News & Views

Here's what we have our eye on today:

- Trump Wants a ‘Phase Two’ of Tax Cuts – CNBC

- Congress Has Until March 23 to Fund the Government. Three Ways This Could Go – Vox

- The First Target on Drug Prices: Pharmacy Benefit Managers – Axios

- No One’s Sure Who Qualifies for This $415 Billion U.S. Tax Deduction – Bloomberg

- Companies Are Putting Tax Savings in the Pockets of Shareholders – CNBC

- Conservative Groups Warn Against Obamacare 'Bailout' in Spending Bill – The Hill

- Trump to Visit Boeing Plant in Missouri to Tout Impact of Tax Overhaul – Reuters

- U.S. DOT Announces TIGER Grants Totaling Nearly $500 Million – Route Fifty

- Are You Underpaid? In a First, U.S. Firms Reveal How Much They Pay Workers – Wall Street Journal

- How Much Do America’s Arms Makers Depend on Foreign Metal? No One Seems to Know – Defense One

- Fox News Launching New Ad Campaign: 'Real News. Real Honest Opinion' – The Hill

- It’s Tax Time! Here’s What to Know This Year – New York Times

VIEWS

- The G.O.P. Accidentally Replaced Obamacare Without Repealing It – Peter Suderman, New York Times

- Red-State Changes Could Strengthen ACA, Medicaid – Drew Altman, Axios

- Social Security Is Headless Because of Trump’s Inaction. Will Other Agencies Be Decapitated? – Joe Davidson, Washington Post

- Britain Has Budget Problems, and the US Can Learn from Them – Tom Rogan, Washington Examiner

- The Rich Are Happier About Their Taxes Than the Poor – Kevin Drum, Mother Jones

- Axing State Corporate Taxes Is Good Policy – Richard F. Keevey, Route Fifty

- Trump's Tariff Move Shows He Flunked Economics – Jeffrey Sachs, CNN

- Without Pressure from the Electorate, Better Infrastructure Will Just Be Talk – Mark Jamison and Jeff Lawrence, RealClear Markets

- Most Small Business Owners Say They Will Not Hire, Give Raises Because of New Tax Law – Frank Knapp, Jr. – The Hill

- Trump Administration Is Helping a Lost Generation of Workers Recover – Scott Jennings, CNN

- I Hate Trump, but I Love These Tariffs – Krystal Ball, The Hill

Number of the Day: $22 Trillion

The total national debt surpassed $22 trillion on Monday. Total public debt outstanding reached $22,012,840,891,685.32, to be exact. That figure is up by more than $1.3 trillion over the past 12 months and by more than $2 trillion since President Trump took office.

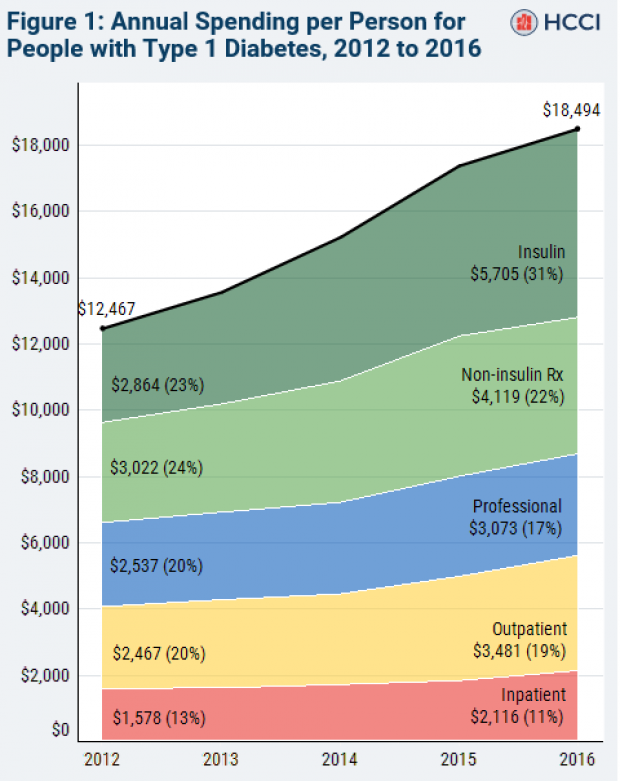

Chart of the Week: The Soaring Cost of Insulin

The cost of insulin used to treat Type 1 diabetes nearly doubled between 2012 and 2016, according to an analysis released this week by the Health Care Cost Institute. Researchers found that the average point-of-sale price increased “from $7.80 a day in 2012 to $15 a day in 2016 for someone using an average amount of insulin (60 units per day).” Annual spending per person on insulin rose from $2,864 to $5,705 over the five-year period. And by 2016, insulin costs accounted for nearly a third of all heath care spending for those with Type 1 diabetes (see the chart below), which rose from $12,467 in 2012 to $18,494.

Chart of the Day: Shutdown Hits Like a Hurricane

The partial government shutdown has hit the economy like a hurricane – and not just metaphorically. Analysts at the Committee for a Responsible Federal Budget said Tuesday that the shutdown has now cost the economy about $26 billion, close to the average cost of $27 billion per hurricane calculated by the Congressional Budget Office for storms striking the U.S. between 2000 and 2015. From an economic point of view, it’s basically “a self-imposed natural disaster,” CRFB said.

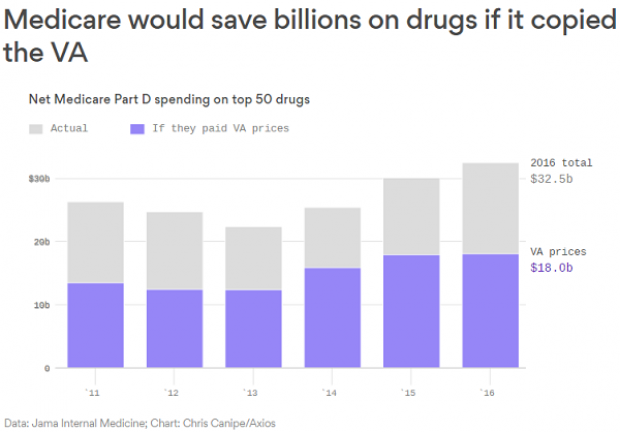

Chart of the Week: Lowering Medicare Drug Prices

The U.S. could save billions of dollars a year if Medicare were empowered to negotiate drug prices directly with pharmaceutical companies, according to a paper published by JAMA Internal Medicine earlier this week. Researchers compared the prices of the top 50 oral drugs in Medicare Part D to the prices for the same drugs at the Department of Veterans Affairs, which negotiates its own prices and uses a national formulary. They found that Medicare’s total spending was much higher than it would have been with VA pricing.

In 2016, for example, Medicare Part D spent $32.5 billion on the top 50 drugs but would have spent $18 billion if VA prices were in effect – or roughly 45 percent less. And the savings would likely be larger still, Axios’s Bob Herman said, since the study did not consider high-cost injectable drugs such as insulin.

Why Craft Brewers Are Crying in Their Beer

It may be small beer compared to the problems faced by unemployed federal workers and the growing cost for the overall economy, but the ongoing government shutdown is putting a serious crimp in the craft brewing industry. Small-batch brewers tend to produce new products on a regular basis, The Wall Street Journal’s Ruth Simon says, but each new formulation and product label needs to be approved by the Treasury Department’s Alcohol and Tobacco Tax and Trade Bureau, which is currently closed. So it looks like you’ll have to wait a while to try the new version of Hemperor HPA from Colorado’s New Belgium Brewing, a hoppy brew that will include hemp seeds once the shutdown is over.