'Tax Reform Is Hard. Keeping Tax Reform Is Harder': Highlights from the House Tax Cuts Hearing

The House Ways and Means Committee held a three-hour hearing Wednesday on the effects of the Republican tax overhaul. We tuned in so you wouldn’t have to.

As you might have expected, the hearing was mostly an opportunity for Republicans and Democrats to exercise their messaging on the benefits or dangers of the new law, and for the experts testifying to disagree whether the gains from the law would outweigh the costs. But there was also some consensus that it’s still very early to try to gauge the effects of the law that was signed into effect by President Trump less than five months ago.

“I would emphasize that, despite all the high-quality economic research that’s been done, never before has the best economy on the planet moved from a worldwide system of taxation to a territorial system of taxation. There is no precedent,” said Douglas Holtz-Eakin, president of the American Action Forum and former director of the Congressional Budget Office. “And in that way we do not really know the magnitude and the pace at which a lot of these [effects] will occur.”

Some key quotes from the hearing:

Rep. Richard Neal (D-MA), ranking Democrat on the committee: “This was not tax reform. This was a tax cut for people at the top. The problem that Republicans hope Americans overlook is the law’s devastating impact on your health care. In search of revenue to pay for corporate cuts, the GOP upended the health care system, causing 13 million Americans to lose their coverage. For others, health insurance premiums will spike by at least 10 percent, which translates to about $2,000 a year of extra costs per year for a family of four. … These new health expenses will dwarf any tax cuts promised to American families. … The fiscal irresponsibility of their law is stunning. Over the next 10 years they add $2.3 trillion to the nation’s debt to finance tax cuts for people at the top – all borrowed money. … When the bill comes due, Republicans intend to cut funding for programs like Medicare, Medicaid and Social Security.”

David Farr, chairman and CEO of Emerson, and chairman of the National Association of Manufacturers: “We recently polled the NAM members, and the responses heard back from them on the tax reform are very significant and extremely positive: 86 percent report that they’ve already planned to increase investments, 77 percent report that they’ve already planned to increase hiring, 72 percent report that they’ve already planned to increase wages or benefits.”

Holtz-Eakin: “No, tax cuts don’t pay for themselves. If they did there would be no additional debt from the Tax Cuts and Jobs Act, and there is. The question is, is it worth it? Will the growth and the incentives that come from it be worth the additional federal debt. My judgment on that was yes. Reasonable people can disagree. … When we went into this exercise, there was $10 trillion in debt in the federal baseline, before the Tax Cuts and Jobs Act. There was a dangerous rise in the debt-to-GDP ratio. It was my belief, and continues to be my belief, that those problems would not be addressed in a stagnant, slow-growth economy. Those are enormously important problems, and we needed to get growth going so we can also take them on.”

“Quite frankly, it’s not going to be possible to hold onto this beneficial tax reform if you don’t get the spending side under control. Tax reform is hard. Keeping tax reform is harder, and the growth consequences of not fixing the debt outlook are entirely negative and will overwhelm what you’ve done so far.”

Steven Rattner: "We would probably all agree that increases in our national debt of these kinds of orders of magnitude have a number of deleterious effects. First, they push interest rates up. … That not only increases the cost of borrowing for the federal government, it increases the cost of borrowing for private corporations whose debt is priced off of government paper. Secondly, it creates additional pressure on spending inside the budget to the extent anyone is actually trying to control the deficit. … And thirdly, and in my view perhaps most importantly, it’s a terrible intergenerational transfer. We are simply leaving for our children additional trillions of dollars of debt that at some point are going to have to be dealt with, or there are going to have to be very, very substantial cuts in benefits, including programs like Social Security and Medicare, in order to reckon with that.”

Will Parents Finally Get a Break on Back-to-School Spending This Year?

The average family with school-age children will spend $630 on clothing and school supplies before their kids return to the classroom.

That’s down slightly from the $669 spent last year, but represents a 42 percent increase over the past decade, according to the National Retail Federation.

Despite the lower per-family spending, fewer consumers say the economy has influenced their spending plans, and a smaller percentage are looking for sales or buying generic products to save.

