Automakers Are Having a Record Year, but Here’s a Trend that Should Worry Them

U.S. auto sales closed out the summer on a positive note, topping estimates and casting some rosy light on the health of the American consumer. Recording its best August since 2003, the auto industry is on pace to sell 17.8 vehicles in 2015, well ahead of expectations of 17.3 million. If the numbers hold up, 2015 will be the best year ever for U.S. auto sales, beating the 17.4 million mark set in 2000.

The general consensus is that auto industry is in pretty good shape these days. Gas prices and interest rates are low, boosting the market for cars and light trucks. More than 2 million jobs were added to the U.S. economy in the past year, and more jobs is usually good news for auto sales. The unemployment rate has been trending lower for five years, sitting at a relatively healthy 5.3 percent in July.

Related: What's Next for Oil Prices? Look Out Below!

As with any statistic, though, there’s more than one way to look at the situation. Sure, auto sales are climbing as the economy gets stronger and more Americans hit their local car dealers’ lots. At least to some degree, though, higher auto sales should be expected just as a result of U.S. population growth. And those rising monthly sales figures are masking a continuing trend that is more worrisome for the auto industry: per capita auto sales are still in a long-term decline, even including the solid growth the industry has seen since the end of the recession. Doug Short at Advisor Perspectives did the math and made a graph:

According to Short’s analysis, the peak year for per capita auto sales in the U.S. was 1978. As the red line in the graph shows, the trend is negative since then.

In the graph, per capita auto sales in January, 1976, were defined as 100; the readings in the index since then are relative to that 1976 sales level. As you can see, the index moves higher until August of 1978, when per capita auto sales were up nearly 20 percent over 1976. Since then, per capita auto sales have fallen, reaching a low in 2009 that was nearly 50 percent lower than 1976. Since 2009, per capita auto sales have risen nicely, but are still more than 15 percent below peak.

What could explain the negative trend? Two factors come to mind. First, demographics. It has been widely reported that the millennial generation is less interested in owning cars for a variety of reasons, ranging from a weak economy to a cultural shift away from suburban life. However, the data on millennial car purchases is ambiguous; recently, millennials have started buying cars in volumes that look a lot like their elders. And even if millennials are less interested in buying cars, their preferences can’t explain a shift that began in the 1970s, before they were born.

Related: U.S. Companies Are Dying Faster Than Ever

The other factor that may explain the trend is income inequality. A study of car ownership by the Carnegie Foundation found that countries with higher income inequality have fewer cars per capita. The logic is simple: As more income is claimed by the wealthy, there’s less to go around for everyone else. And that means there’s less money for middle and lower income groups to buy and maintain automobiles, among other things.

Here’s a chart of the Gini index for the U.S. since 1947. (The Gini Index is a widely-used measure of income inequality. A higher Gini number means higher inequality.) Note that the Gini reading started climbing in the late ‘70s – the same time when per capita car ownership in the U.S. began to fall.

This chart tells us, not for the first time, that the U.S. has experienced more income inequality since the 1970s. Combined with the per capita auto sales data above, it suggests that as the rich have gotten richer and everyone else has struggled to keep up, car ownership has suffered. Although this is by no means proof of the relationship between income inequality and per capita car ownership over the last 40 years, it hints at an interesting theory – and suggests that the auto industry has good reason to be concerned about growing inequality in the U.S.

Top Reads From The Fiscal Times:

- 6 Reasons Gas Prices Could Fall Below $2 a Gallon

- Hoping for a Raise? Here’s How Much Most People Are Getting

- What the U.S. Must Do to Avoid Another Financial Crisis

CVS Quit Selling Cigarettes, but It’s Found a Patch for Sales

CVS executives knew that some of their sales would go up in smoke when they decided last year to stop selling cigarettes. The press release announcing that all 7,600 CVS stores nationwide would stop selling all tobacco products acknowledged that sales would take a hit. Still, the company said, “This is the right thing to do.”

The costs of the decision are now becoming clear. CVS Health’s general merchandise sales slumped 7.8 percent last quarter on a same-store basis, the company said Tuesday. The company claims non-pharmacy sales would have stayed the same if tobacco sales — and the other products cigarette buyers added to their baskets — were removed from sales figures for the same quarter in 2014.

Related: Why Smoking Is Even Worse Than We Thought

Same-store sales in the pharmacy category climbed 4.1 percent, boosting overall same-store sales growth to 0.5 percent compared with the second quarter of last year, down from a 1.2 percent year-over-year increase the previous quarter. Net revenue overall grew by 7.4 percent to $37.2 billion, helped by pharmacy services revenue that surged 11.9 percent ($2.6 billion) to $24.4 billion. The company has reportedly increased its market share in the health and beauty categories (it did, however, narrow its full-year earnings forecast).

So even as the move to drop cigarettes has cost the company, its bet on health as the source of future growth may be starting to pay off. CVS stock dropped in the wake of its earnings announcement, but shares are still up more than 15 percent on the year and 44 percent over the past 12 months.

Is the American Dream Dead? Most Parents Think Their Kids Will Be Less Well Off

Parents think their children will be happier and healthier in the future as adults, but also less well off, according to a new report commissioned by insurance company Haven Life.

Only one in eight Americans believe that their children will be better off financially, when compared to their parents. More than half of American parents believe their children will have less disposable income in the future, and only one in five Americans believe their children will enjoy greater quality of life.

Related: Should You Leave Your Home to Your Kids?

