Don’t Feel Like a Chump When You Close on Your New Mortgage

Mortgage closing costs dropped 7 percent over the past year, falling to $1,847 on a $200,000 loan, according to a new analysis by Bankrate.

Typical closing costs varied by state, ranging from $2,163 in Hawaii to $1,613 in Ohio. You can find the average rate for your state in the table below.

Lenders compete for business, so shopping around with at least three mortgage providers can help you reduce the fees associated with your loan. “Homebuyers have more say over closing costs than they think,” Bankrate Senior Mortgage Analyst Holden Lewis said in a statement.

Even as banks lower their mortgage fees, they’re increasing fees in most other categories, according to MoneyRates.com.

While lower mortgage fees are good news for homebuyers and those refinancing their loans, the average saving amount to just $140. That’s not much relative to the total costs associated with buying a house. The average down payment for homebuyers in the first quarter of 2015 was $57,710, for example.

Related: Want Your Own Home? Here’s How to Do the Math

The costs don’t stop once the buyers move in. On top of mortgage payments, homeowners face an average of more than $6,000 in additional costs related to their house, including homeowners insurance, property taxes and utilities.

The National Association of Realtors expects home prices to increase 6.5 percent this year to a median $221,900, which would put them at the same level as their 2006 record high.

For buyers, better news than the lower mortgage fees is that rates remain relatively low, falling to 3.98 percent last week, per Freddie Mac.

Closing costs | |||

|---|---|---|---|

| State | Average origination fees | Average third-party fees | Average origination plus third-party fees |

| Alabama | $1,066 | $776 | $1,842 |

| Alaska | $935 | $922 | $1,857 |

| Arizona | $1,208 | $761 | $1,969 |

| Arkansas | $1,057 | $760 | $1,817 |

| California | $937 | $896 | $1,834 |

| Colorado | $1,192 | $719 | $1,910 |

| Connecticut | $1,074 | $960 | $2,033 |

| Delaware | $904 | $924 | $1,828 |

| District of Columbia | $1,077 | $718 | $1,794 |

| Florida | $1,028 | $778 | $1,806 |

| Georgia | $1,058 | $821 | $1,879 |

| Hawaii | $1,033 | $1,130 | $2,163 |

| Idaho | $894 | $788 | $1,682 |

| Illinois | $1,080 | $767 | $1,847 |

| Indiana | $1,067 | $770 | $1,837 |

| Iowa | $1,161 | $762 | $1,923 |

| Kansas | $1,047 | $753 | $1,800 |

| Kentucky | $1,060 | $737 | $1,797 |

| Louisiana | $1,060 | $817 | $1,877 |

| Maine | $897 | $830 | $1,727 |

| Maryland | $1,093 | $742 | $1,835 |

| Massachusetts | $905 | $851 | $1,756 |

| Michigan | $1,072 | $746 | $1,818 |

| Minnesota | $1,067 | $689 | $1,757 |

| Mississippi | $1,046 | $837 | $1,884 |

| Missouri | $1,040 | $792 | $1,833 |

| Montana | $1,062 | $855 | $1,917 |

| Nebraska | $1,047 | $770 | $1,817 |

| Nevada | $1,002 | $848 | $1,850 |

| New Hampshire | $1,084 | $750 | $1,835 |

| New Jersey | $1,181 | $913 | $2,094 |

| New Mexico | $1,076 | $876 | $1,952 |

| New York | $1,032 | $879 | $1,911 |

| North Carolina | $1,036 | $875 | $1,911 |

| North Dakota | $1,045 | $791 | $1,836 |

| Ohio | $933 | $681 | $1,613 |

| Oklahoma | $1,027 | $734 | $1,761 |

| Oregon | $1,080 | $785 | $1,864 |

| Pennsylvania | $1,055 | $678 | $1,733 |

| Rhode Island | $1,093 | $802 | $1,896 |

| South Carolina | $1,058 | $837 | $1,895 |

| South Dakota | $1,055 | $704 | $1,759 |

| Tennessee | $1,033 | $773 | $1,806 |

| Texas | $1,031 | $833 | $1,864 |

| Utah | $909 | $788 | $1,697 |

| Vermont | $1,074 | $862 | $1,936 |

| Virginia | $1,050 | $787 | $1,837 |

| Washington | $1,077 | $824 | $1,901 |

| West Virginia | $1,067 | $904 | $1,971 |

| Wisconsin | $1,047 | $723 | $1,770 |

| Wyoming | $874 | $814 | $1,689 |

| Average | $1,041 | $807 | $1,847 |

Bankrate.com surveyed up to 10 lenders in each state in June 2015 and obtained online Good Faith Estimates for a $200,000 mortgage to buy a single-family home with a 20 percent down payment in a prominent city. Costs include fees charged by lenders, as well as third-party fees for services such as appraisals and credit reports. The survey excludes title insurance, title search, taxes, property insurance, association fees, interest and other prepaid items.