Among those surveyed, 93 percent said they’d buy clothing for their kids, laying out an average $218 on new threads and $117 on new shoes. Spending on school supplies will average $98.

Families said they planned to spend an average of $197 on electronics, down from $212 spent in that category last year.

Related: 10 Sure Ways to Save on Back-to-School Shopping

A quarter of those surveyed said that they’d start back-to-school shopping just a week or two before school started, while one in five start shopping two months before school begins.

Discount stores represented the most popular destinations for online shopping (62 percent), followed by department stores (56 percent), and clothing stores (54 percent).

Parents are letting their kids take the lead on some purchases, with 86 percent of shoppers saying that their kids will influence at least a quarter of purchases. Teens will spend $33 of their own money an average, and pre-teens will pay $18 out of pocket.

Total spending on back-to-school shopping will amount to $25 billion for K-12, with another $43 billion spent on back-to-college shopping.

They’re Leaving Las Vegas: Fewer I Do’s in Last Decade

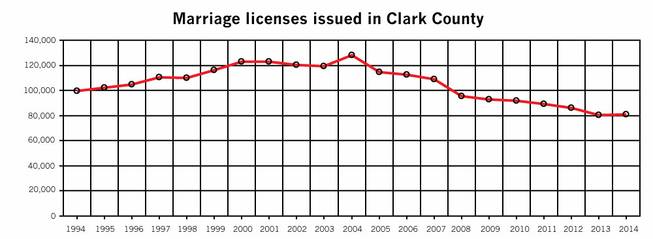

When it comes to destination weddings, Las Vegas has lost that loving feeling. The Las Vegas Sun reports that the wedding rate in Sin City has plummeted 37 percent in the past decade—nearly 47,000 fewer couples got married in 2014 than in 2004.

By comparison, 2004 was a boom year for weddings in Sin City. There were 128,000 weddings that year—including Britney Spears’ 55-hour marriage to Jason Allen Alexander at A Little White Wedding Chapel.

Related: Marriage?? Young Americans Aren’t Even Shacking Up

Who knows why gambling on love in Sin City has become a losing bet? Perhaps the dip reflects a national trend of millennials waiting to tie the knot or choosing to stay single. The marriage rate in the U.S. neared a record low in 2015 and is expected to drop further in 2016. Then there’s the expense. According to the TheKnot, the average wedding cost (excluding the honeymoon) is $31,213, with many couples looking for more unusual venues.

Clark County Clerk Lynn Goya, who took office in January, wants to change that trend in Vegas. The current fee for a marriage license in Las Vegas is $60, but Goya is asking for a $14 increase in the cost of wedding licenses to support marketing efforts targeting engaged couples. Last year 81,000 weddings happened in Las Vegas—and she’s hoping that wedding vow renewals and gay weddings will help boost those numbers even more. In New York, the legalization of gay marriage in 2011 led to an estimated $259 million in spending and $16 million in revenues for New York City.

Related: The $2.6 Billion Gay Wedding Boom

Then again it may be hard for Las Vegas to shake that quickie, drive-thru wedding image. Sin City has always had an illustrious history of celebrity weddings, with many more misses than hits: Cher’s nine-day union to rocker Gregg Allman in 1975, Mia Farrow and Frank Sinatra in 1966, Demi Moore and Bruce Willis in 1987, Richard Gere and Cindy Crawford in 1991, and Angelina Jolie and Billy Bob Thornton in 2000. On the bright side, there’s Paul Newman and Joanne Woodward’s marriage, which endured for 50 years, Jon Bon Jovi and his wife, Dorothea’s 1987 wedding day, and Kelly Ripa and Mark Consuelo’s union from 1996, which is still standing.

Expense Account Dining: More McDonald's Than 'Mad Men'

The 15 Most Popular Restaurants for Business Travelers

Road warriors know that business travel can be far from glamorous — a seemingly endless series of meetings broken up by long stretches behind the wheel or in cramped airplane seats. And despite the occasional great meal, expense account dining isn’t all it’s cracked up to be, either.

That’s made clear by a new quarterly report from Certify, which provides software for companies and employees to manage their expenses. The company used millions of receipts and vendor ratings from business people to compile rankings of the most commonly expensed restaurants and those with the highest ratings.