On the other hand, more than 60 percent of adults believe that future generations will lead “as healthy or healthier” lifestyles than adults today. And half of them think their children will grow up to be more environmentally conscious adults who lead greener lifestyles. More than half believe that this future generation will be more ethnically and racially diverse.

The study was done by YouGov for the Haven Life Insurance Agency. YouGov conducted an online poll with a representative sample of 1,124 U.S. adults in the first quarter of 2015.

Top Reads from The Fiscal Times

- The 10 Fastest-Growing Jobs Right Now

- Teens Are Having Much Less Sex Than Their Parents Did at That Age

- 9 Social Security Tips You Need to Know Right Now

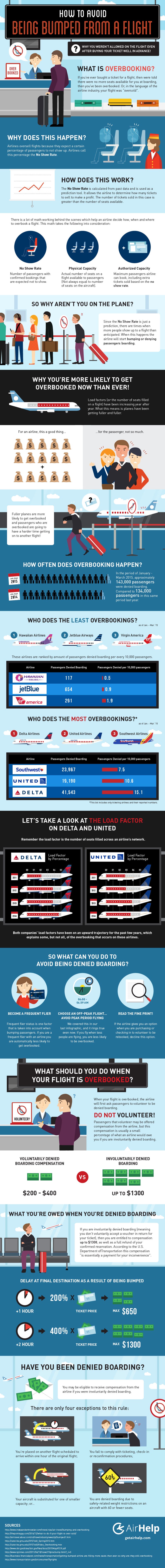

Travel Nightmares: How to Avoid Getting Bumped from Your Flight

You're finally on your way out for a summer vacation. The flight was booked months ago. Your bags are packed and ready. You arrive at the airport the recommended 90 minutes before the scheduled departure time (because it's a great long trip, and you've decided to check your bags). After enduring the inhumanity that is the TSA line, you get to your gate. Of course, everyone else has done the same thing, and you hear the familiar strains of "this flight is overbooked, we are offering a travel voucher if you are willing to fly on a later flight."

But you ignore that, as always, because, well, your bags are already on the plane, and you don't want to miss even a second of your long-awaited time away. Still, that $300 voucher sounds tempting. You could use it to help defray the cost of holiday travel in a few months.

Don't do it. Resisting that temptation can be even more rewarding: If the worst still happens and you get involuntarily bumped, you can get a full refund of your ticket price plus up to $1,300 in added compensation.

The AirHelp inforgraphic below lays out the basic dos and don'ts of dealing with an overbookd flight. You can also find more from AirHelp here.

(h/t lifehacker.com)

Blame China for Your Costly Lobster Roll

Looking for authentic, down-home Maine lobster? Head to China.

The upsurge in demand for lobster in China this year has caused the price of the succulent marine crustacean to shoot up to record highs in the U.S., according to Bloomberg News. Wholesale prices for lobsters have clawed 32 percent higher over the last year.

Lacking a lobster industry itself, China used to rely on Australian imports to meet the demand from an expanding middle class that views lobster as a status symbol. But in 2012, as catches off of Western Australia began dwindling and prices of lobster fell in the Gulf of Maine, China changed its main supplier to the U.S.

Related: McDonald’s Aims for a Classier Crowd with Lobster Rolls

Lobster exports from the East Coast are the main reason for the hike in fish and seafood exports to China in recent years, according to U.S. Department of Agriculture data. Over the past seven months, about 60,000 live North American lobsters a week make the 7,500-mile trek halfway across the world. The lobsters must still be alive by the time they arrive in China or else they lack appeal, so they’re packed in wet newspapers and Styrofoam coolers for a trip that must be made in 18 hours or less, according to Bloomberg.

Another reason for the surge in prices was the bitterly cold winter this year, which slowed the catch in Canada and delayed the summer harvest in Maine.

Holding off on your lobster roll until next summer in the hopes that prices will wane? Don’t count on it. The Chinese middle class is still growing rapidly, and the country already consumes 35 percent of the world’s seafood — a number likely to increase.

Top Reads from The Fiscal Times:

- Born in the USA: 24 Iconic American Foods

- America’s 10 Top Selling Medications

- You’re Richer Than You Think. Really.

Meet Blade, the Uber for Helicopters in NYC

Uber may be convenient, but New York’s Hamptons set doesn’t always have the time or patience to deal with the traffic getting out to their summer spots on Long Island’s East End.

Blade, which calls itself “the first digitally driven short distance aviation company,” says it has a solution for those who want to get to East Hampton within the hour, or Southampton in 35 minutes: Ordering their own chartered helicopter via an app.

Related: 10 Biggest Tech Flops of the Century

Once you download the app, you can select your flight time, chill out in a Blade lounge at a Manhattan heliport and then enjoy “a snack, a drink, a newspaper and lots of other fun things” on your flight. Passengers are allowed one carry-on weighing 25 lbs. maximum — but no golf clubs.

The service, which launched in May 2014, doesn’t come cheap, at $595 per seat to go to Quogue, Southampton, East Hampton, Montauk or Fire Island. Blade can also be booked for trips to Nantucket, Martha’s Vineyard, Cape Cod and some other destinations in the Northeast as well as to the New York area’s major airports.

The website advises that if your flight is grounded due to bad weather, you’ll be offered a ride to your destination in a chauffeured Mercedes at no extra cost.

Top Reads from The Fiscal Times:

- The Best Things to Charge on Your Credit Card

- The Wealthy Worry, Too—And It’s Not All About Money

- 10 Best Islands in the World