It’s Not Just in Your Head, the Web Is Slowing Down

It’s not your imagination, and it’s not because AT&T — and possibly others — is purposefully cutting speeds to unlimited data plan users. The Internet is slowing down. The reason: Websites are growing in size, causing slower load times.

The average website is now 2.1 MB in size, compared to 1.5 MB two years ago, according to HTTP Archive, an Internet data measurement company. Multiple reasons can explain this increase in size.

Sites have been adding more content in an effort to drum up traffic, such as videos, engaging images, interactive plug-ins (comments and feeds) and other code and script-heavy features. Websites are becoming more and more technically advanced, and other sites have to keep adding features to stay competitive.

To keep up with the rapidly increasing number of users accessing sites on various platforms, developers are offering more versions of websites as well as apps to accommodate all devices, including smartphones, watches, tablets, and other gadgets. All of these versions require additional code, ultimately adding to the weight of a given website.

Then there are the advertisers who want to get the user’s attention by creating dramatic displays for their products that consume even more bandwidth.

Websites also want to know who is visiting their pages, both welcome and unwelcome visitors. New tools that track and analyze visitors have increased in popularity, as well as stronger encryption technology to add more security. These security measures and trackers require more code, again slowing load times.

Unfortunately for websites trying to keep up with the times, Google has just introduced a new ‘Slow to Load’ warning sign in mobile search results. Since mobile searches account for more than half of the total Google searches in 10 countries, Google wants to enhance user experience for those on their mobile platform.

Although the weight of a website isn’t all that contributes to slow loading, it’s a major factor. Other reasons include users overusing data, a poor connection, or a high level of traffic in the mobile network.

Google also changed its algorithm in April, so now ‘mobile friendly’ sites are ranked higher on search results, while those that fail to meet its criteria are ranked lower.

Although the internet is only slowing by a matter of seconds, it’s still slowing down. All the more reason for a user to become frustrated with a page that’s taking a couple extra seconds to load and go to a competitor’s site.

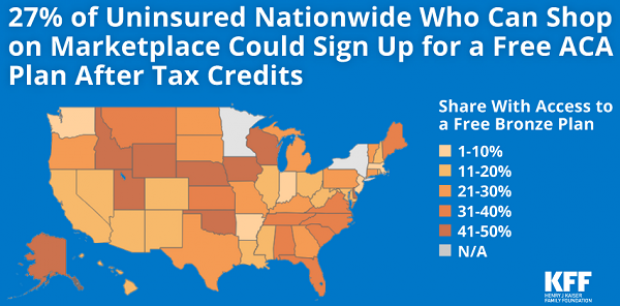

4.2 Million Uninsured People Could Get Free Obamacare Plans

About 4.2 million uninsured people could sign up for a bronze-level Obamacare health plan and pay nothing for it after tax credits are applied, the Kaiser Family Foundation said Tuesday. That means that 27 percent of the country’s 15.9 million uninsured people could get covered for free. The chart below breaks down the eligible population by state.

Takedown of the Day: Ezra Klein on Paul Ryan's Legacy of Debt

Vox’s Ezra Klein says that retiring House Speaker Paul Ryan’s legacy can be summed up in one number: $343 billion. “That’s the increase between the deficit for fiscal year 2015 and fiscal year 2018— that is, the difference between the fiscal year before Ryan became speaker of the House and the fiscal year in which he retired.”

Klein writes that Ryan’s choices while in office — especially the 2017 tax cuts and the $1.3 trillion spending bill he helped pass and the expansion of the earned income tax credit he talked up but never acted on — should be what define his legacy:

“[N]ow, as Ryan prepares to leave Congress, it is clear that his critics were correct and a credulous Washington press corps — including me — that took him at his word was wrong. In the trillions of long-term debt he racked up as speaker, in the anti-poverty proposals he promised but never passed, and in the many lies he told to sell unpopular policies, Ryan proved as much a practitioner of post-truth politics as Donald Trump. …

“Ultimately, Ryan put himself forward as a test of a simple, but important, proposition: Is fiscal responsibility something Republicans believe in or something they simply weaponize against Democrats to win back power so they can pass tax cuts and defense spending? Over the past three years, he provided a clear answer. That is his legacy, and it will haunt his successors.”

Number of the Day: $300 Million

Mick Mulvaney, the acting director of the Consumer Financial Protection Bureau, wants the agency to be known as the Bureau of Consumer Financial Protection, the name under which it was established by Title X of the 2010 Dodd-Frank Wall Street reform law. Mulvaney even had new signage put up in the lobby of the bureau. But the rebranding could cost the banks and other financial businesses regulated by the bureau more than $300 million, according to an internal agency analysis reported by The Hill’s Sylvan Lane. The costs would arise from having to update internal databases, regulatory filings and disclosure forms with the new name. The rebranding would cost the agency itself between $9 million and $19 million, the analysis estimated. Lane adds that it’s not clear whether Kathy Kraninger, President Trump’s nominee to serve as the bureau’s full-time director, would follow through on Mulvaney’s name change once she is confirmed by the Senate.

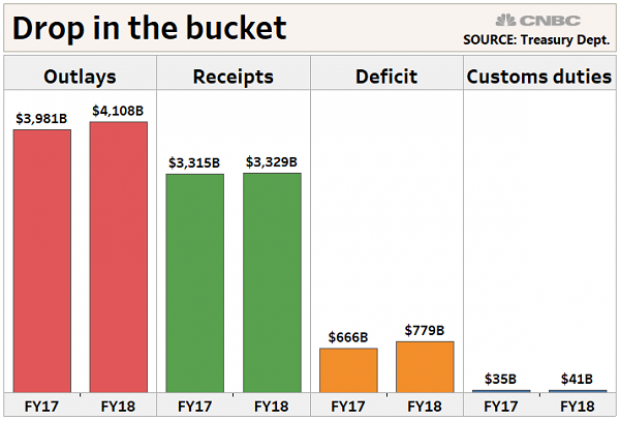

Why Trump's Tariffs Are Just a Drop in the Bucket

President Trump said this week that tariff increases by his administration are producing "billions of dollars" in revenues, thereby improving the country’s fiscal situation. But CNBC’s John Schoen points out that while tariff revenues are indeed higher by several billion dollars this year, the total revenue is a drop in the bucket compared to the sheer size of government outlays and receipts – and the growing annual deficit.

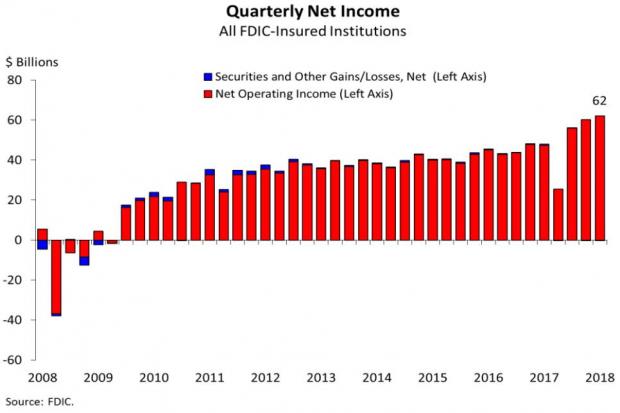

Bank Profits Hit New Record Thanks to 2017 Tax Law

Bank profits reached a record $62 billion in the third quarter, up $14 billion, or 29.3 percent, from the same period last year, according to data from the Federal Deposit Insurance Corporation. The FDIC said that about half of the increase in net income was attributable to last year’s tax cuts. The FDIC estimated that, with the effective tax rates from before the new law, bank profits for the quarter would have risen by about 14 percent, to $54.6 billion.