Unsurprisingly, Starbucks was the most commonly expensed restaurant, accounting for 4.7 percent of receipts submitted for reimbursement. McDonald’s and Subway were next on the list, with the burger chain the most common choice for dinners and the sandwich chain the top pick for lunches. Fast food chain Chick-fil-A received the top rating among restaurants, with a 4.5 average on a scale from 1 to 5. The days of the three Martini lunch are clearly long gone.

Related: 9 Ways McDonald’s Wants to Get You Excited About Its Food Again

Certify also reported that business travelers continue to increasingly choose Uber and Airbnb over taxis and hotels. Airbnb grew 143 percent in receipts in the second quarter of the year, though it remains far behind hotels like Marriott and Hampton Inn in popularity. Rental cars still dominated the group transportation receipts (45 percent), but Uber made up 31 percent of receipts, an increase of 8 percentage points from this time last year. For the first time ever, Uber was more popular than taxis, which made up 24 percent of receipts.

What Your Smartphone Knows That Your Mother Doesn’t

Can Your Smartphone Be Used to Detect Depression?

It’s always there, in your pocket or purse or on your desk, quietly collecting information. And apparently, when it comes to depression, there’s quite a lot your smartphone knows about you.

According to a small study from Northwestern Medicine, that data from your smartphone can predict with eerie 87 percent accuracy whether you’re suffering from depression or not.

The telling signs: You spend more time on your smartphone and less time leaving the house, and you visit very few places each day.

Related: Smartphone Notifications Are Killing Our Concentration

The researchers used Craigslist to find 40 test subjects between the ages of 19 and 58, and outfitted their smartphones with an app to monitor their location and usage. The individuals took a questionnaire that measured signs of depression; half of the subjects had troubling symptoms and half did not. Using GPS, the phones tracked the subjects’ movements and locations every five minutes. The subjects also were asked questions about their mood at different points during the day.

These factors were then correlated with the test subjects’ original depression test scores. And the results were uncanny. Depressed people used their phones more often and for longer periods of time —an average of 68 minutes a day. By comparison, the individuals who didn’t show signs of depression spent only 17 minutes on theirs. Researchers attributed the increased use of the phone to task avoidance, another symptom of depressed people.

Perhaps more significant than the findings of this small study — only 28 of the 40 subjects had enough data to be studied — is the potential the researchers felt that smartphones could play in future medical diagnosis.

When loaded up with the correct sensors, the smartphone can be used to detect a person’s emotional states, and monitor moods, without the user having to utter a word. It also has the ability to offer suggestions to reinforce positive behaviors when depression is detected. The results of the study were published in the Journal of Medical Internet Research yesterday, but one conclusion was becoming increasingly evident even before the report came out: Smartphones — and the sensors they now contain — just keep getting smarter.

Obamacare Plans Offer 34 Percent Fewer Choices

As many predicted, Americans insured under the Affordable Care Act may not be able to keep their doctors--and even their hospitals.

A new study reveals that the average plans provided on the Obamacare health insurance exchanges offer 34 percent fewer providers than the average commercial plan offered outside the exchange.

The analysis from Avalere shows the disparity compared with commercial plans:

- 42 percent fewer oncology and cardiology specialists

- 32 percent fewer mental health and primary care providers

- 24 percent fewer hospitals

Related: Top 10 Questions Consumers Ask About Obamacare

“Patients should evaluate a plan’s provider network when picking insurance on the exchange,” said Elizabeth Carpenter, vice president at Avalere. “Out-of-network care does not accrue toward out-of-pocket maximums, leaving consumers vulnerable to high costs if they seek care from a provider not included in their plan’s network.”

Patients need to evaluate a plan’s provider network when selecting insurance on the exchange, especially if they have a history of cancer or heart disease or require mental health services.

Limiting choice is one way for health exchanges to keep costs down, but ultimately patients bear the cost. “Plans continue to test new benefit designs in the exchange market,” said Dan Mendelson, CEO at Avalere. “Given the new requirements put in place by the ACA, network design is one way plans can drive value-based care and keep premiums low.”