Top Reads from The Fiscal Times:

- You’re Richer Than You Think. Really.

- The 10 Fastest-Growing Jobs Right Now

- The 5 Worst Cities to Raise a Family

The High Cost of Child Poverty

Childhood poverty cost $1.03 trillion in 2015, including the loss of economic productivity, increased spending on health care and increased crime rates, according to a recent study in the journal Social Work Research. That annual cost represents about 5.4 percent of U.S. GDP. “It is estimated that for every dollar spent on reducing childhood poverty, the country would save at least $7 with respect to the economic costs of poverty,” says Mark R. Rank, a co-author of the study and professor of social welfare at Washington University in St. Louis. (Futurity)

Do You Know What Your Tax Rate Is?

Complaining about taxes is a favorite American pastime, and the grumbling might reach its annual peak right about now, as tax day approaches. But new research from Michigan State University highlighted by the Money magazine website finds that Americans — or at least Michiganders — dramatically overstate their average tax rate.

In a survey of 978 adults in the Wolverine State, almost 220 people said they didn’t know what percentage of their income went to federal taxes. Of the people who did provide an answer, almost 85 percent overstated their actual rate, sometimes by a large margin. On average, those taxpayers said they pay 25.5 percent of their income in federal taxes. But the study’s authors estimated that their actual average tax rate was just under 14 percent.

The large number of people who didn’t want to venture a guess as to their tax rate and the even larger number who were wildly off both suggest to the researchers “that a very substantial portion of the population is uninformed or misinformed about average federal income-tax rates.”

Why don’t we know what we’re paying?

Part of the answer may be that our tax system is complicated and many of us rely on professionals or specialized software to prepare our filings. Money’s Ian Salisbury notes that taxpayers in the survey who relied on that kind of help tended to be further off in their estimates, after controlling for other factors.

Also, many people likely don’t understand the different types of taxes they pay. While the survey asked specifically about federal taxes, the tax rates people provided more closely matched their total tax rate, including federal, state, local and payroll taxes.

But our politics likely play a role here as well. People who believe that taxes on households like theirs should be lower and those who believe tax dollars are spent ineffectively tended to overstate their tax rates more.

“Since the time of Ronald Reagan, American[s] have been inundated with messages about how high taxes are,” one of the study’s authors told Salisbury. “The notion they are too high has become deeply ingrained.”

Wealthy Investors Are Worried About Washington, and the Debt

A new survey by the Spectrem Group, a market research firm, finds that almost 80 percent of investors with net worth between $100,000 and $25 million (not including their home) say that the U.S. political environment is their biggest concern, followed by government gridlock (76 percent) and the national debt (75 percent).

Trump’s Push to Reverse Parts of $1.3 Trillion Spending Bill May Be DOA

At least two key Republican senators are unlikely to support an effort to roll back parts of the $1.3. trillion spending bill passed by Congress last month, The Washington Post’s Mike DeBonis reported Monday evening. While aides to President Trump are working with House Majority Leader Kevin McCarthy (R-CA) on a package of spending cuts, Sens. Susan Collins (R-ME) and Lisa Murkowski (R-AK) expressed opposition to the idea, meaning a rescission bill might not be able to get a simple majority vote in the Senate. And Roll Call reports that other Republican senators have expressed significant skepticism, too. “It’s going nowhere,” Sen. Lindsey Graham said.

Goldman Sees Profit in the Tax Cuts

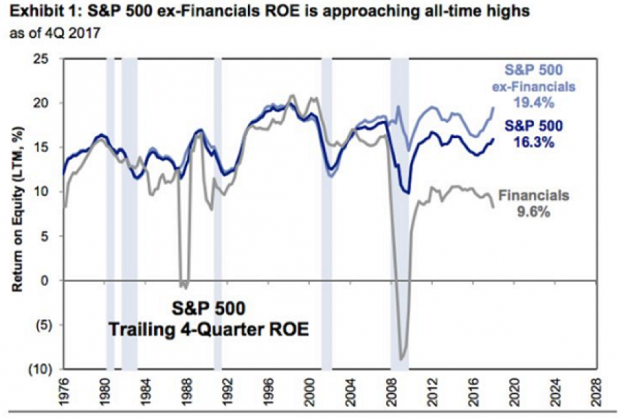

David Kostin, chief U.S. equity strategist at Goldman Sachs, said in a note to clients Friday cited by CNBC that companies in the S&P 500 can expect to see a boost in return on equity (ROE) thanks to the tax cuts. Return on equity should hit the highest level since 2007, Kostin said, providing a strong tailwind for stock prices even as uncertainty grows about possible conflicts over trade.

Return on equity, defined as the amount of net income returned as a percentage of shareholders’ equity, rose to 16.3 percent in 2016, and Kostin is forecasting an increase to 17.6 percent in 2018. "The reduction in the corporate tax rate alone will boost ROE by roughly 70 [basis points], outweighing margin pressures from rising labor, commodity, and borrow costs," Kostin wrote.