Diamond Prices Are Falling, but Don’t Rush to Buy an Engagement Ring

Diamond prices are getting slashed, but that doesn’t mean you should run out to the jewelry store right now.

De Beers, the world’s largest producer and distributor of diamonds by value, is cutting diamond prices by as much as 9 percent, according to Bloomberg.

Diamond prices have already slumped over the past year as demand has fallen, partly as a result of the economic slowdown in China, the second-biggest market for the precious stones.

Related: Can Gold Regain Its Shine?

De Beers, which is a unit of mining giant Anglo American and controls one-third of the global diamond market, initially tried to stabilize prices by ramping down its production. It had started the year with a production goal of 34 million carats, but has twice slashed the goal to a current 29 million to 31 million carats.

That hasn’t been enough to counterbalance sagging demand, so De Beers says it will invest in a holiday marketing campaign in an attempt to boost consumer interest. The campaign will be focused in the U.S. and China, the world’s two leading diamond markets, and will primarily target men buying diamond jewelry gifts for their partners.

In other words, you can expect to see a whole lot of diamond commercials soon — and in an interview with The Fiscal Times, one diamond industry expert predicted that the industry’s struggles will lead at least some retailers to cut prices this holiday season.

Related: Putin’s Spokesman Wears a Golden Skull Watch Worth $620K

The De Beers price cuts probably won’t have much effect on prices at high-end jewelry retailers such as Tiffany’s, though. These stores only purchase gems from a limited number of producers and since the diamonds they use are higher in value, their prices aren’t as vulnerable to market pressures as less valuable stones.

But it never hurts to look, right?

Top Reads from The Fiscal Times:

- Why You Should Ignore the Stock Market Sell-Off

- The 10 Worst States for Property Taxes

- The Best Things to Charge on Your Credit Card

Coming Soon: Deductible Relief Day!

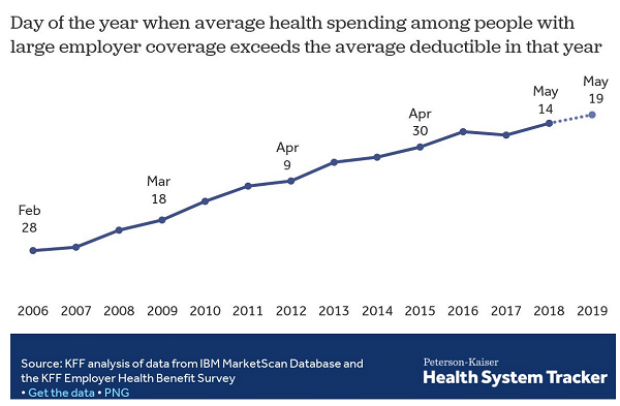

You may be familiar with the concept of Tax Freedom Day – the date on which you have earned enough to pay all of your taxes for the year. Focusing on a different kind of financial burden, analysts at the Kaiser Family Foundation have created Deductible Relief Day – the date on which people in employer-sponsored insurance plans have spent enough on health care to meet the average annual deductible.

Average deductibles have more than tripled over the last decade, forcing people to spend more out of pocket each year. As a result, Deductible Relief Day is “getting later and later in the year,” Kaiser’s Larry Levitt said in a tweet Thursday.

