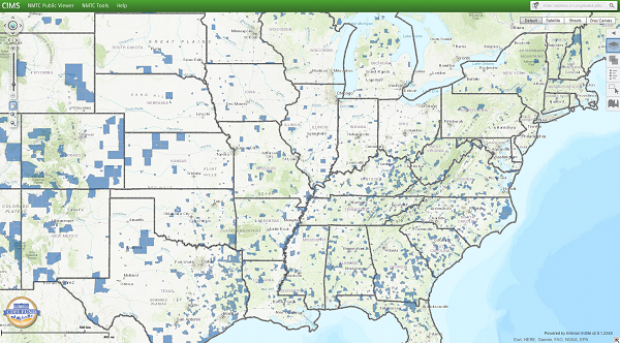

Special Tax Break Zones Defined for All 50 States

The U.S. Treasury has approved the final group of opportunity zones, which offer tax incentives for investments made in low-income areas. The zones were created by the tax law signed in December.

Bill Lucia of Route Fifty has some details: “Treasury says that nearly 35 million people live in the designated zones and that census tracts in the zones have an average poverty rate of about 32 percent based on figures from 2011 to 2015, compared to a rate of 17 percent for the average U.S. census tract.”

Click here to explore the dynamic map of the zones on the U.S. Treasury website.

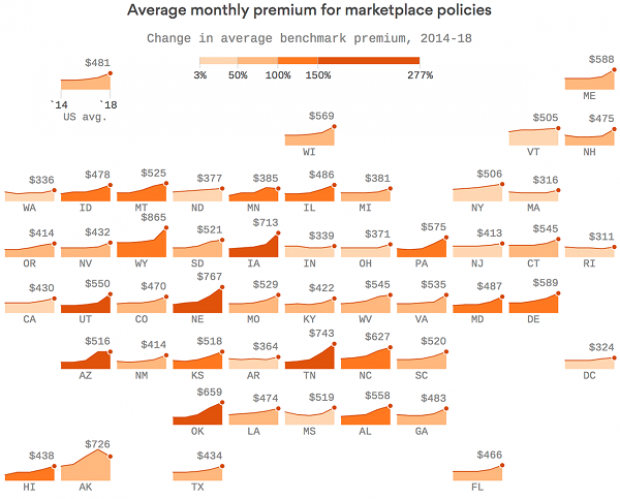

Map of the Day: Affordable Care Act Premiums Since 2014

Axios breaks down how monthly premiums on benchmark Affordable Care Act policies have risen state by state since 2014. The average increase: $481.

Obamacare Repeal Would Lead to 17.1 Million More Uninsured in 2019: Study

A new analysis by the Urban Institute finds that if the Affordable Care Act were eliminated entirely, the number of uninsured would rise by 17.1 million — or 50 percent — in 2019. The study also found that federal spending would be reduced by almost $147 billion next year if the ACA were fully repealed.

Your Tax Dollars at Work

Mick Mulvaney has been running the Consumer Financial Protection Bureau since last November, and by all accounts the South Carolina conservative is none too happy with the agency charged with protecting citizens from fraud in the financial industry. The Hill recently wrote up “five ways Mulvaney is cracking down on his own agency,” and they include dropping cases against payday lenders, dismissing three advisory boards and an effort to rebrand the operation as the Bureau of Consumer Financial Protection — a move critics say is intended to deemphasize the consumer part of the agency’s mission.

Mulvaney recently scored a small victory on the last point, changing the sign in the agency’s building to the new initials. “The Consumer Financial Protection Bureau does not exist,” Mulvaney told Congress in April, and now he’s proven the point, at least when it comes to the sign in his lobby (h/t to Vox and thanks to Alan Zibel of Public Citizen for the photo, via Twitter).