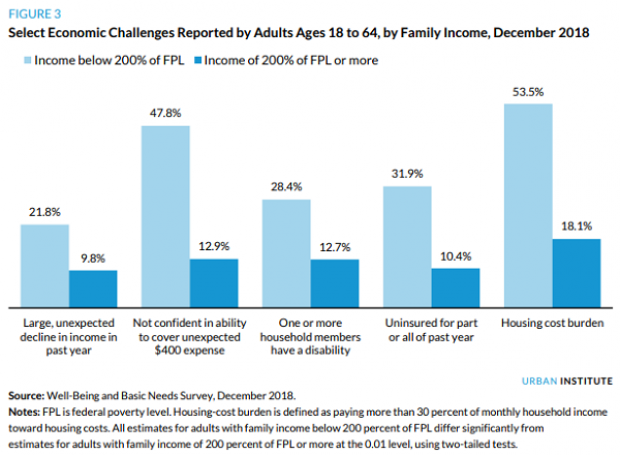

Chart of the Day: Families Still Struggling

Ten years into what will soon be the longest economic expansion in U.S. history, 40% of families say they are still struggling, according to a new report from the Urban Institute. “Nearly 4 in 10 nonelderly adults reported that in 2018, their families experienced material hardship—defined as trouble paying or being unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties for the previous year,” the report says. “Among adults in families with incomes below twice the federal poverty level (FPL), over 60 percent reported at least one type of material hardship in 2018.”

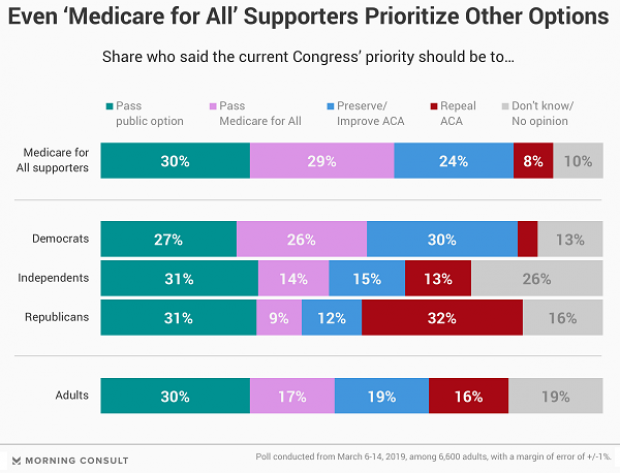

Chart of the Day: Pragmatism on a Public Option

A recent Morning Consult poll 3,073 U.S. adults who say they support Medicare for All shows that they are just as likely to back a public option that would allow Americans to buy into Medicare or Medicaid without eliminating private health insurance. “The data suggests that, in spite of the fervor for expanding health coverage, a majority of Medicare for All supporters, like all Americans, are leaning into their pragmatism in response to the current political climate — one which has left many skeptical that Capitol Hill can jolt into action on an ambitious proposal like Medicare for All quickly enough to wrangle the soaring costs of health care,” Morning Consult said.

Chart of the Day: The Explosive Growth of the EITC

The Earned Income Tax Credit, a refundable tax credit for low- to moderate-income workers, was established in 1975, with nominal claims of about $1.2 billion ($5.6 billion in 2016 dollars) in its first year. According to the Tax Policy Center, by 2016 “the total was $66.7 billion, almost 12 times larger in real terms.”

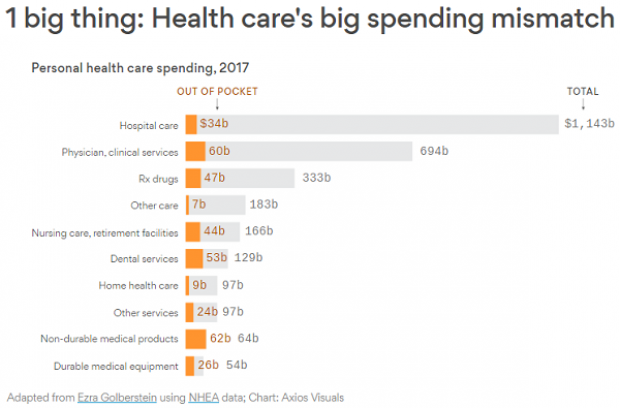

Chart of the Day: The Big Picture on Health Care Costs

“The health care services that rack up the highest out-of-pocket costs for patients aren't the same ones that cost the most to the health care system overall,” says Axios’s Caitlin Owens. That may distort our view of how the system works and how best to fix it. For example, Americans spend more out-of-pocket on dental services ($53 billion) than they do on hospital care ($34 billion), but the latter is a much larger part of national health care spending as a whole.